GBP/JPY Price Analysis: Steps back from near-term key resistance confluence

- GBP/JPY snaps three-day winning streak.

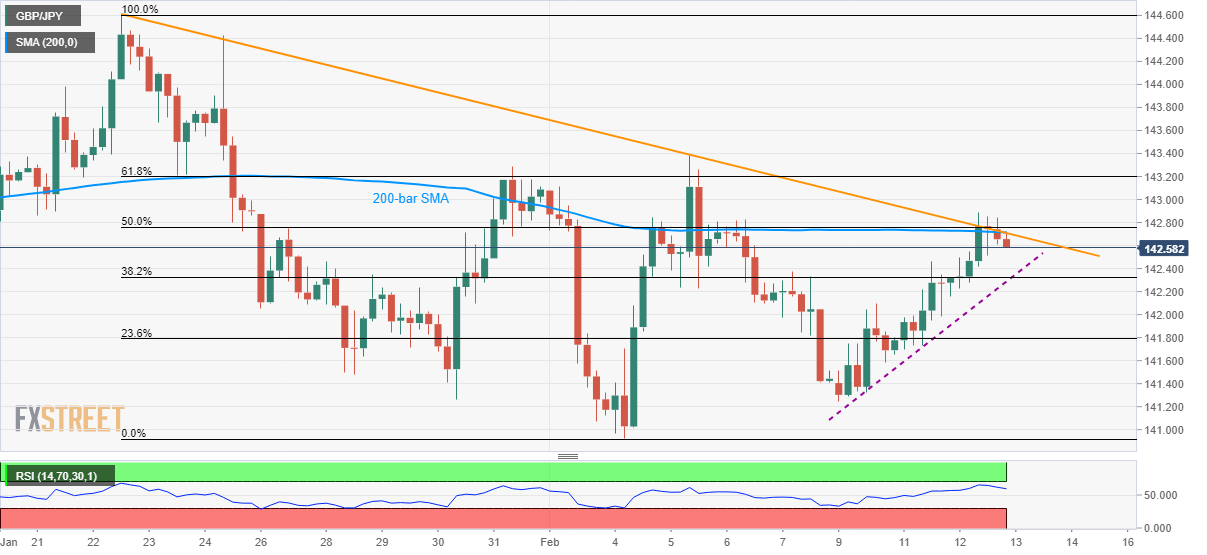

- 200-bar SMA, 50% Fibonacci retracement and a three-week-old falling trend line together offer a strong upside barrier.

- Sellers will look for entry below a short-term rising support line.

GBP/JPY declines to 142.60 amid the Asian session on Thursday. The quote recently took a U-turn from a resistance confluence including 200-bar SMA, 50% Fibonacci retracement of January-February decline and a three-week-old falling trend line.

Though, the quote is still beyond a three-day-old support-line and 38.2% Fibonacci retracement, around 142.30 now, which in turn will push the bears to wait before entry.

Should prices slip below 142.30, 142.00 and the monthly bottom near 140.90 hold the gate for further declines targeting 140.00 round-figure.

Meanwhile, the pair’s sustained run-up beyond 142.70/80 resistance confluence could push it through a 61.8% Fibonacci retracement level of 143.20 to the monthly top near 143.40.

If at all buyers manage to rule past-143.40, the yearly high close to 144.60 will become their favorite.

GBP/JPY four-hour chart

Trend: Pullback expected