Back

24 Feb 2020

USD/JPY Price Analysis: Dollar accelerates correction down below 111.00 figure vs. yen

- USD/JPY is starting the week trading sharply down after a large bullish breakout last week.

- The correction down is extending below the 111.00 level.

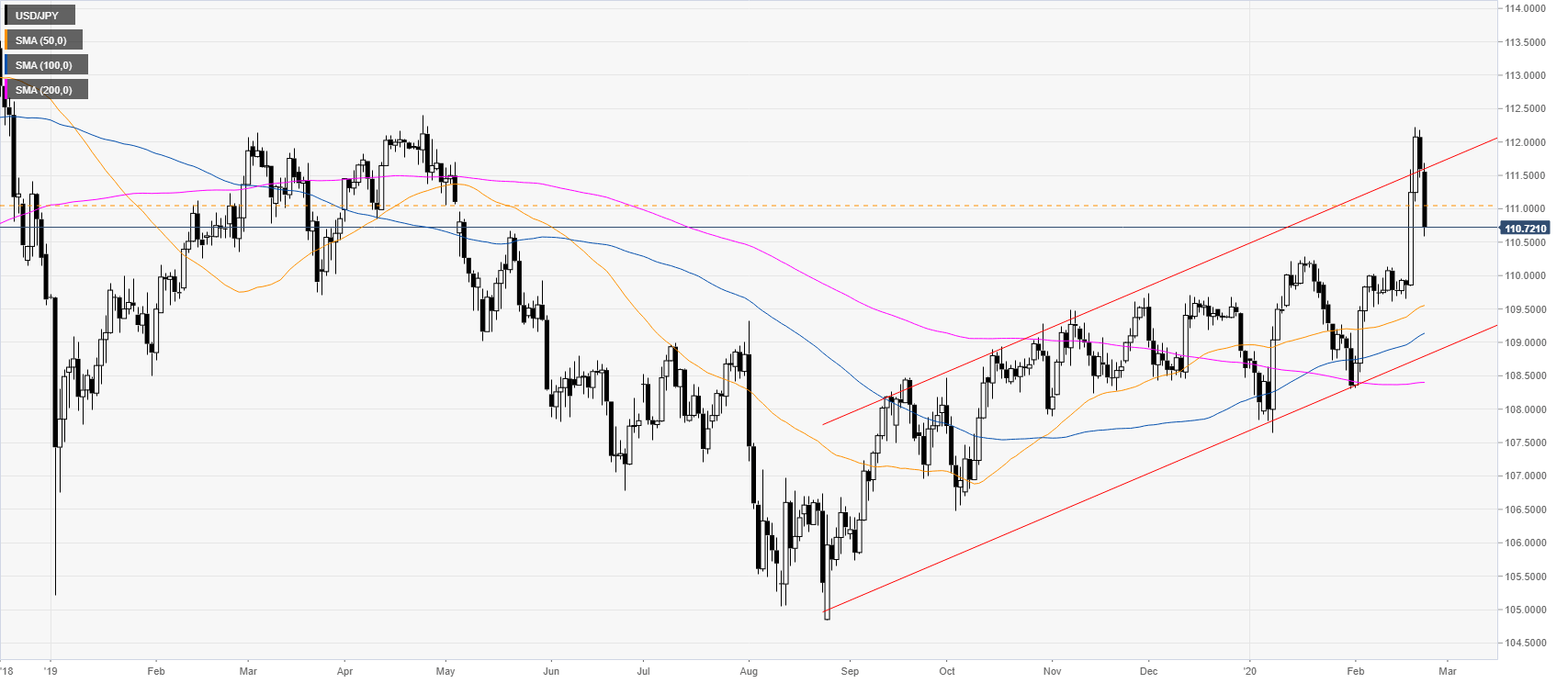

