Back

20 Feb 2020

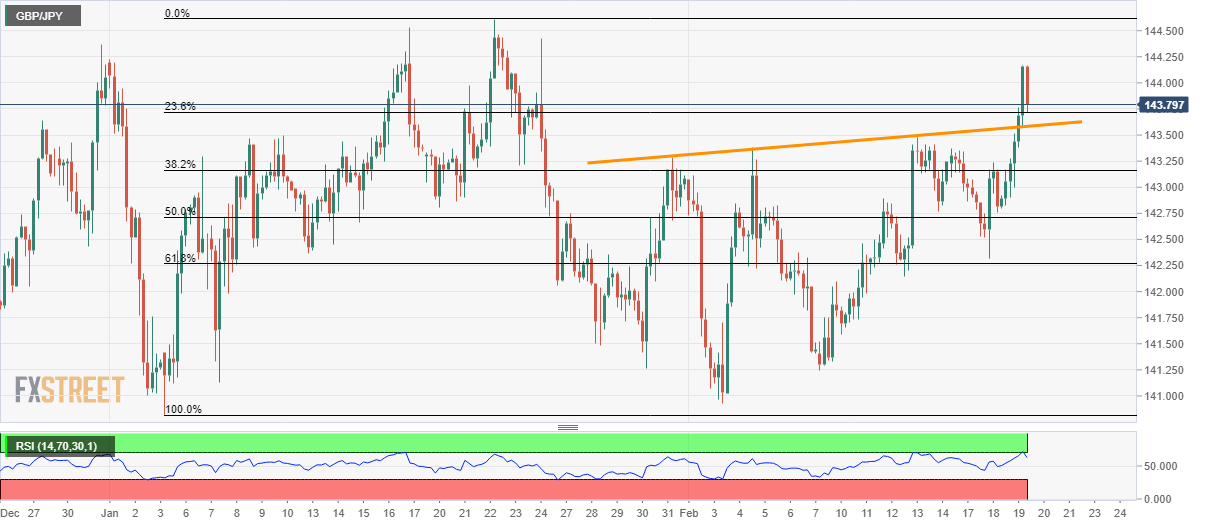

GBP/JPY Price Analysis: Monthly rising trendline becomes the key support

- GBP/JPY steps back from the top spot in four weeks.

- While overbought RSI conditions seem to have triggered the pullback, sellers will wait for entry below the resistance-turned-support.

- January high is on the bulls’ radars.

GBP/JPY declines to 143.80 during the Asian session on Thursday. The pair recently took a U-turn from the monthly high amid overbought RSI conditions. Though, an upward sloping trend line from January 31 is still stopping the sellers.

While the pair’s declines below 143.55 support line will further please the bears by offering 143.00 support, 61.8% Fibonacci retracement of the quote’s January month upside, around 142.30, becomes the key afterward.

On the upside, 144.00 and the latest high, near 144.20, holds the gate for the pair’s run-up to the fresh yearly peak surrounding 144.60.

It should, however, be noted that the quote’s sustained rise past-144.60 enables it to question December 13, 2019 low near 145.45.

GBP/JPY four-hour chart

Trend: Pullback expected