Back

6 Feb 2020

USD/JPY New York Price Forecast: Greenback exhausted vs. yen, 110.00 is a tough barrier

- USD/JPY recovery might be running out of steam as the spot struggles near the 110.00 figure.

- The level to beat for sellers is the 109.65 support.

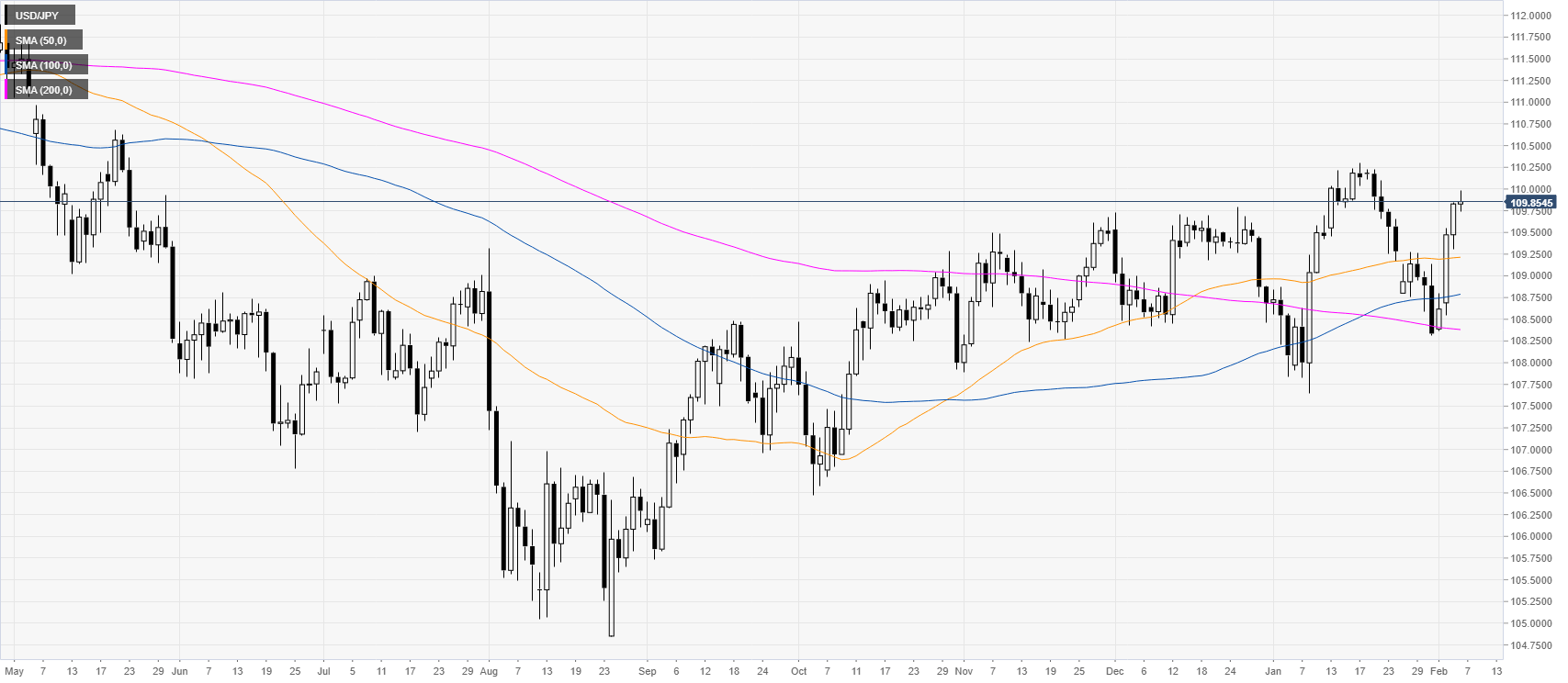

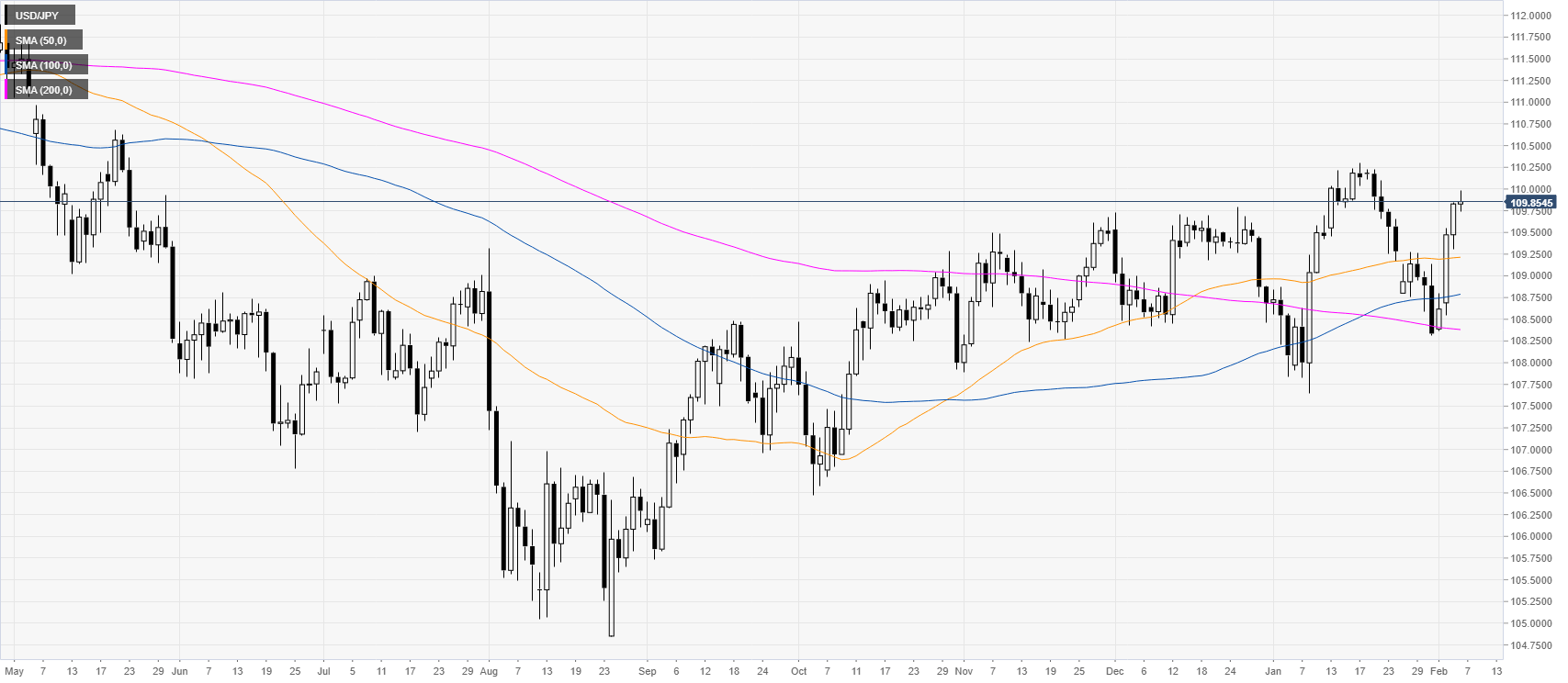

USD/JPY daily chart

The risk-on mood propelled USD/JPY near the 110.00 figure and above the main simple moving averages (SMAs).

