USD/CAD Price Analysis: Wedge breakout fails to inspire bulls

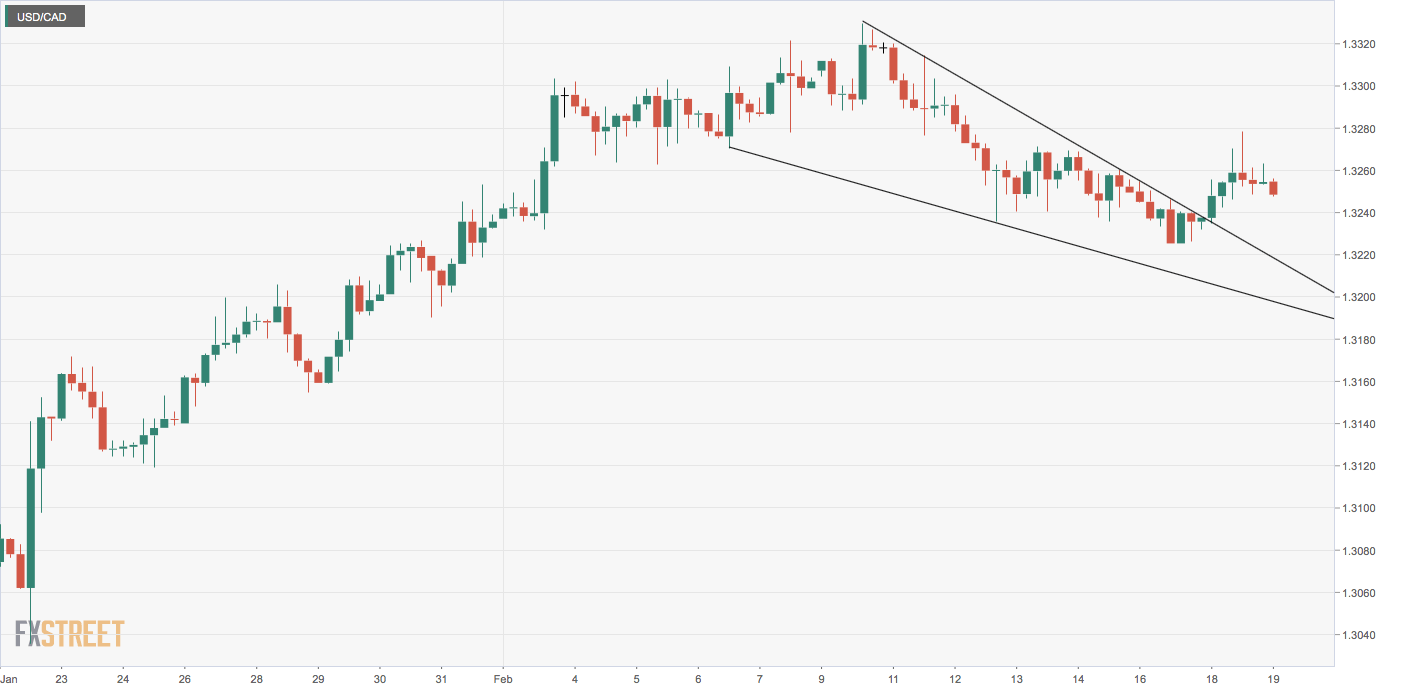

- USD/CAD is on the offer despite the falling wedge breakout on the 4H chart.

- Tuesday's high of 1.3278 needs to breached to confirm a bullish revival.

USD/CAD is struggling to gather upside traction despite a bullish continuation setup on the 4-hour chart.

The pair broke out of a falling wedge pattern on Monday, signaling a continuation of the recent rally from the December low of 1.2951.

The post-breakout upside, however, stalled at 1.3278 on Tuesday, allowing sellers to push the spot back to levels near 1.3250 where it is currently trading.

Tuesday’s high of 1.3278 is now the level to beat for the bulls. A break higher would expose the recent high of 1.3329.

Alternatively, if sellers manage to establish a secure foothold below 1.3225 (Feb. 17 low), additional losses toward 1.3185 could be seen. That level marks the 38.2% Fibonacci retracement of the rally from 1.2951 to 1.3329.

4-hour chart

Trend: Bearish below 1.3225

Technical levels