WTI remains depressed below $50.00 on China, OPEC+

- Prices of the WTI drop to levels below the $50.00 mark.

- Oversupply concerns plus coronavirus fears keep weighing on traders.

- API, EIA weekly reports on US supplies next on tap in the docket.

Crude oil prices are extending the pessimism for yet another session on Monday, taking the price of the WTI to the area sub-$50.00 per barrel.

WTI focused on China, OPEC+

Prices of the barrel of the American reference for the sweet light crude oil have entered the sixth consecutive week trading in the negative territory, losing around 25% since 2020 highs in the vicinity of the $66.00 mark recorded in early January.

The sentiment surrounding WTI stays depressed as fears of the impact of the Wuhan coronavirus on the Chinese economy – particularly the demand for crude oil – remains unabated.

In addition, doubts among traders still persist as to whether the OPEC+ will be able to finally announce an extension of the ongoing oil output cut agreement as well as deeper cuts (as suggested by the JTC last week).

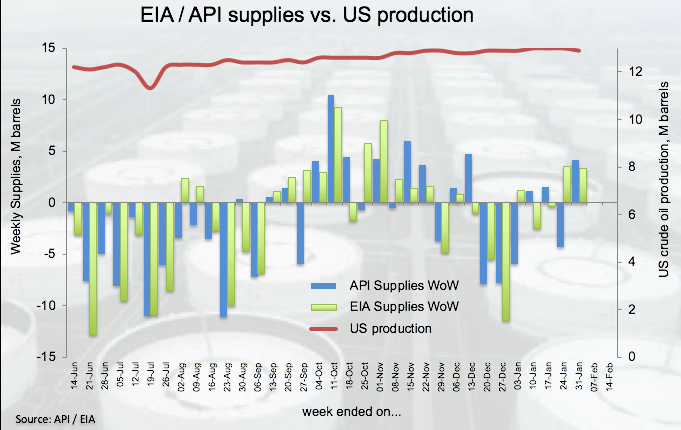

Furthermore, on the negative side, omnipresent concerns regarding the excess of oil supply in the markets continue to keep traders’ sentiment subdued. In this regard, all the attention will be on the usual weekly reports on US crude oil supplies by the API and the EIA on Tuesday and Wednesday, respectively.

What to look for around WTI

Crude oil prices remain under heavy pressure and threaten to extend the sell-off after Russia said it needs to re-assess the recent suggestion by the OPEC’s Joint Technical Committee (JTC) to reduce by and extra 600K bpd the current oil output cut agreement. In the meantime, developments around the Chinese coronavirus and its impact on the global economy, and particularly on Chinese demand for crude oil, continue to be the main driver of the price action. Also adding to traders’ concerns and potentially fuelling the downside pressure in prices, warring parties in Libya could clinch a peace deal, which should immediately see oil exports from the key North African producer gradually resuming its pace.

WTI significant levels

At the moment the barrel of WTI is retreating 0.94% at $49.87 and a breach of $49.31 (2020 low Feb.5) would aim for $42.20 (2018 low Dec.24) and finally $41.83 (2017 low Jun.21). On the upside, the next hurdle is expected to emerge at $52.18 (weekly high Feb.6) seconded by $54.35 (weekly high Jan.29) and then $56.78 (200-day SMA).