Our best spreads and conditions

About platform

About platform

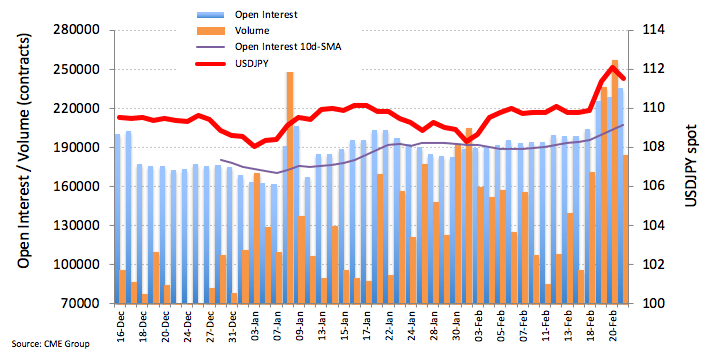

In light of advanced figures from CME Group for JPY futures markets, investors added around 6.8K contracts to their open interest positions, clinching at the same time the fourth consecutive build. Volume, on the other hand, reversed three builds in a row and shrunk by around 72.8K contracts.

USD/JPY has receded from recent YTD highs above 112.00 the figure in past sessions. Friday’s pullback was on the back of rising open interest in the Japanese currency, which could allow for further pullbacks in the pair. However, the moderate pullback in volume could also favour some consolidation in the short-term horizon.