Back

14 Feb 2020

EUR Futures: Downside remains well in place

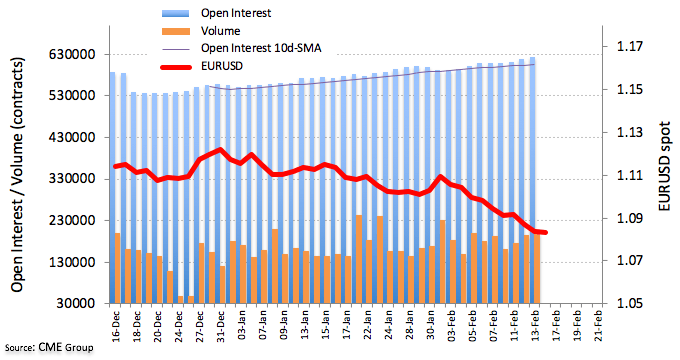

Open interest in EUR futures markets rose for the third consecutive session on Thursday, this time by nearly 4.4K contracts according to preliminary data from CME Group. Volume, too, extended the uptrend and increased by around 5.2K contracts.

EUR/USD now targets 1.0814

EUR/USD prolonged the leg lower for yet another day on Thursday, moving further into the negative territory after the recent breakout of the 1.09 support. Rising open interest and volume amidst negative price action now open the door to a potential test of the Fibo retracement at 1.0814 in the near-term.