Back

13 Feb 2020

USD/CHF Price Analysis: Greenback grinding up vs. Swiss franc, clings to 2020 highs

- USD/CHF is slowly advancing printing fresh 2020 highs by a few pips.

- The rising wedge formations can limit the upside on USD/CHF.

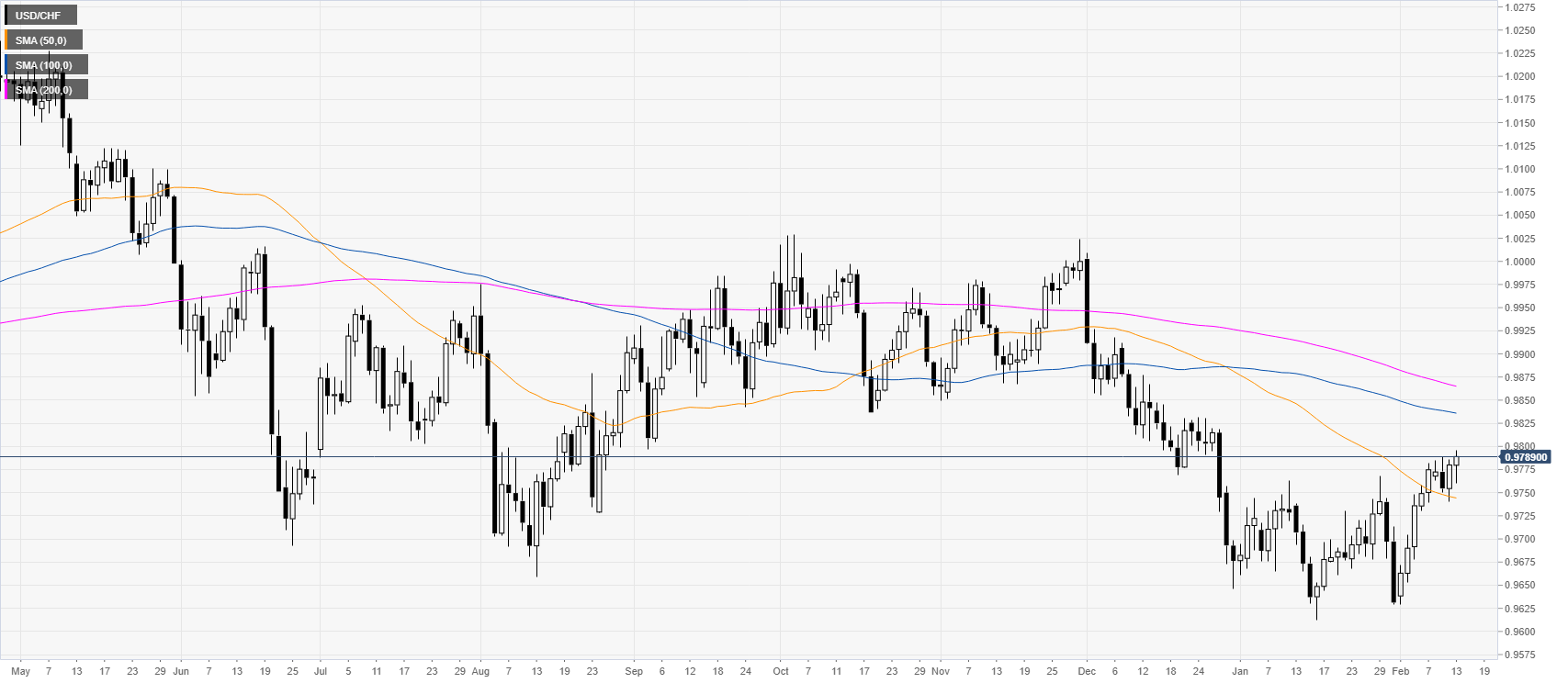

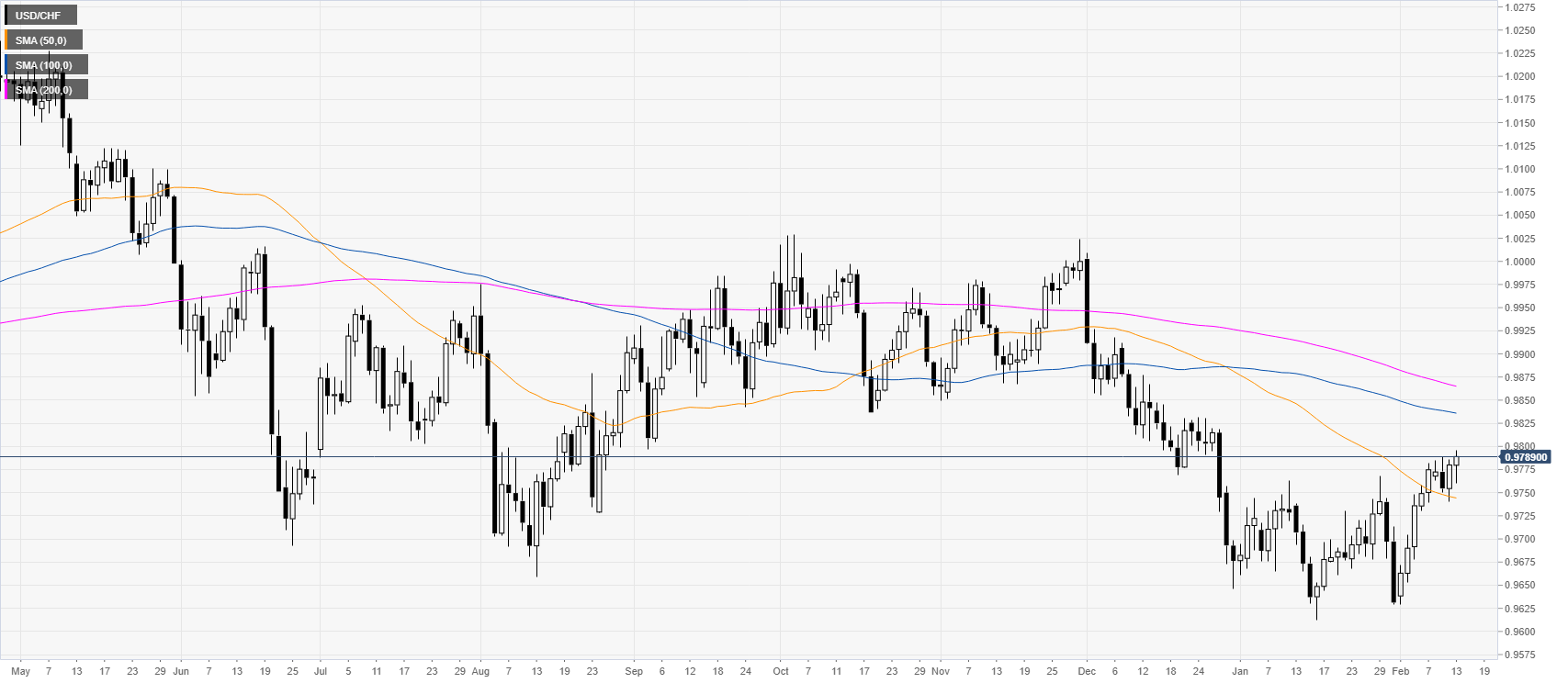

USD/CHF daily chart

USD/CHF is printing new 2020 highs while the quote is trading below the 100/200-day simple moving averages suggesting an overall bearish momentum.

