Back

13 Feb 2020

Gold New York Price Forecast: XAU/USD bulls looking for a break above 1577 resistance

- XAU/USD appears supported above the 1560.00 mark.

- The level to beat for buyers is the 1577.00 resistance.

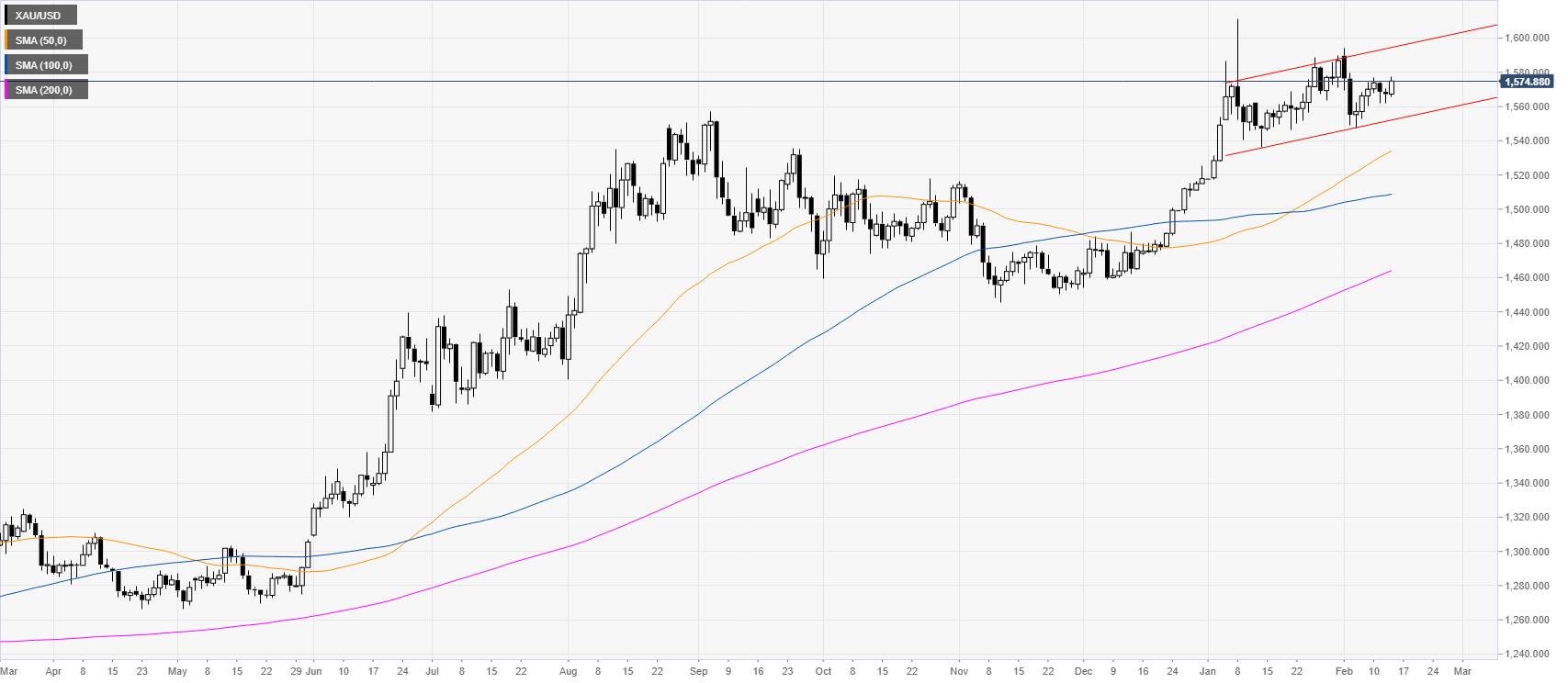

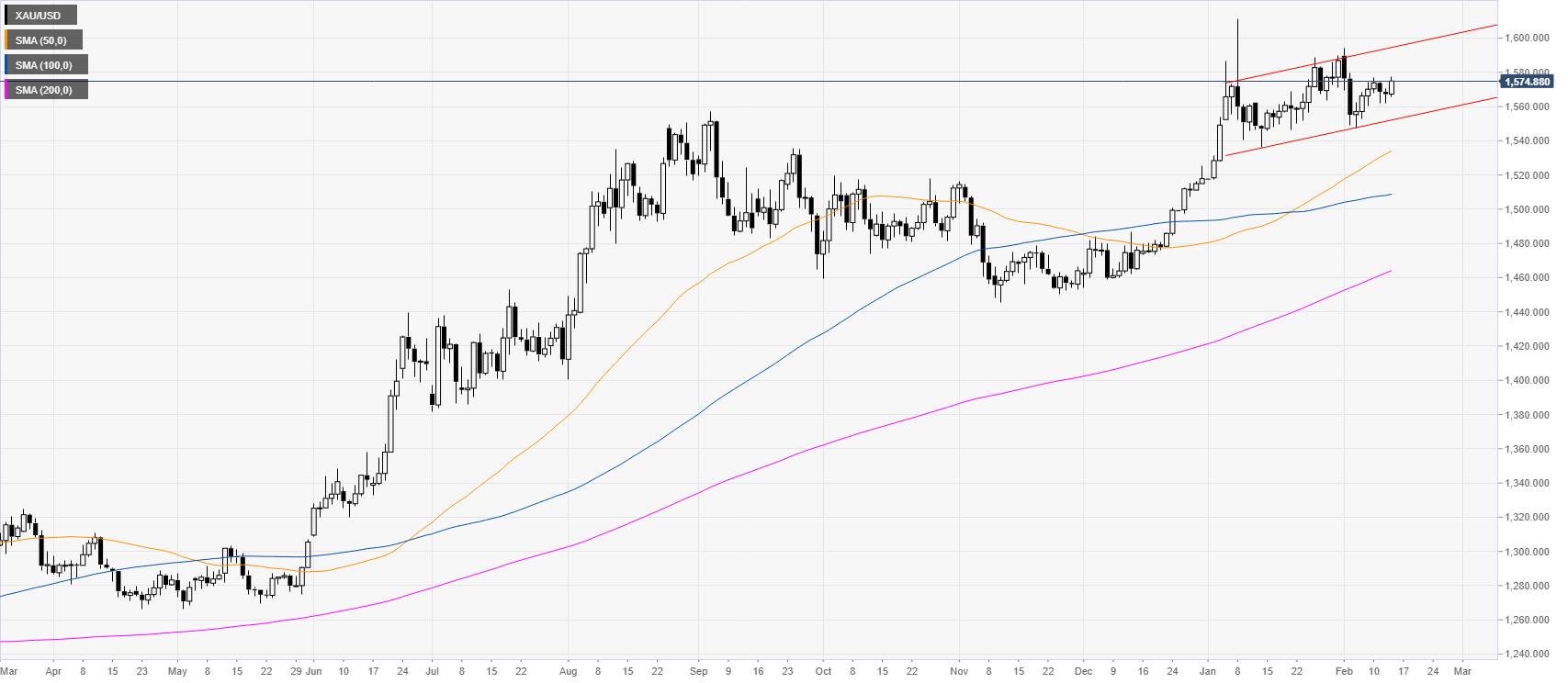

Gold daily chart

Gold is trading in an uptrend above its main daily simple moving averages (SMAs). XAU/USD is evolving in an upward channel while the market is being supported above the 1560.00 figure.

