Our best spreads and conditions

About platform

About platform

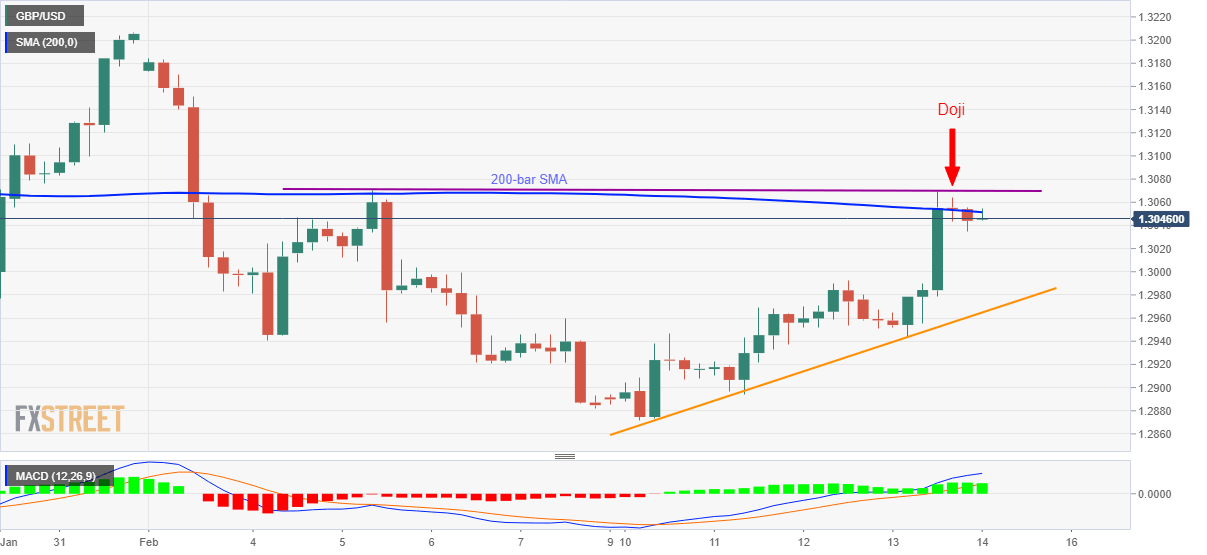

GBP/USD pullback to 1.3045 during Friday’s Asian session. The quote surged to the highest since February the previous day but a bearish candlestick formation around the key SMA resistance seems to question further upside.

That said, sellers are again targeting 1.3000 marks whereas an upward sloping trend line from February 10, at 1.2965, could restrict the pair’s further downside.

Should there be additional weakness below 1.2965, the pair’s drop to the monthly bottom surrounding 1.2870 can’t be ruled out.

Meanwhile, an upside clearance of 1.3070 will negate the bearish candlestick formation and could propel the quote towards 1.3140 ahead of aiming for late-January top close to 1.3210.

Trend: Pullback expected