EUR/USD Futures: Downside losing momentum?

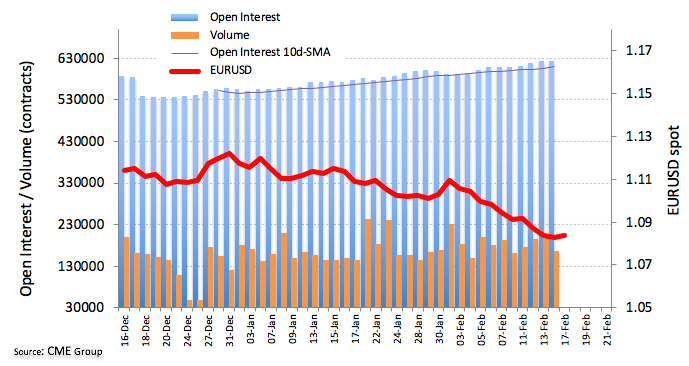

CME Group’s flash data for EUR futures markets showed open interest rose by just 478 contracts on Friday, reaching the fourth consecutive build. On the other hand, volume shrunk by nearly 33.1K contracts following three consecutive daily builds.

EUR/USD looks supported near 1.0830

The decline in EUR/USD seems to have met some decent support in the 1.0830 region, or YTD lows so far. While rising open interest on Friday favours further losses in the near-term, the moderate drop in volume hints at the likeliness that the pair could be attempting to find a base, leaving extra pullbacks somewhat contained.