Back

13 Feb 2020

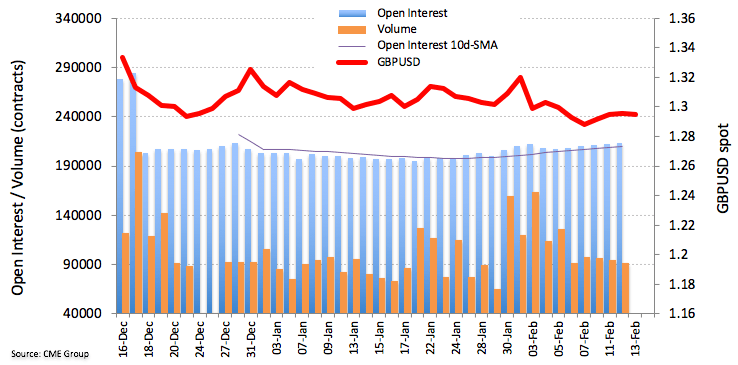

GBP Futures: Extra rangebound on the cards

CME Group’s preliminary figures for GBP futures markets noted investors increased their open interest positions for the fifth session in a row on Wednesday, this time by nearly 1.5K. On the other hand, volume shrunk for the third straight day, now by around 2.2K contracts.

GBP/USD still capped by 1.30

Cable’s inconclusive performance on Wednesday was in tandem with rising open interest and volume. The lack of a clear direction in the pair leaves unchanged the consolidative view for the time being.