WTI firmer, regains the $51.00 mark ahead of EIA

- Prices of the WTI advance beyond the $51.00 mark.

- Russia has to still decide on deeper output cuts.

- EIA weekly report on US oil stockpiles next on the docket.

Prices of the barrel of the American reference for the sweet light crude oil are trading in weekly highs above the $51.00 mark on Wednesday.

WTI bid ahead of data, looks to OPEC+

Prices of the West Texas Intermediate are advancing for the second session in a row on Wednesday, trading back to the levels beyond the $51.00 mark per barrel on improving risk-on sentiment in the global markets and news that the OPEC reduced its oil output during the first month of the year.

In addition, the cartel also revised lower its forecasts for crude oil demand for the current year to more than 29M bpd, some 200K barrels lower than the previous projections.

In the meantime, and with ebbing concerns regarding the coronavirus, traders keep looking to the possibility that the cartel could extend further the oil output cut agreement, while a decision to implement deeper cuts is still waiting for Russia’s decision on the fact.

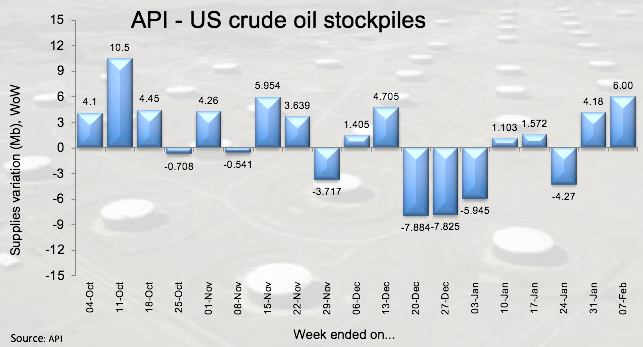

Moving forward, the EIA will publish its weekly report on US crude oil inventories. Late on Tuesday, the API reported a 6M build during last week, adding to the previous weekly increase.

What to look for around WTI

Crude oil prices are attempting a serious rebound after bottoming out in 2020 lows around $49.30 per barrel of West Texas Intermediate. All the attention has now shifted to the OPEC+ and the palpable likelihood that the cartel could extend the ongoing agreement and announce deeper cuts. Also adding to the upbeat tone in the commodity, the military unrest in Libya remains unsolved, while declining production keeps weighing on exports from the key North African producer.

WTI significant levels

At the moment the barrel of WTI is advancing 3.12% at $51.47 and faces the next resistance at $52.18 (weekly high Feb.6) seconded by $54.35 (weekly high Jan.29) and then $56.66 (200-day SMA). On the other hand, a breach of $49.31 (2020 low Feb.5) would aim for $42.20 (2018 low Dec.24) and finally $41.83 (2017 low Jun.21).