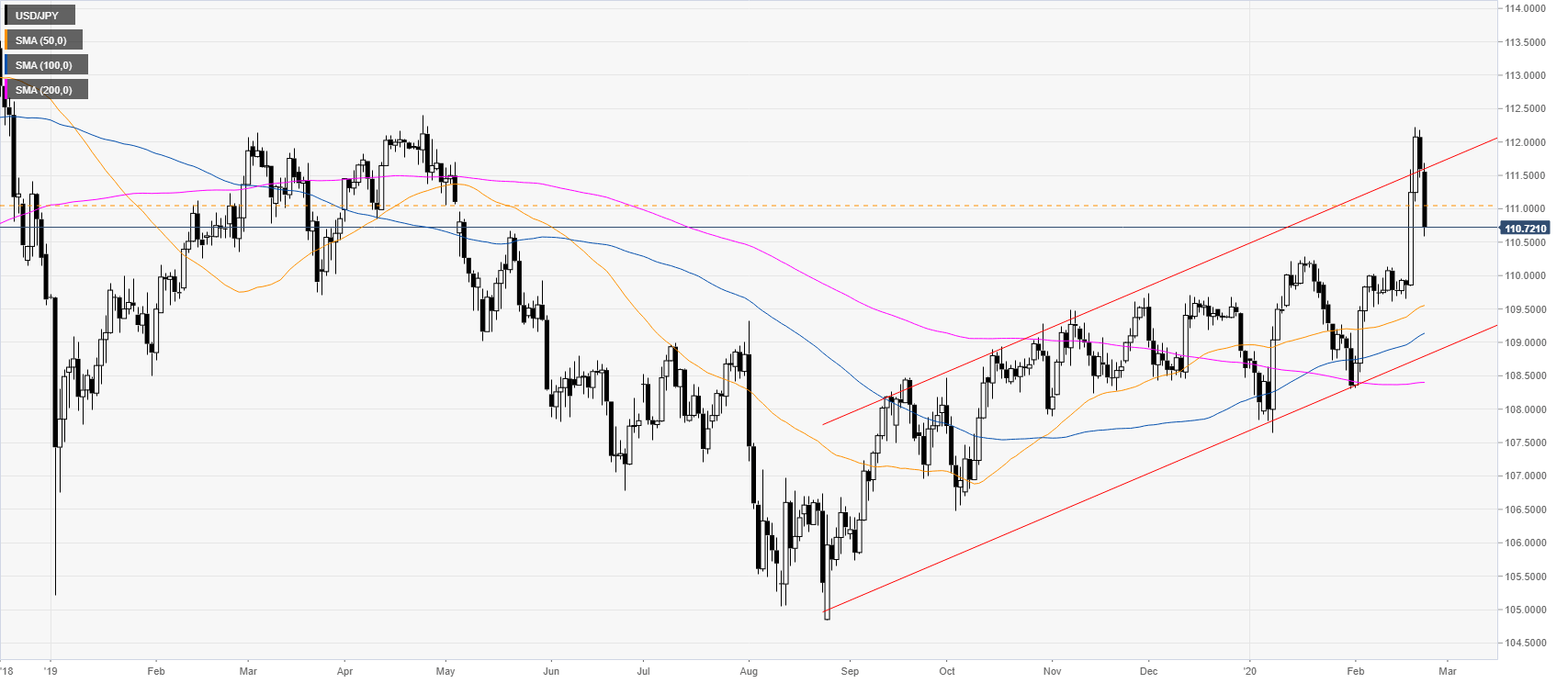

USD/JPY daily chart

USD/JPY is trading in an ascending channel while trading above the main daily simple moving averages (SMAs). The market is correcting down after two consecutive days of above-average intraday rallies.

