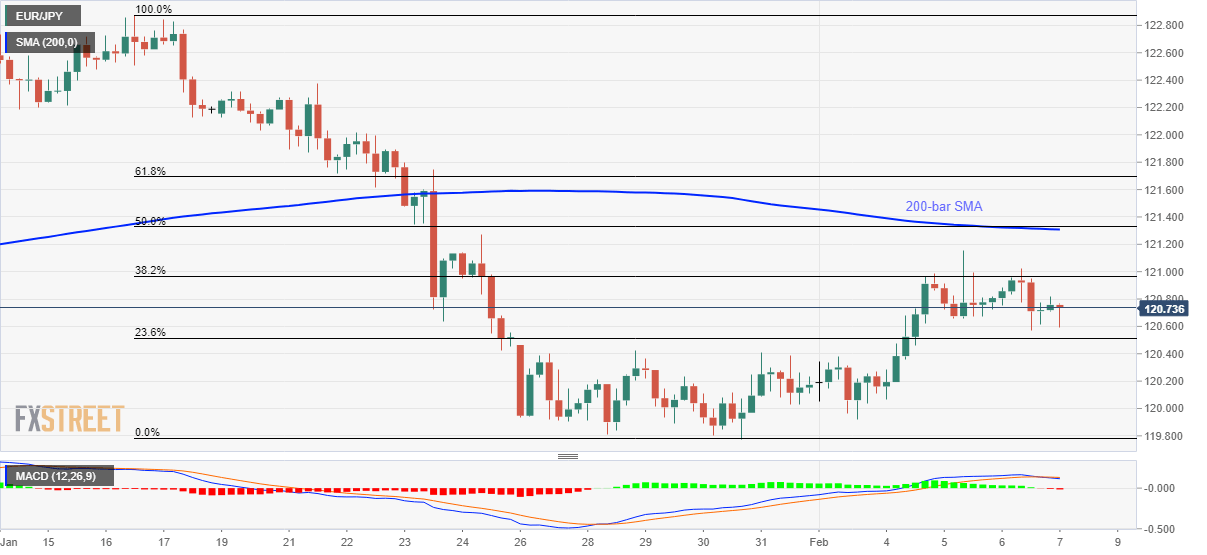

EUR/JPY Price Analysis: 200-bar SMA, 50% Fibonacci guard short-term upside

- EUR/JPY trades modestly changed below near-term key resistance confluence.

- Late-January tops limit immediate declines, 61.8% Fibonacci retracement adds to the resistance.

- MACD turns bearish for the first time in eight days.

EUR/JPY seesaws around 120.70 during the mid-Asian session on Friday. The quote remains above 23.6% Fibonacci retracement of its January 16-30 fall. However, a confluence of 200-bar SMA and 50% Fibonacci offers strong resistance to the pair.

In addition to the pair’s two-week-old trading beneath the key upside barrier, the MACD histogram is also favoring the bears for the first time since January 28.

With this, sellers can look for entry below 120.40, comprising January 28 top, to aim for 120.00 and the yearly bottom surrounding 119.75/80.

On the contrary, pair’s run-up beyond 121.30/35 resistance confluence will have to cross 61.8% Fibonacci retracement level of 121.70 before targeting 122.00.

Should there be a further upside beyond 122.00, 122.20/25 can offer an intermediate halt to the pair’s run-up towards the previous month high near 122.90.

EUR/JPY four-hour chart

Trend: Sideways