AUD/NZD Price Analysis: Bears looking for a break to 1.0390, although bullish outlook constructive

- AUD/NZD bulls in charge on a long term and near term outlook.

- Accumulation should evolve into a prolonged uptrend, but there is work to do within the accumulation channel still.

- Failures of the near-term support stricture will limit the scope for immediate breakup potential.

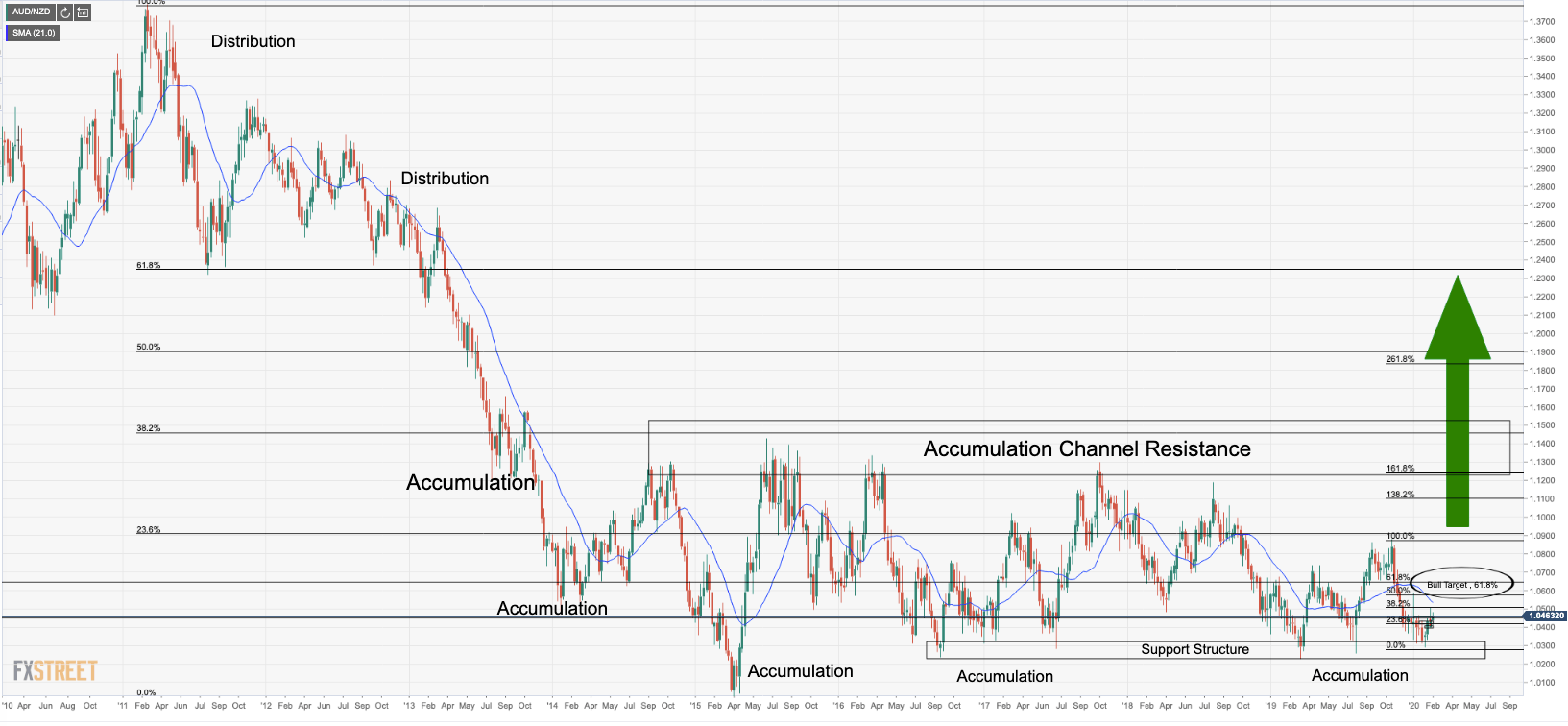

AUD/NZD has been in a long period of accumulation dating all the way back to the end of the Aril 2013's bearish impulse to July 2013 lows. There are bullish signs of monthly accumulation beginning which paints an upside bias on the nearer term charts - Daily accumulation is already in play.

