EUR/USD Price Analysis: Euro hits lowest level since April 2017

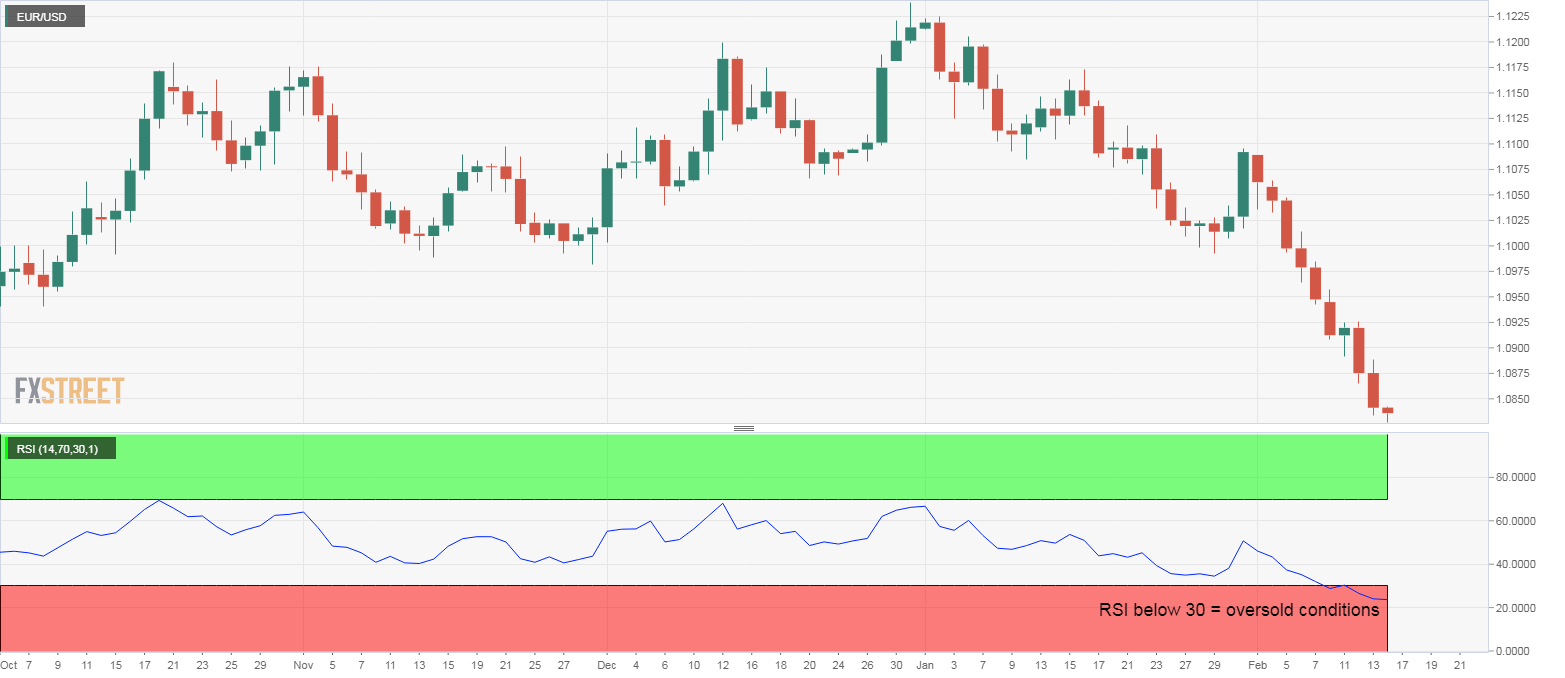

- EUR/USD has dropped to the levels last seen in April 2017.

- The weekly candle indicate the path of least resistance is to the downside.

- Short-term oversold conditions suggest scope for a corrective bounce.

EUR/USD breached support at 1.0839 a few minutes before press time and fell to 1.0827, the lowest levels since April 2017.

The bearish trend looks quite strong with the weekly candle carrying little or no wicks, similar to last week's big bearish "marubozu" candle.