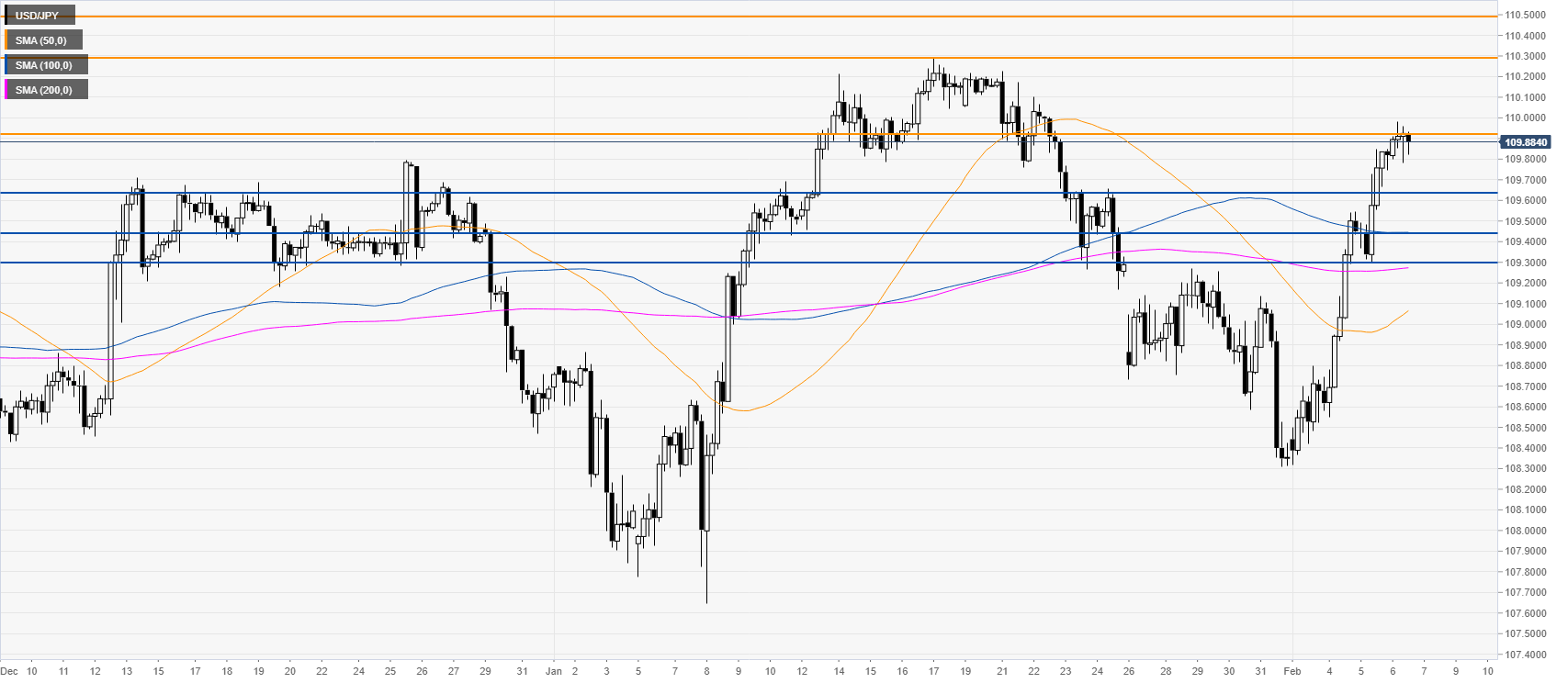

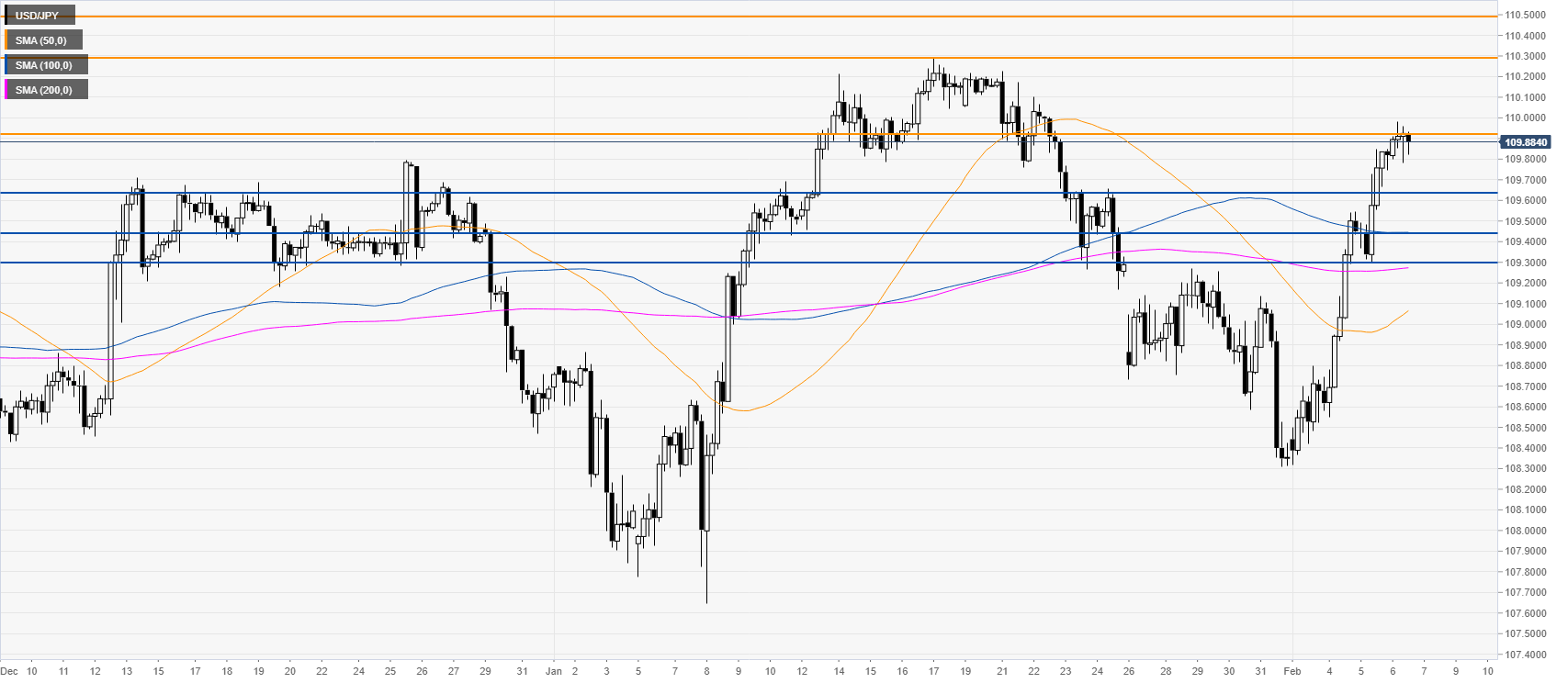

USD/JPY four-hour chart

The market is losing steam near the 109.92 resistance. Bulls want a clear break above this level to reach the 110.30 and 110.49 price levels. However, if the bears prevent the break above the 110.00 figure and drive the market below the 109.65 level, USD/JPY is most likely to pull back down further towards the 109.46 and 109.30 levels, according to the Technical Confluences Indicator.

Resistance: 109.92, 110.30, 110.49

Support: 109.65, 109.46, 109.30

Additional key levels