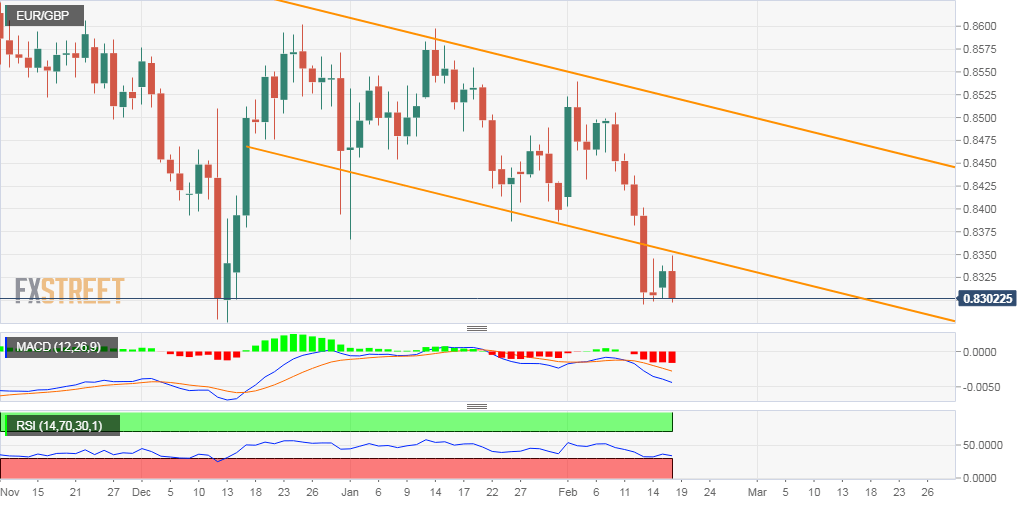

EUR/GBP Price Analysis: Slips below 0.8300 mark, 2-month lows

- EUR/GBP meets with some fresh supply and slides back closer to two-month lows.

- The technical set-up supports prospects for an extension of the depreciating move.

The EUR/GBP cross failed to capitalize on its early uptick to mid-0.8300s and witnessed a dramatic intraday turnaround since the early European session on Tuesday.

The downfall dragged the cross back closer to two-month lows set last week, with bears now eyeing some follow-through selling below the 0.8300 round-figure mark.

Given the recent break below a near two-month-old descending trend-channel, the set-up remains tilted in favour of bearish traders and support prospects for a further downfall.

Meanwhile, technical indicators on the daily chart maintained their bearish bias and are still far from being in the oversold territory, which further reinforces the negative outlook.

Sustained weakness below multi-year lows – around the 0.8277 region – set in December, will reaffirm the bearish bias and pave the way for a further depreciating move.

The cross then might accelerate the slide further towards the 0.8200 round-figure mark before eventually dropping to its next major support near the 0.8115-10 region.

EUR/GBP daily chart