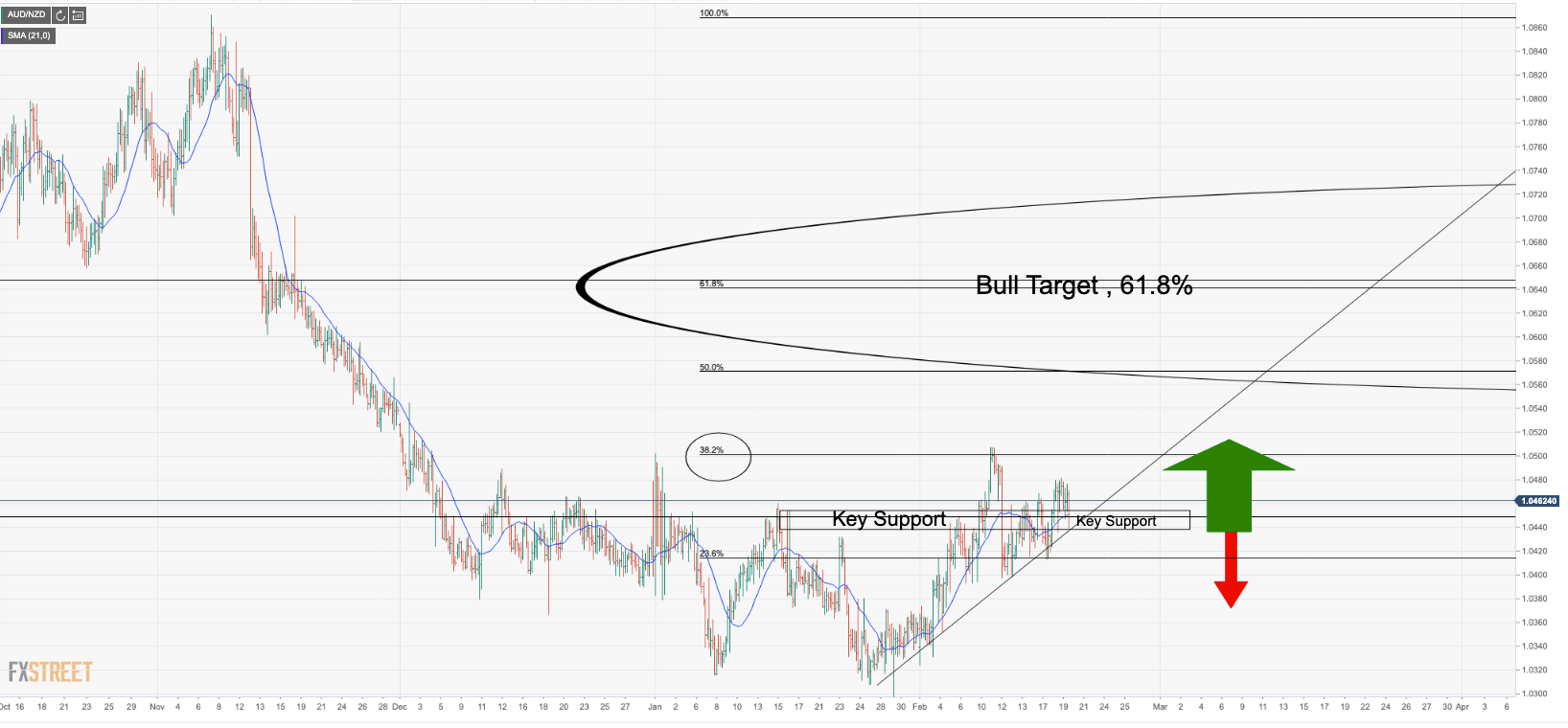

Bulls have been rising an upside correction from a double bottom, 8th and 27th of Jan down at 1.0307 and bulls have avoided a right-hand shoulder H&S formation in the recent advance, riding the 21- moving average on the 4-hour charts as support. so far, a critical support structure is holding, this is located at 1.0450, or thereabouts. Today's jobs data from Australia will be critical, which could make or break the bull's dominance.

