Our best spreads and conditions

About platform

About platform

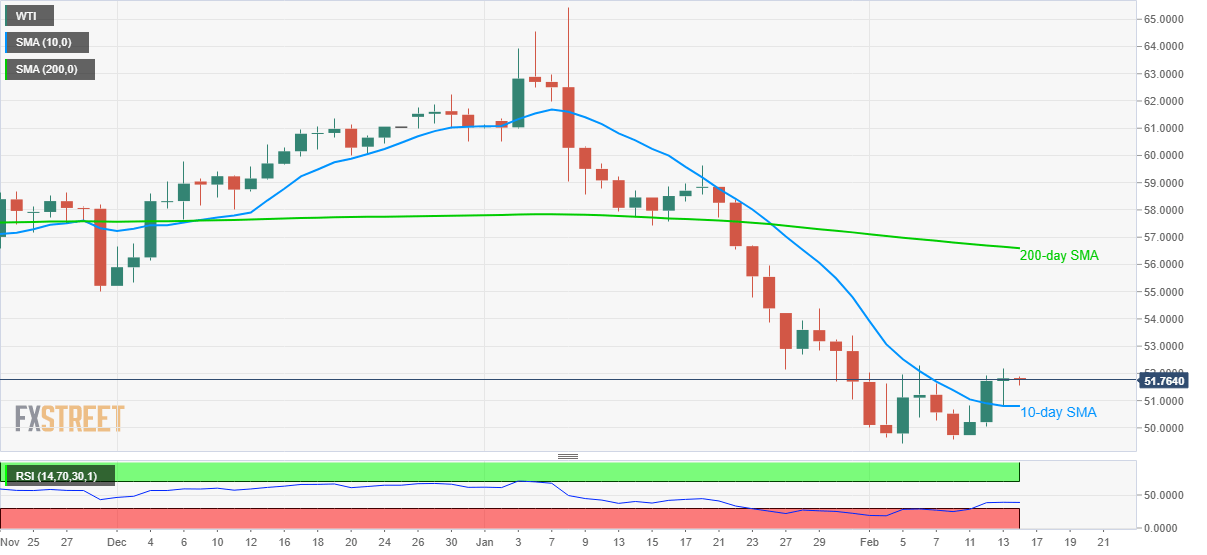

WTI steps back to $51.72 while heading into the European session on Friday. the oil benchmark crossed 10-day SMA for the first time since early January on Wednesday and has been above that afterward. Also supporting the bullish sentiment is oversold RSI conditions.

As a result, buyers can take aim on January 29 to surrounding $54.38 whereas November 2019 low near $55.00 could challenge the upside then after.

If at all the oil prices remain on the front foot past-$55, a 200-day SMA level around $56.60 will be in the spotlight.

Meanwhile, the black gold’s declines below 10-day SMA level of $50.80 can take rest at the latest lows, also the multi-year low, near $49.40.

Trend: Recovery expected