Our best spreads and conditions

About platform

About platform

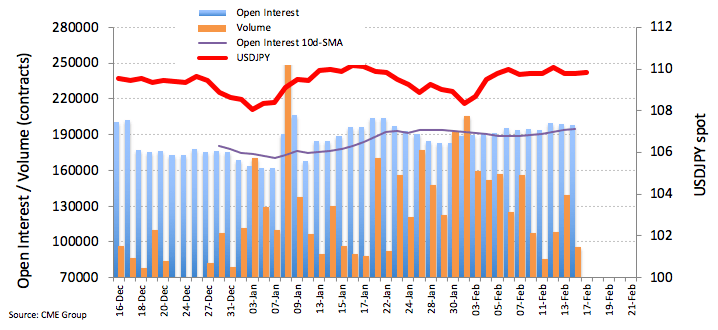

According to preliminary prints from CME Group for JPY futures markets, investors scaled back their open interest positions for the second session in a row on Friday, this time by 592 contracts. Volume followed suit and dropped by nearly 43.5K contracts after two builds in a row.

Friday’s knee-jerk in USD/JPY was accompanied by declining open interest and volume in the Japanese safe haven, signalling that extra gains in the yen could be temporary. Against this, the pair is expected to resume the downside and attempt another breakout of the 110.00 mark in the short-term horizon.