The Big Picture: Accumulation Channel In-Play, Bullish Bias

We have seen a long period of accumulation along with weekly support. The longer the accumulation, the stronger the distribution should be with a 61.8% Fibonacci retracement of March 2011 downtrend, at least, on the cards

Close-UP Outlook

A bullish bias persists above the key support zone wh a 61.8% Fibonacci retracement target of the recent downtrend, (Sep-Nov 2019 tops). A 38.2% resistance could hold up initial attempts.

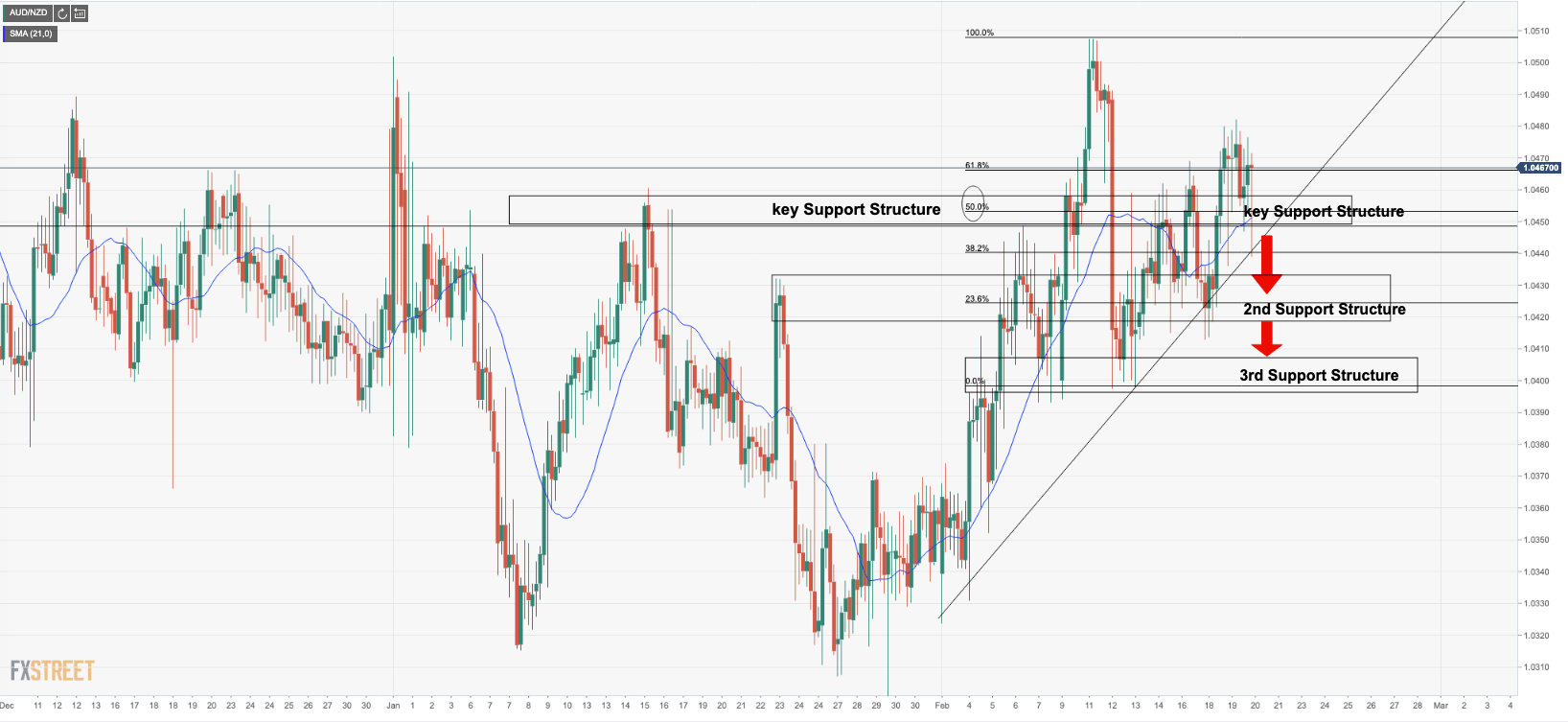

4-Hour Chart Downside Supports on Up Side Failures Above Key Support

However, AUD/NZD has failed to hold critical support on 1.0465, but should 1.0450 hold, then the bullish bottoming of the Nov downtrend will be confirmed with an initial 1.05 handle target. Failures to hold support opens the case for a correction towards the 3rd support structure, between 1.0400 and 1.0360.