Back

7 Feb 2020

EUR/USD Price Analysis: Euro under heavy selling pressure post-NFP

- Broad-based USD strength is pushing the EUR/USD down near four-month lows.

- The level to beat for sellers is the 1.0930 support.

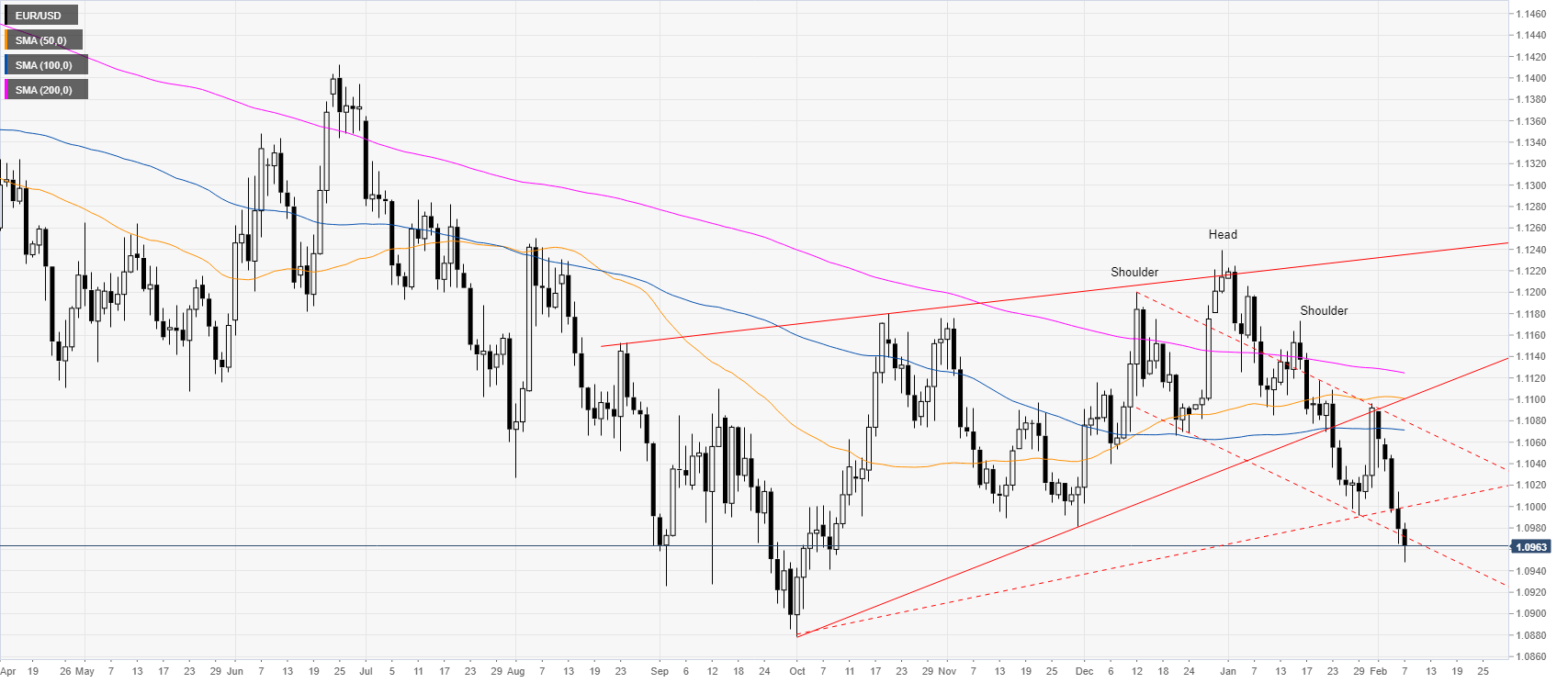

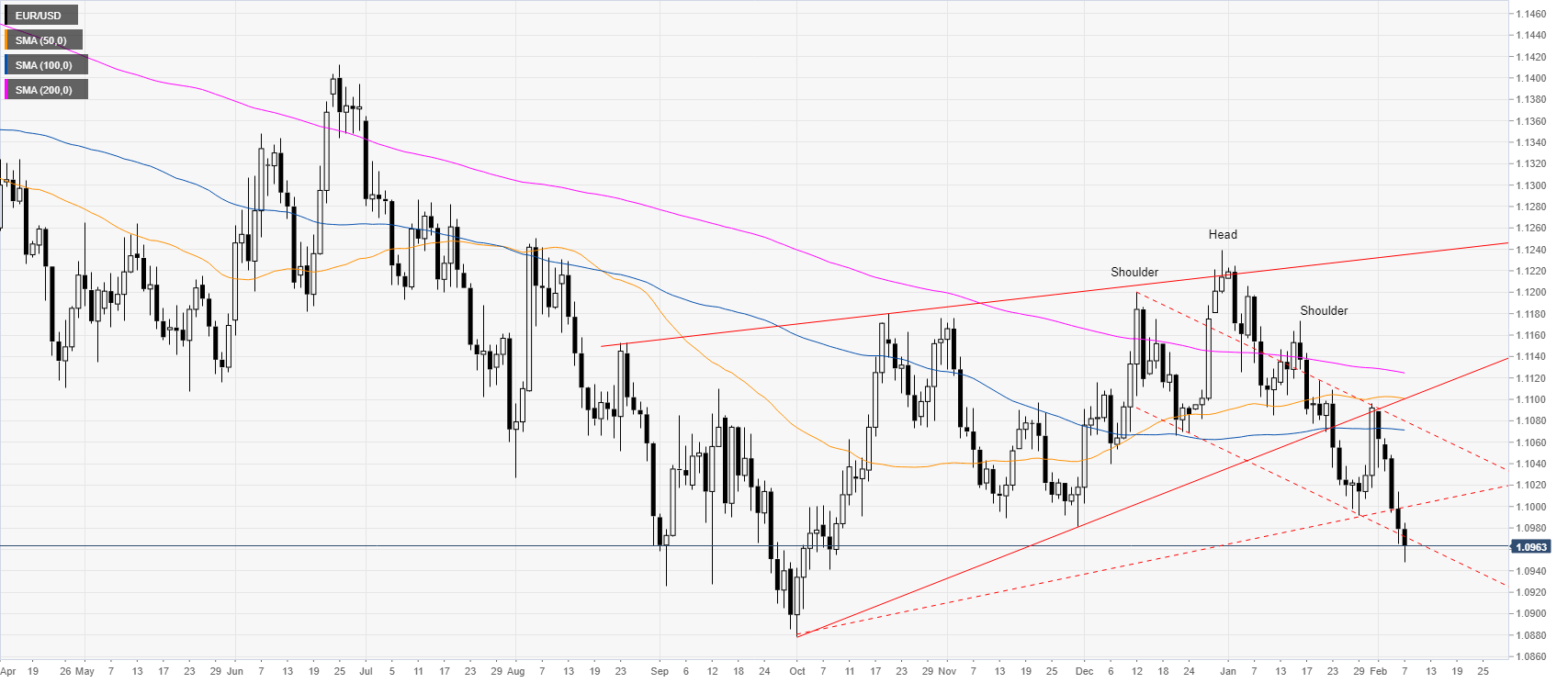

EUR/USD daily chart

The euro is trading in a weak downtrend below its main simple moving averages (SMAs) as the spot is hitting levels not seen since October 2019. The Non-farm payrolls reported that the US added 225K jobs vs. 160K expected.

