Back

13 Feb 2020

Gold Futures: Potential rebound near-term

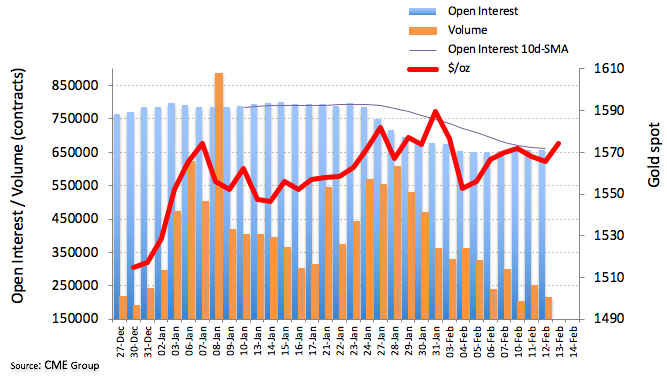

In light of preliminary prints from CME Group for Gold futures markets, open interest and volume went down by nearly 1.1K contracts and almost 36.3K contracts, respectively, on Wednesday.

Gold posed for extra consolidation

Alternating risk appetite trends – always looking to developments from the COVID-19 – are expected to keep driving the mood around Gold. The recent decline in open interest and volume coupled with lower prices opens the door to a potential bounce in the short-term horizon. Against this backdrop, the ounce troy of the precious metal is still seen capped by monthly peaks near $1,570 (February 1st).