EUR Futures: Further decline not ruled out

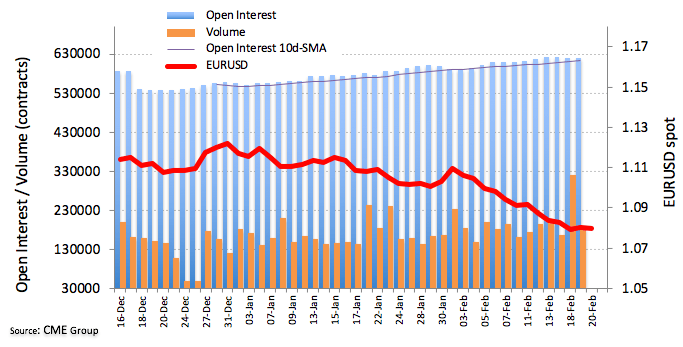

Open interest in EUR futures markets rose by just 621 contracts on Wednesday according to preliminary readings from CME Group. On the other hand, volume shrunk markedly by around 136.2K contracts, partially offsetting the previous large build.

EUR/USD: A move to 1.0710 looks unlikely in the short-term

EUR/USD’s small uptick on Wednesday was on the back of a marginal increase in open interest, allowing for some continuation of the rebound from recent yearly lows. However, the large drop in volume leaves bullish attempts shallow while keeping the focus on the downside. The next target appears in the 1.0710 region (January 2016), although a move to this area looks unlikely for the time being.