Our best spreads and conditions

About platform

About platform

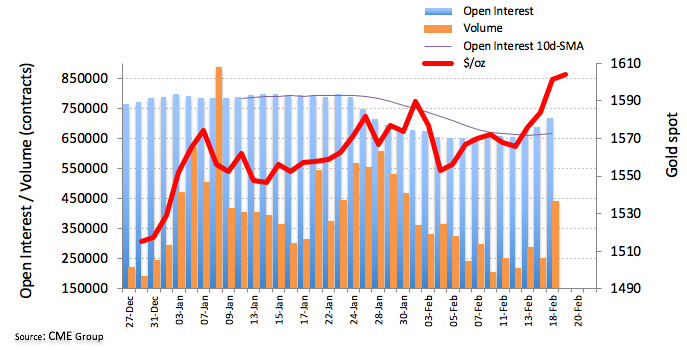

Open interest in Gold futures markets went up by nearly 28.4K contracts on Tuesday, reaching the third consecutive build according to flash data from CME Group. In the same line, volume rose by nearly 188.7K contracts, reaching the largest single day build so far this year.

The ounce troy of the precious metal regained the key $1,600 mark on Tuesday amidst rising open interest and volume, opening the door at the same time for a potential visit to the 2020 peaks at $1,611.34 recorded earlier in January.