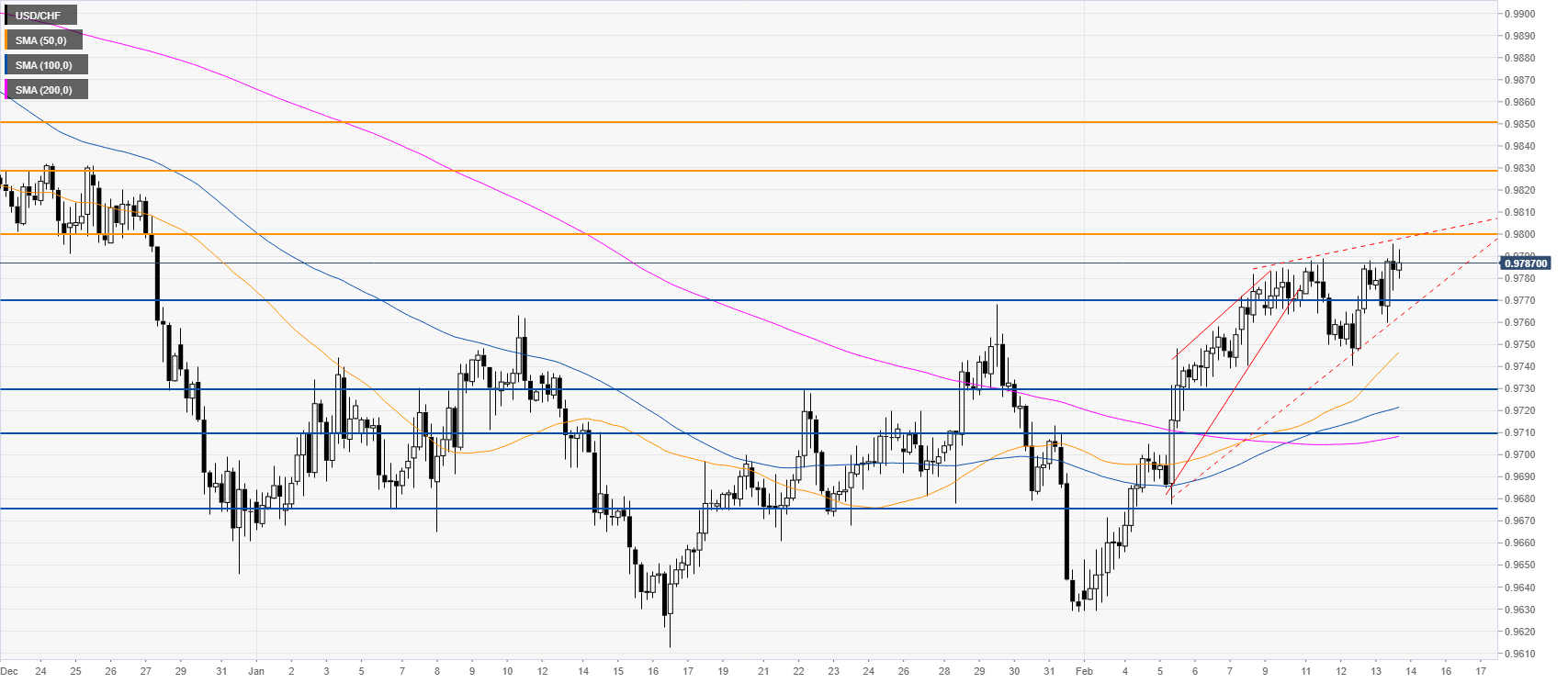

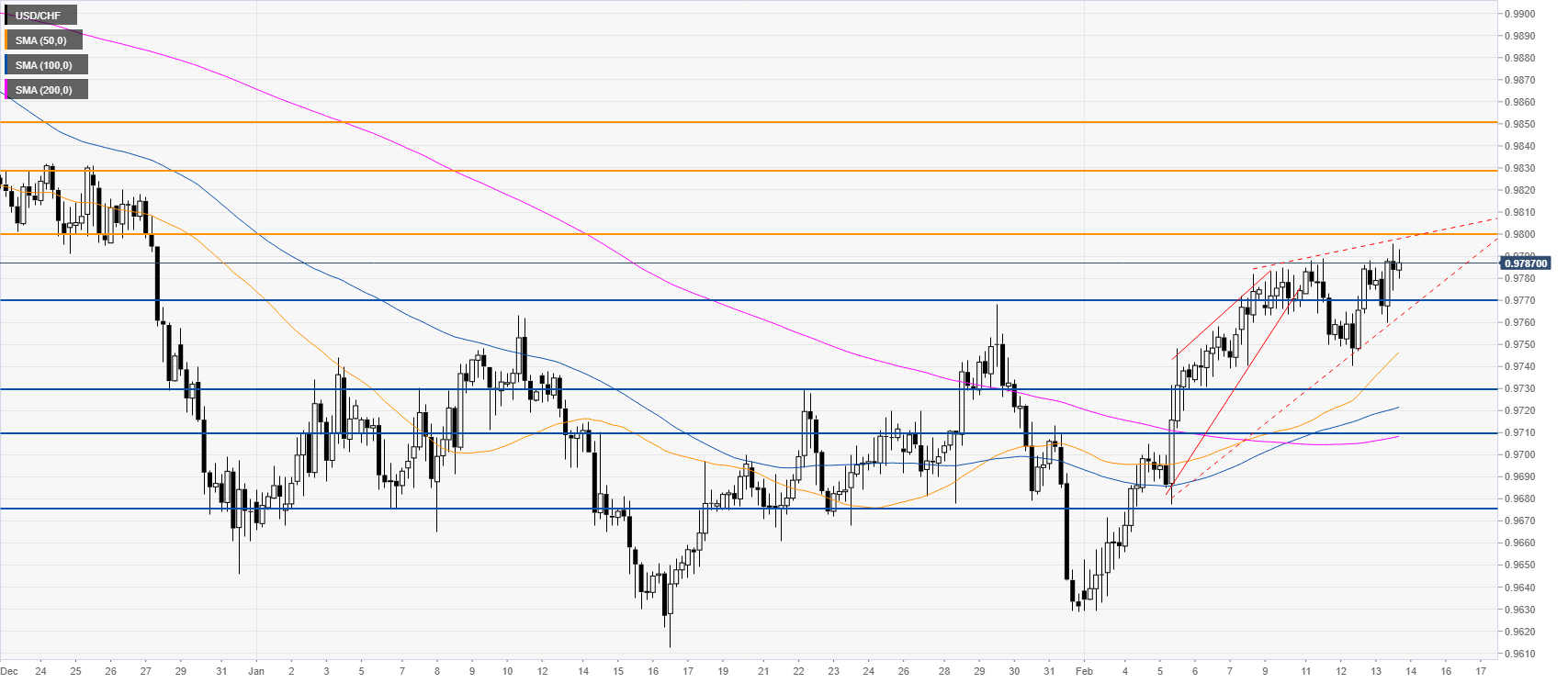

USD/CHF four-hour chart

After USD/CHF broke below the rising wedge pattern the market made a retest of the high creating a higher high by a few pips just below the 0.9800 figure. The spot is also trading within a larger rising wedge pattern which can be seen as potentially bearish if the bears start to show some signs of conviction. In fact, bears want to weaken the market and trade below the 0.9770 level to drive the quote below the last swing low towards the 0.9730 and 0.9710 price levels. However, a daily break above the 0.9800 figure might invalidate the bearish scenario and lead to an acceleration towards the 0.9830 and 0.9850 price levels.

Resistance: 0.9800, 0.9830, 0.9850

Support: 0.9770, 0.9730, 0.9710

Additional key levels