Back

19 Feb 2020

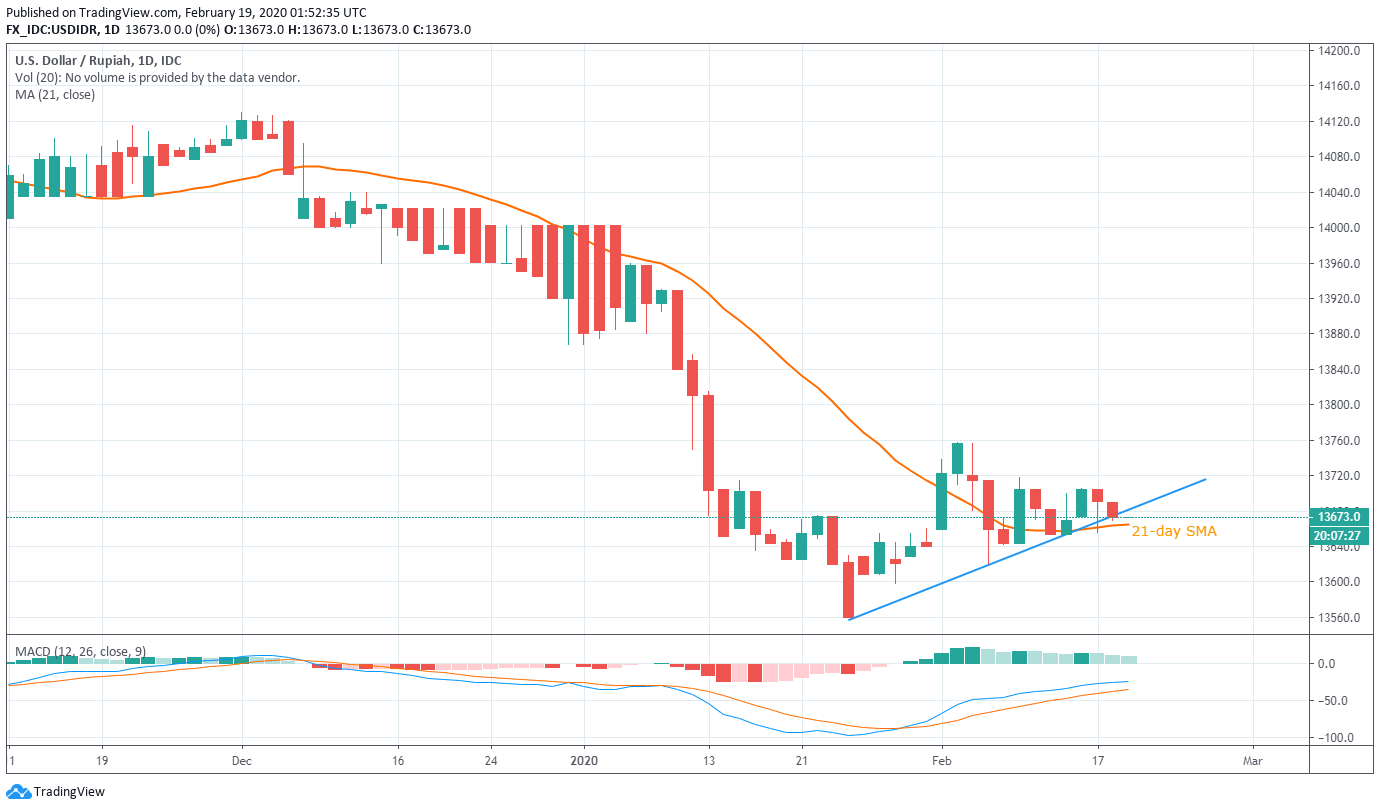

USD/IDR Price Analysis: 21-day SMA questions break of short-term rising trendline

- USD/IDR struggles to extend the latest declines.

- Further declines can challenge monthly bottom whereas 13,705 holds the key to the month’s top.

USD/IDR stays modestly changed to 13,675 amid the initial trading hours on Wednesday. The quote recently broke the three-week-old rising trend line but stays above 21-day SMA.

However, bullish MACD pushes buyers to look for entry if prices take a U-turn beyond the support-turned-resistance line of 13,685.

In doing so, 13,705 could be their target ahead of challenging the monthly high near 13,760.

Meanwhile, pair’s further declines below 21-day SMA level of 13,665 could aim for the month’s low near 13,620 whereas 13,600 and 13,560 can please the bears afterward.

USD/IDR daily chart

Trend: Pullback expected