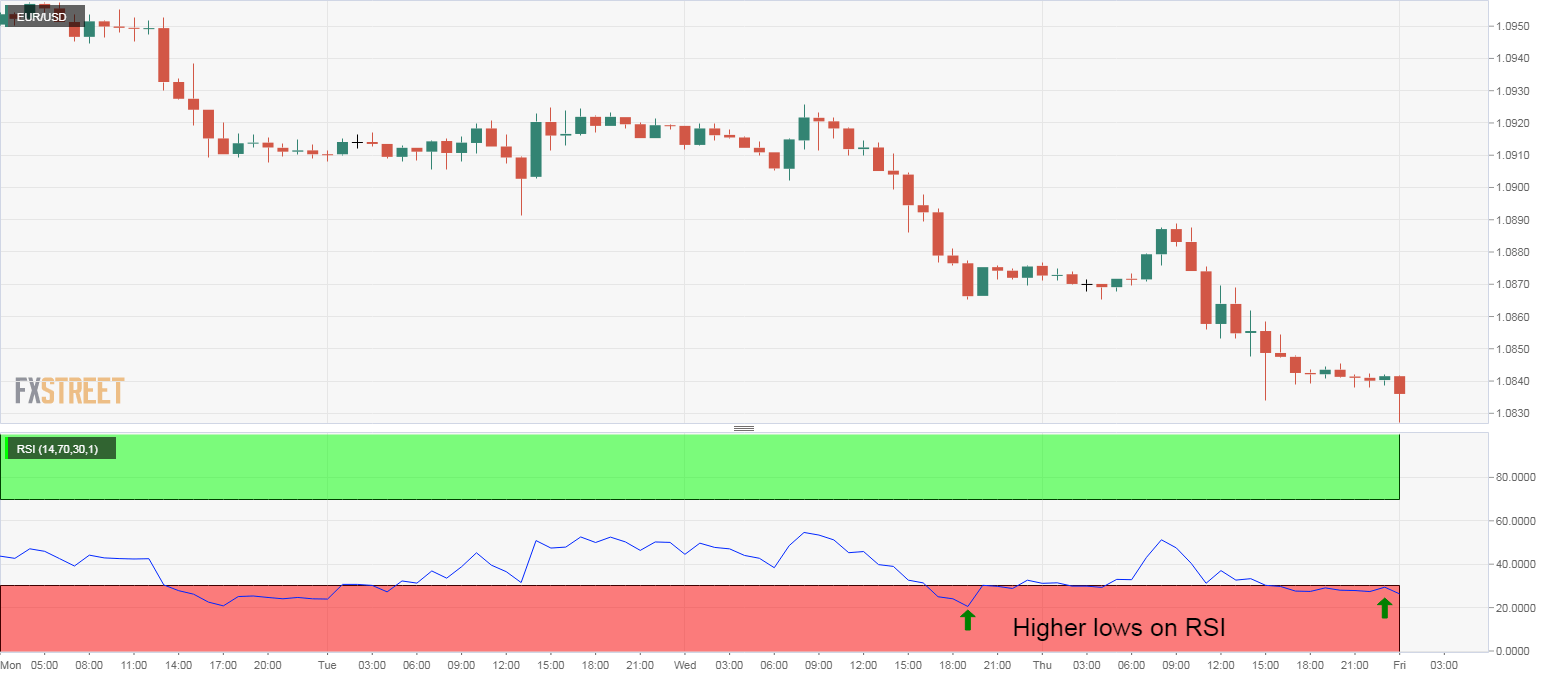

That said, the 14-day relative strength index (RSI) is now reporting oversold conditions and the hourly chart RSI is printing higher lows, contradicting lower lows on price (bullish divergence).

As a result, a corrective bounce may be seen before further declines toward levels below 1.08.

An oversold bounce, if any, could challenge the former hourly chart support-turned-resistance of 1.0865, above which the focus would shift to the descending or bearish 50-hour average at 1.0880.

Daily chart

Hourly chart

Trend: Bearish