Back

13 Feb 2020

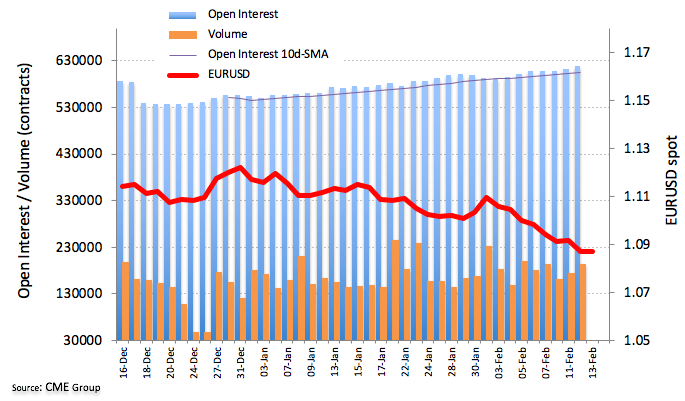

EUR Futures: Downside looks unabated

Open interest in EUR futures markets rose by nearly 6.5K contracts on Wednesday, reaching the second build in a row according to advanced data from CME Group. In the same line, volume edged higher for the second consecutive session, this time by around 18.7K contracts.

EUR/USD remains under pressure

EUR/USD stays well on the defensive and the recent breach below the key support at 1.09 the figure has opened the door to further pullbacks. Supporting this view, rising open interest and volume now point to a potential test of a Fibo retracement (of the 2017-2018 rally) at 1.0814.