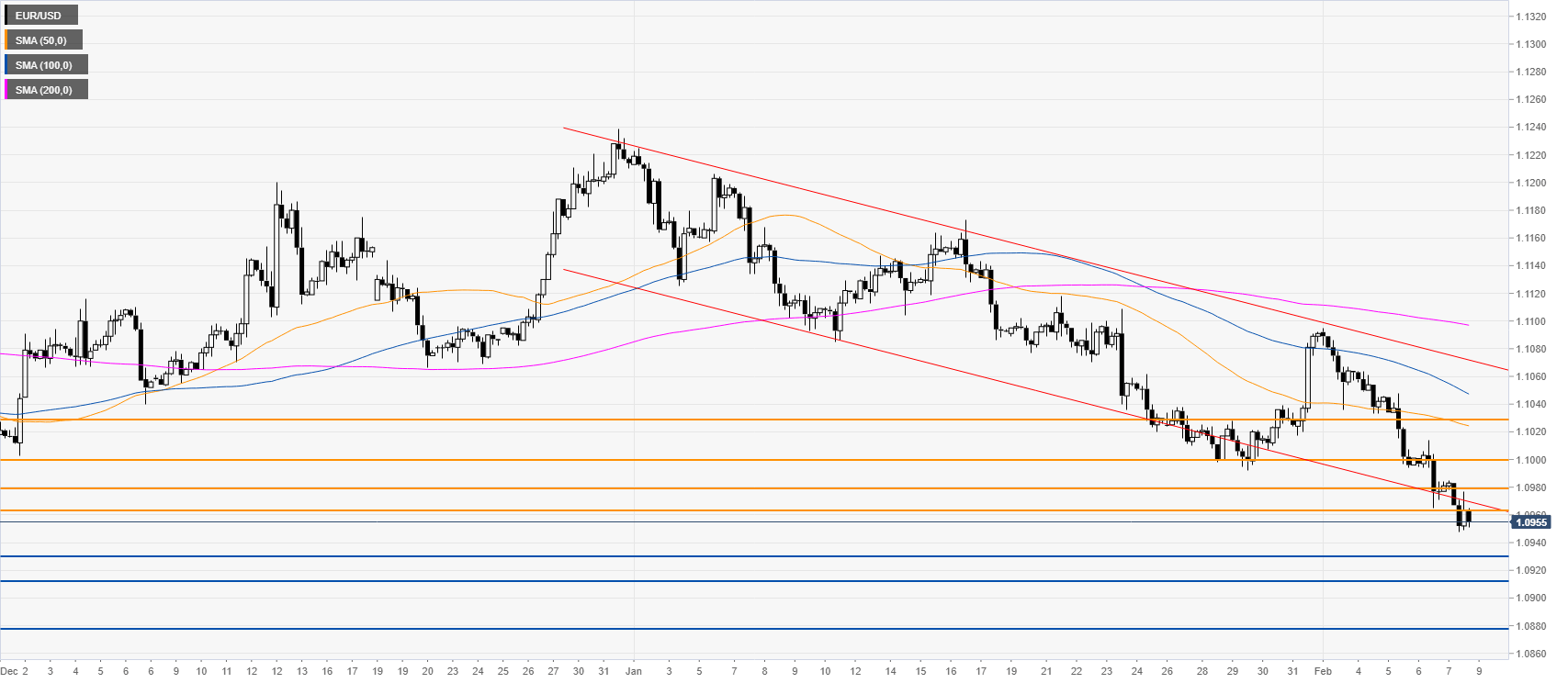

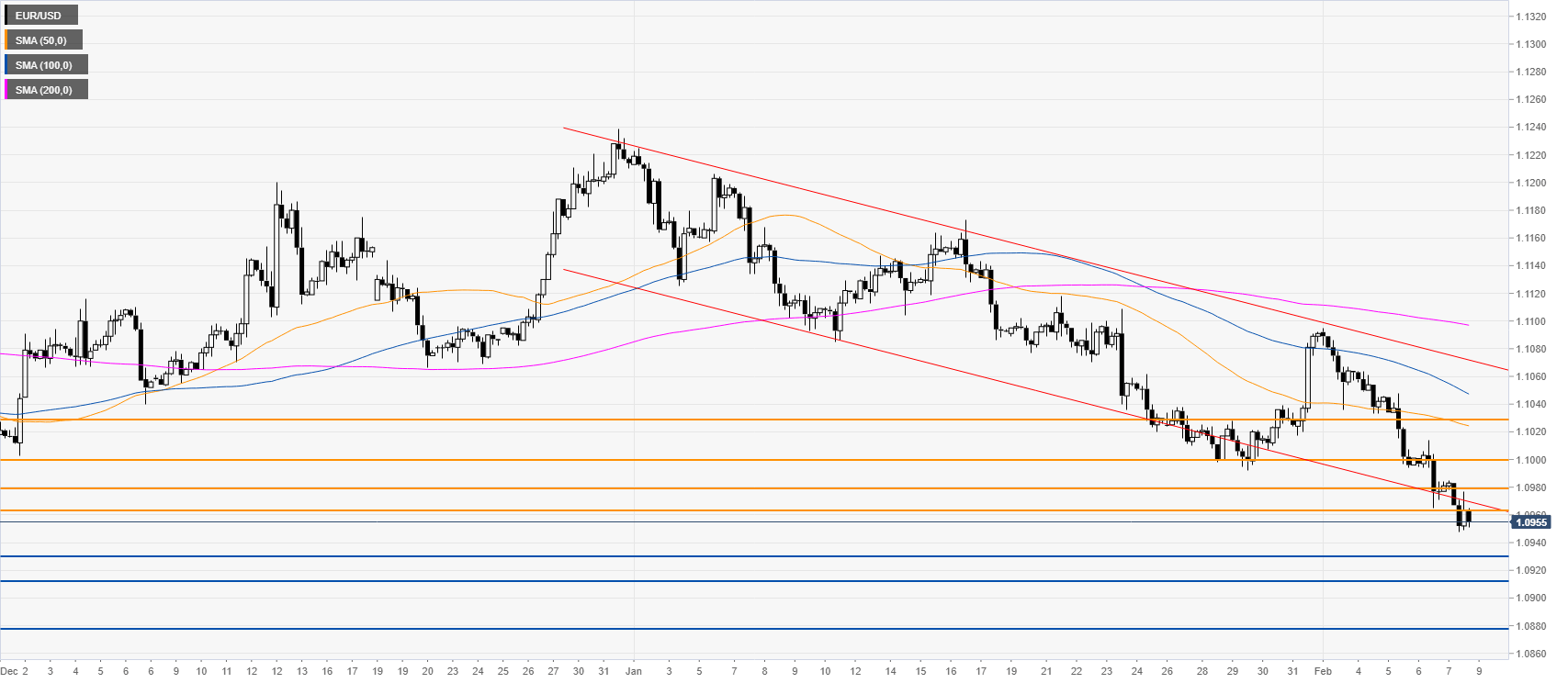

EUR/USD four-hour chart

EUR/USD is trading in a bear channel below the main SMAs while bears are eying a break below the 1.0930 support. As the euro remains under heavy selling pressure, a break below the above-mentioned level is likely to lead to further declines towards the 1.0912 and 1.0877 levels, according to the Technical Confluences Indicator. Resistances are seen near 1.0964, 1.0980 and the 1.1000 figure.

Resistance: 1.0964, 1.0980, 1.1000

Support: 1.0930, 1.0912, 1.0877

Additional key levels