Back

24 Feb 2020

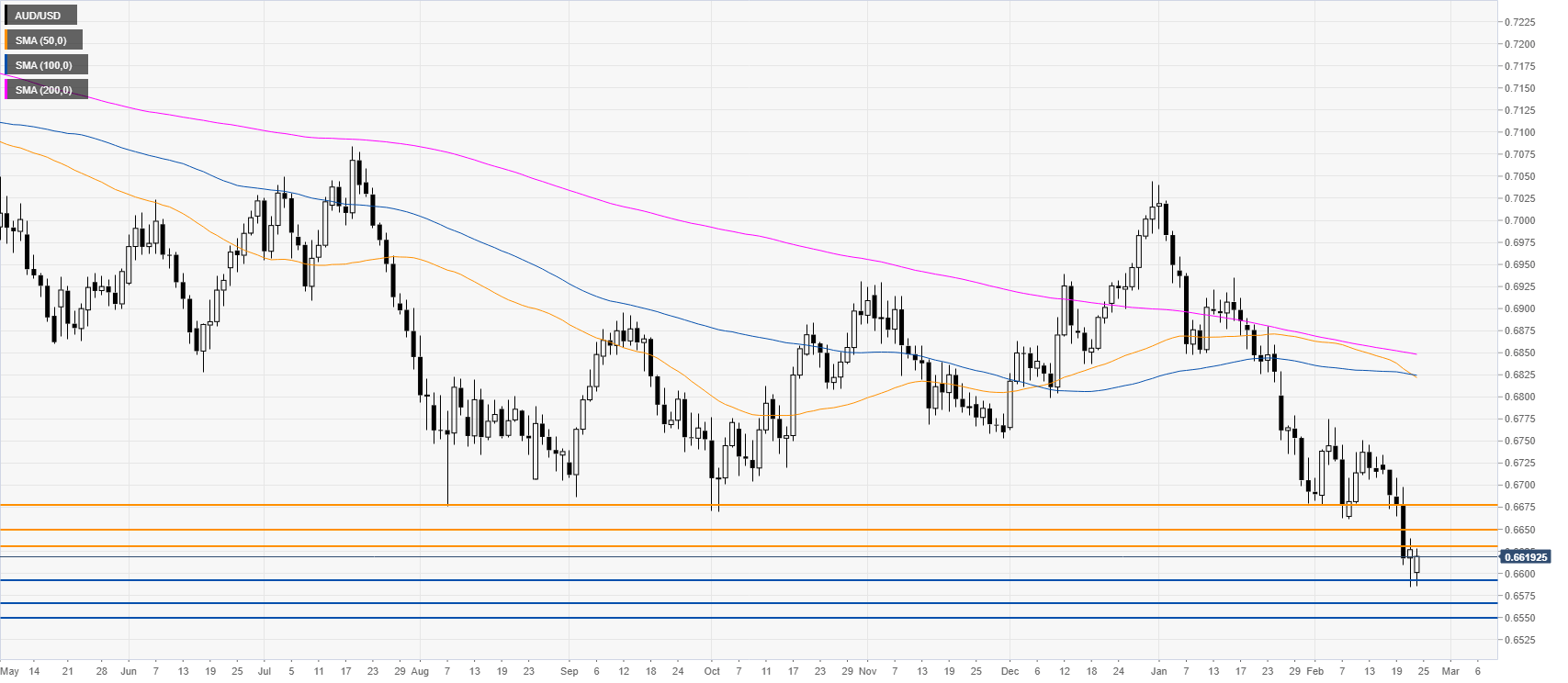

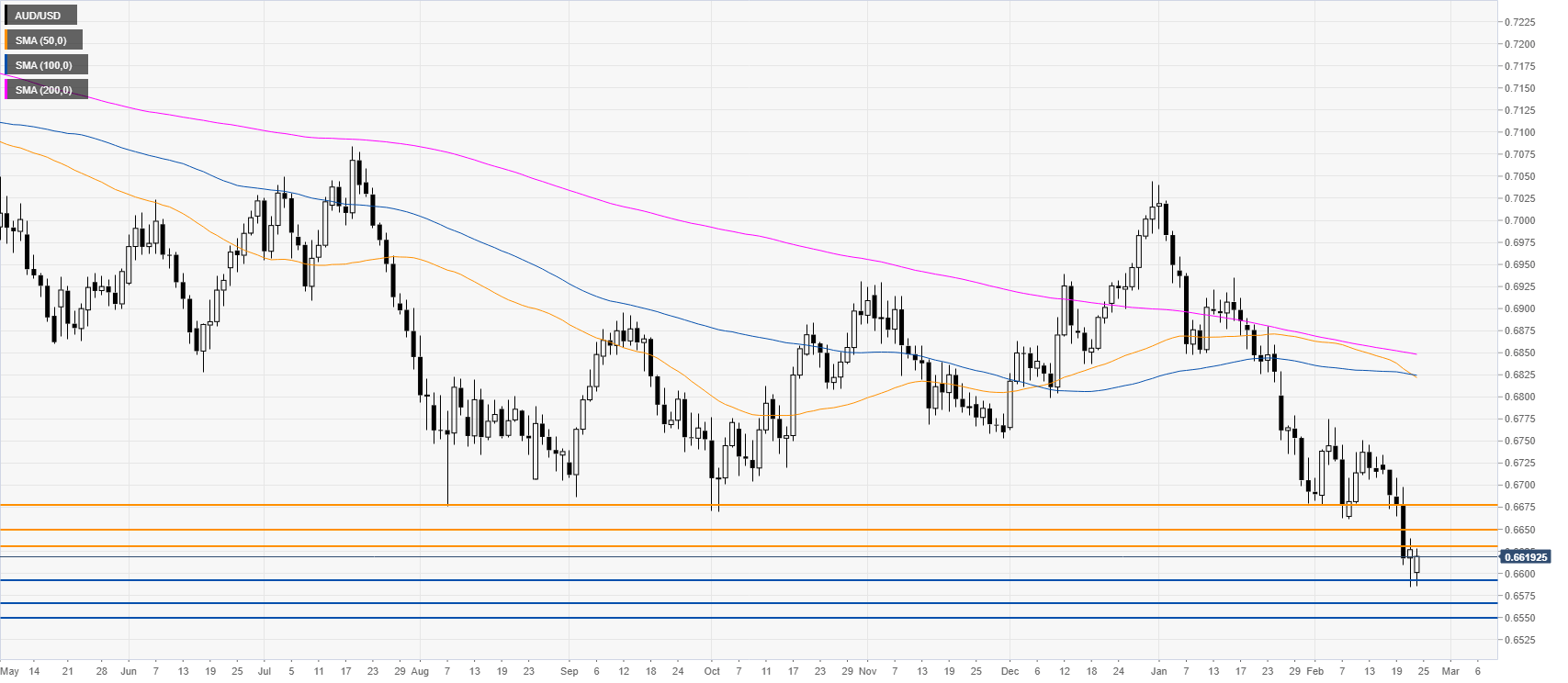

AUD/USD Price Analysis: Aussie bouncing from 2020 lows, trading near

- AUD/USD is consolidating losses as USD is on the back foot.

- Resistance is seen near the 0.6630 level.

AUD/USD daily chart

The aussie is bouncing from one-decade lows while trading well below the main daily simple moving averages (SMAs). The trend is clearly to the downside, however, as USD is losing steam across the board, AUD/USD might be correcting up in the coming sessions. A break above the 0.6630 level can lead to further gains towards 0.6650 and 0.6778 levels. Support is seen near 0.6596, 0.6569 and 0.6548 levels, according to the Technical Confluences Indicator.

Resistance: 0.6630, 0.6650, 0.6678

Support: 0.6596, 0.6569, 0.6548

Additional key levels