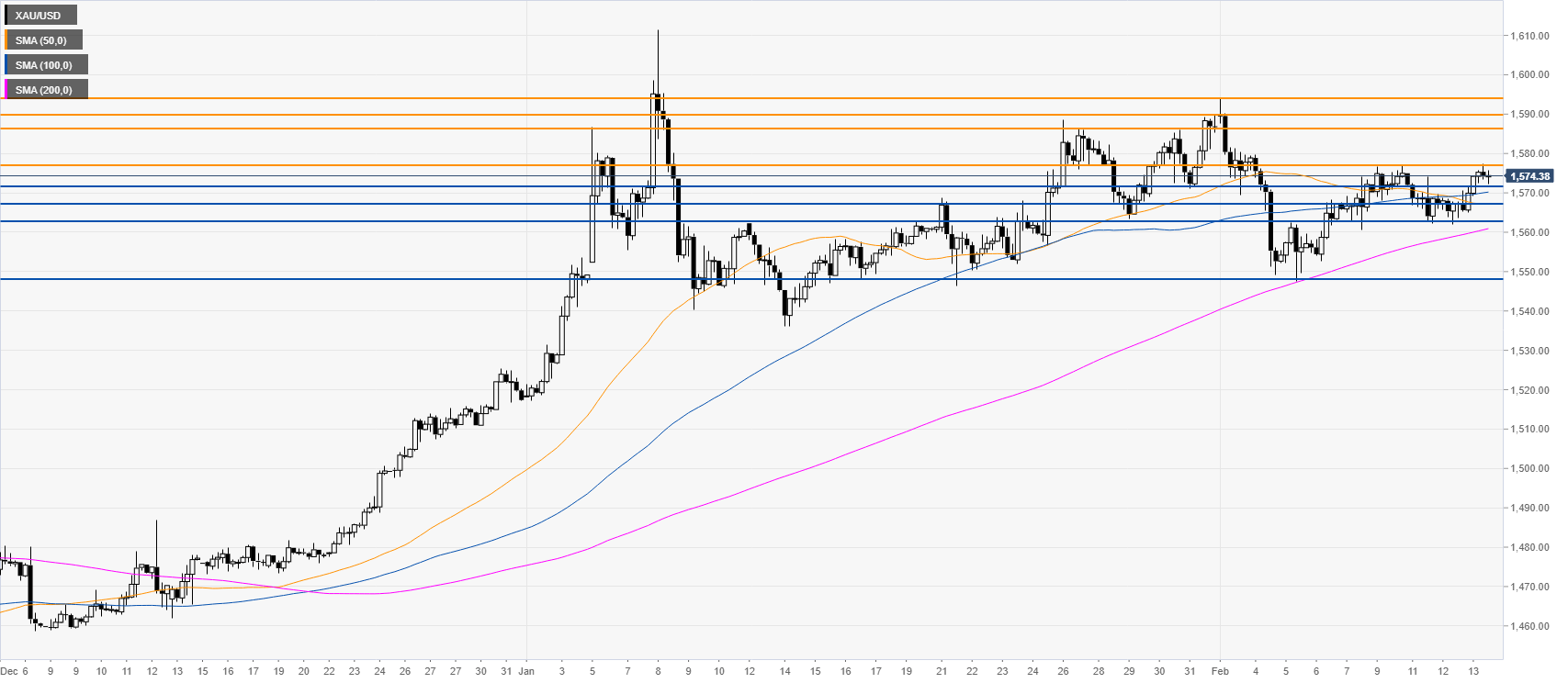

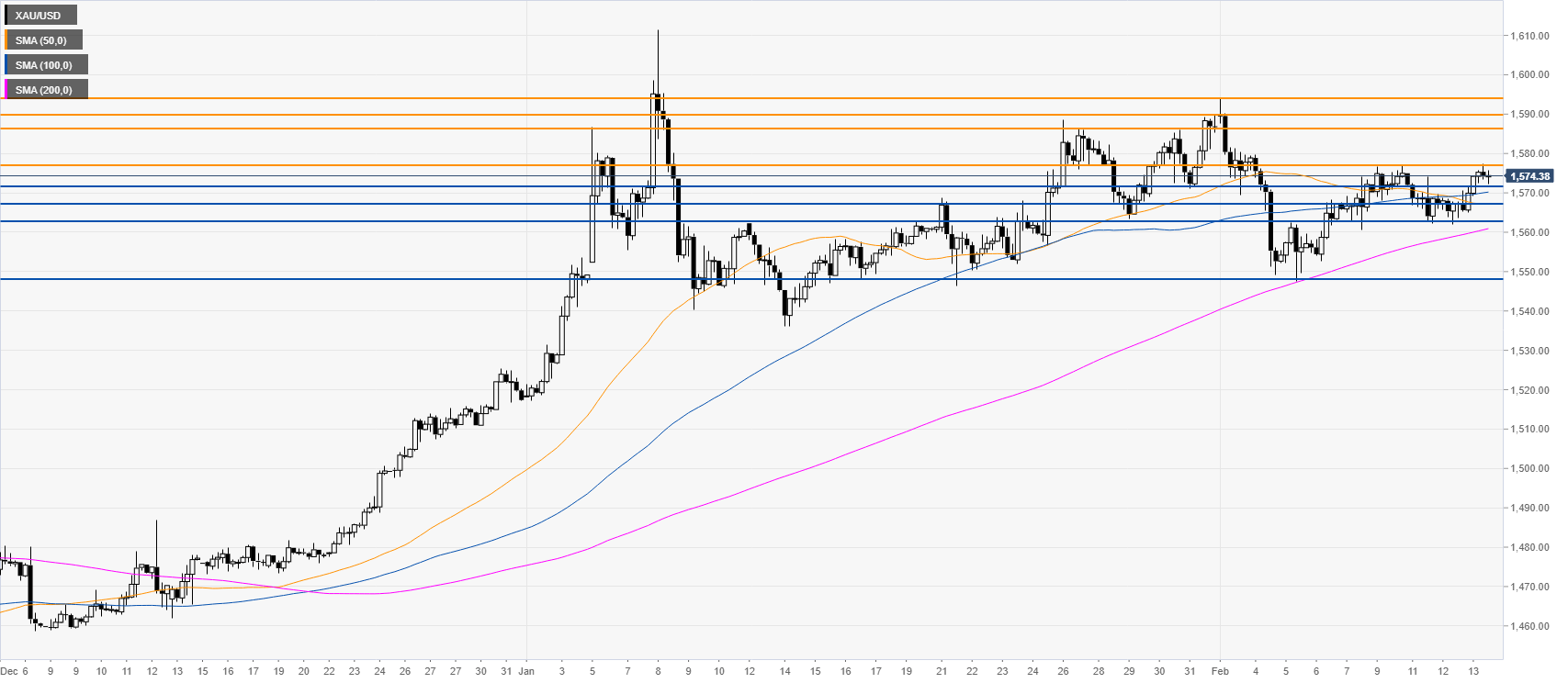

Gold four-hour chart

XAU/USD is challenging the 1577.00 resistance while trading above the main SMAs on the four-hour chart suggesting a bullish momentum in the medium term. A break above the above-mentioned level can lead to extra gains towards the 1586.74, 1590.00 and 1594.00 price levels. On the flip side, corrections down could find support near the 1572.00, 1567.50, 1562.00 and 1557.27 levels, according to the Technical Confluences Indicator.

Resistance: 1577.00, 1586.74, 1590.00, 1594.00

Support: 1572.00, 1567.50, 1562.00, 1557.27

Additional key levels