Our best spreads and conditions

About platform

About platform

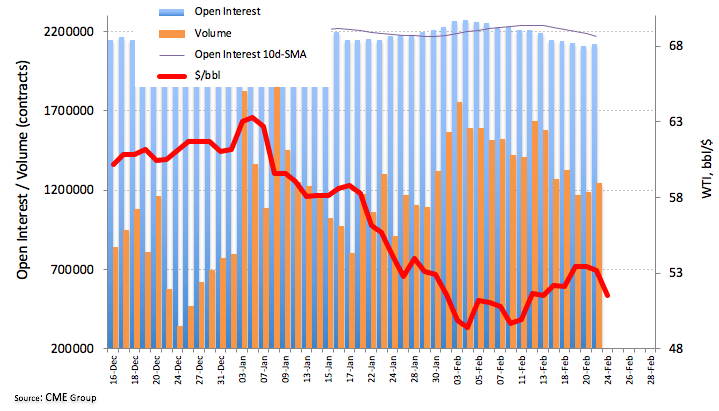

Investors added around 12.3K contracts to their open interest positions in Crude Oil futures markets on Friday, according to advanced data from CME Group. In the same line, volume rose for the second session in a row, this time by around 57.4K contracts.

Friday’s pullback in prices of the West Texas Intermediate were on the back of rising open interest and volume, hinting at the probability of a deeper correction in the short-term horizon. That said, a new visit to the $50.00 mark per barrel has now re-emerged on the horizon.