Back

11 Feb 2020

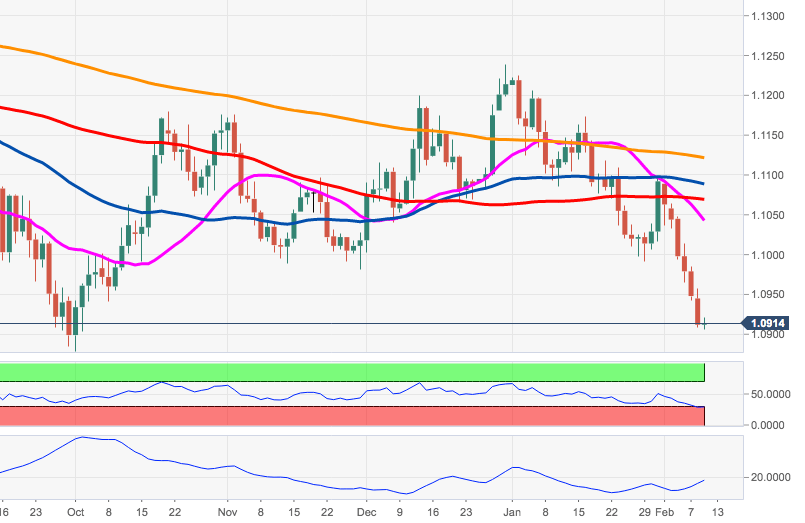

EUR/USD Price Analysis: Rising bets for a visit to 1.0879

- EUR/USD keeps the negative view near the 1.09 mark.

- Further downside exposes the 2019 low at 1.0879.

The downside in EUR/USD looks to have met some support in the 1.09 neighbourhood in the first half of the week, or new 2020 lows.

The increasing selling bias has now opened the door to a potential visit to the 2019 low at 1.0879 recorded on October 1st.

In the broader picture, while below the 55-day SMA, today ay 1.1081, further downside should remain well on the table.

EUR/USD daily chart