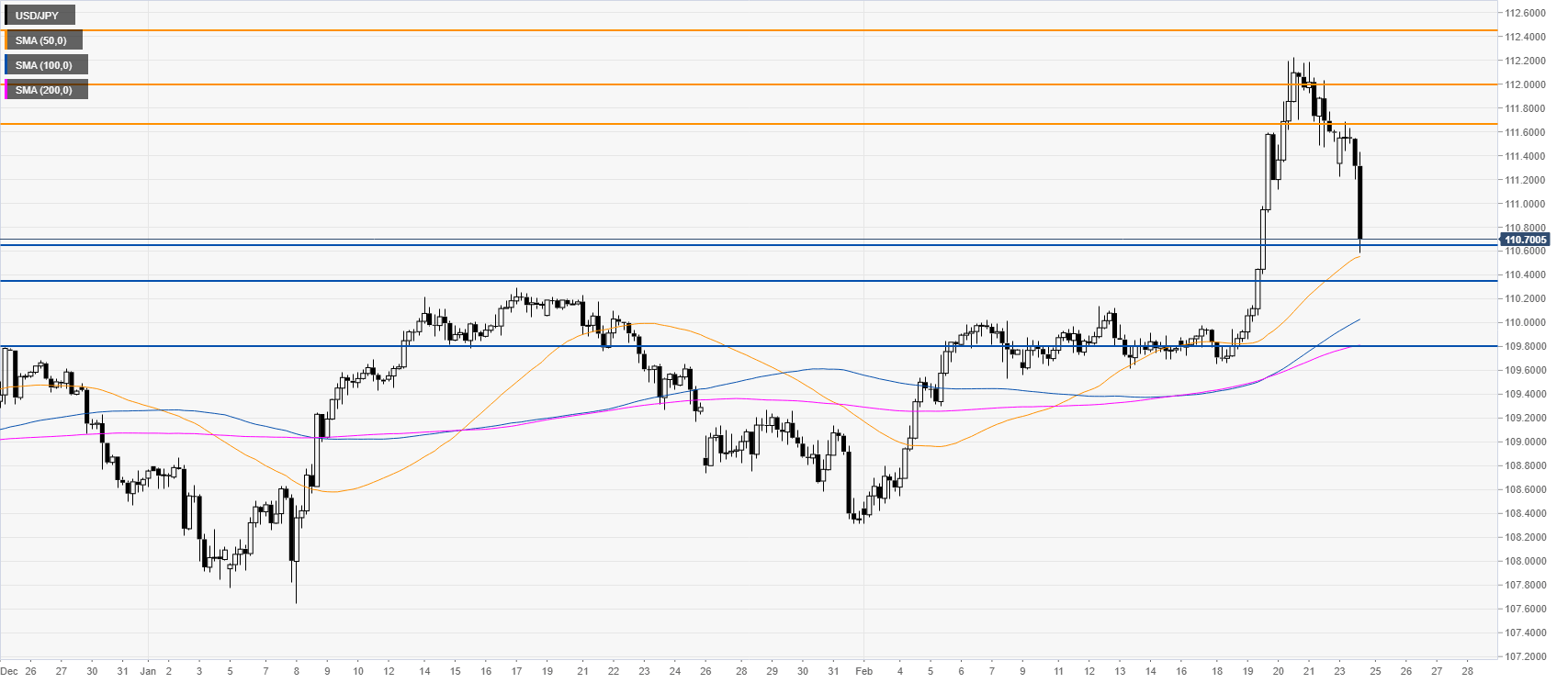

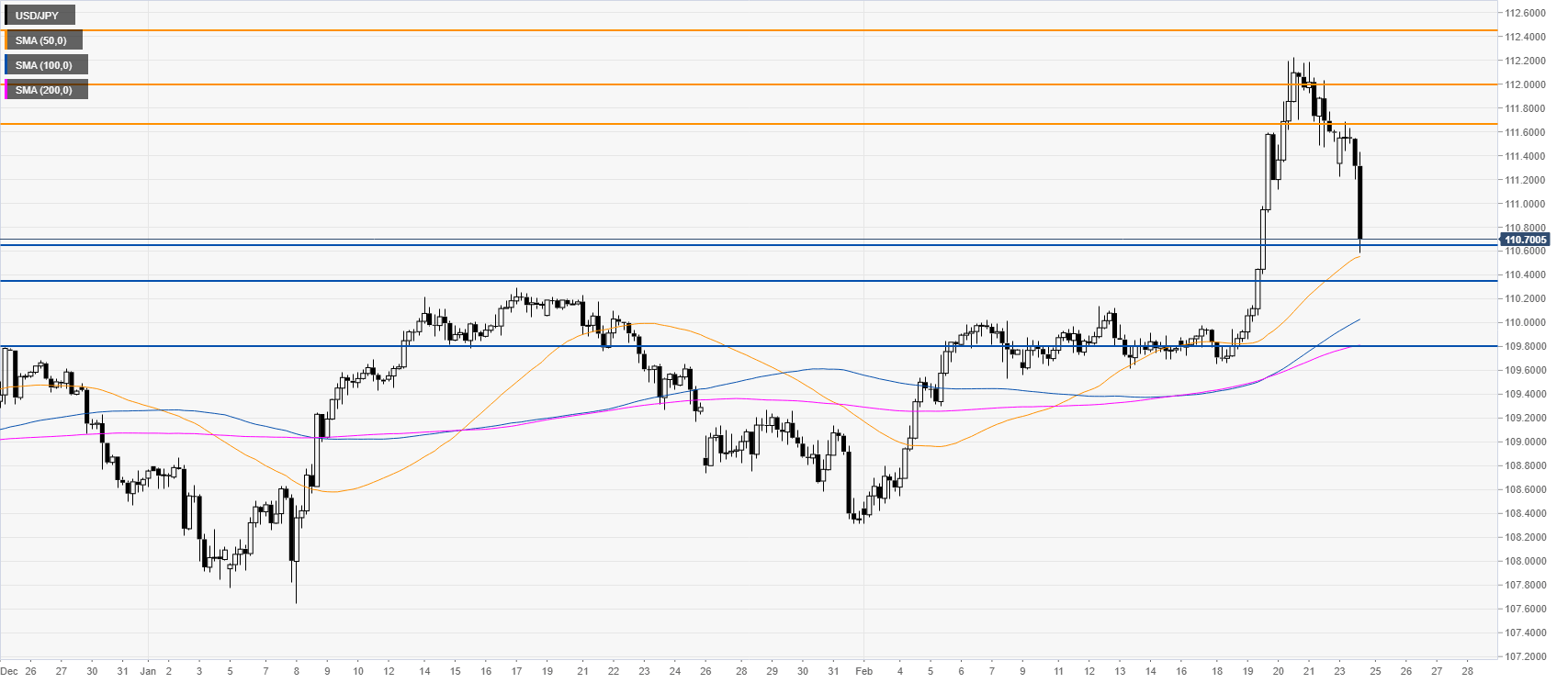

USD/JPY four-hour chart

Dollar/Yen is correcting down sharply after a very volatile last week. The spot is challenging the 110.65 support and a break below it could lead to further losses to the 110.35 and 109.80 levels. Resistance can be found near the 111.65 level, according to the Technical Confluences Indicator.

Resistance: 111.65, 112.00, 112.46

Support: 110.65, 110.35, 109.80

Additional key levels