Back

6 Feb 2020

USD/INR New York Price Forecast: Greenback under pressure vs. rupee, trades near 71.20 level

- USD/INR broke below the bear flag formation near the 71.20 support level.

- Bears keep their eyes on the 70.40 target.

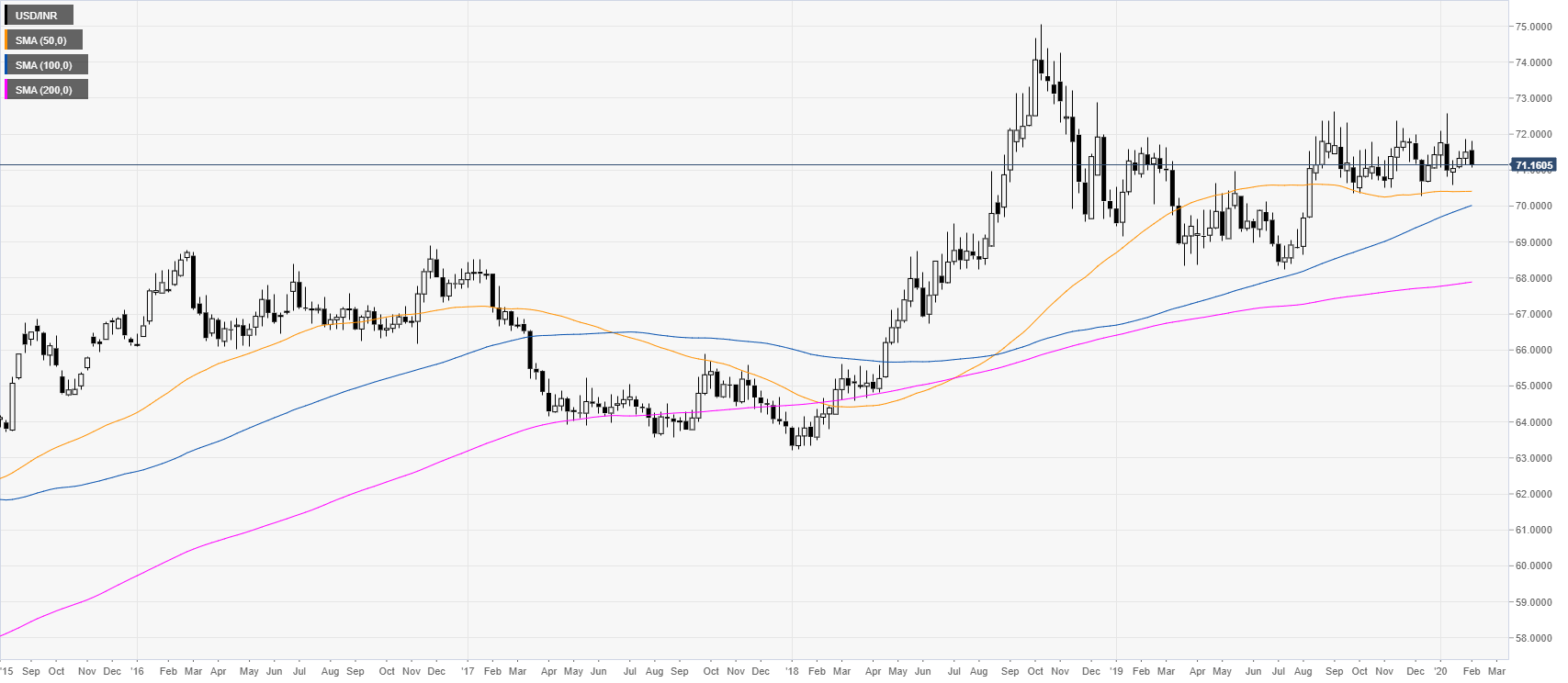

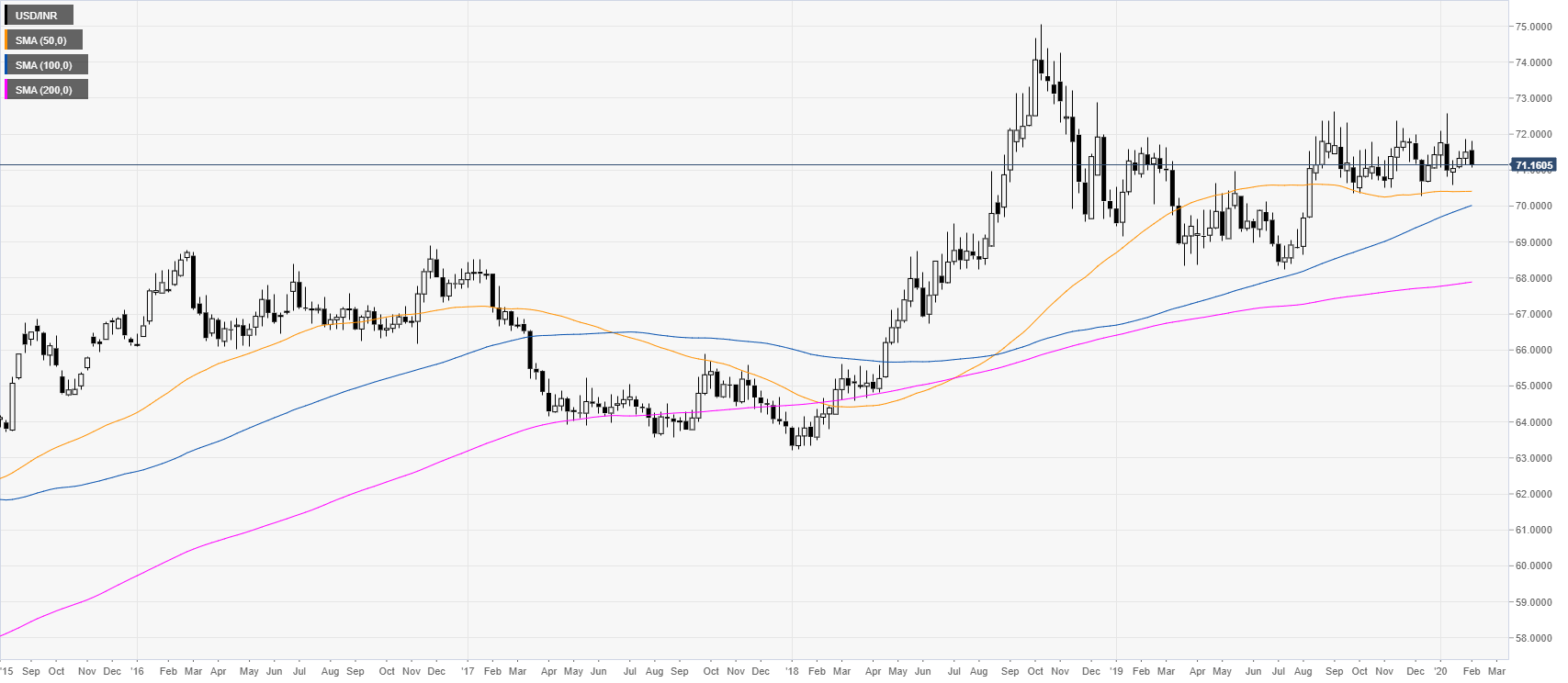

USD/INR weekly chart

Following the 2018 bull-run, USD/INR has been consolidating in a rectangle formation. The spot is also trading above the main weekly simple moving averages (SMAs), suggesting a bullish bias in the long term.

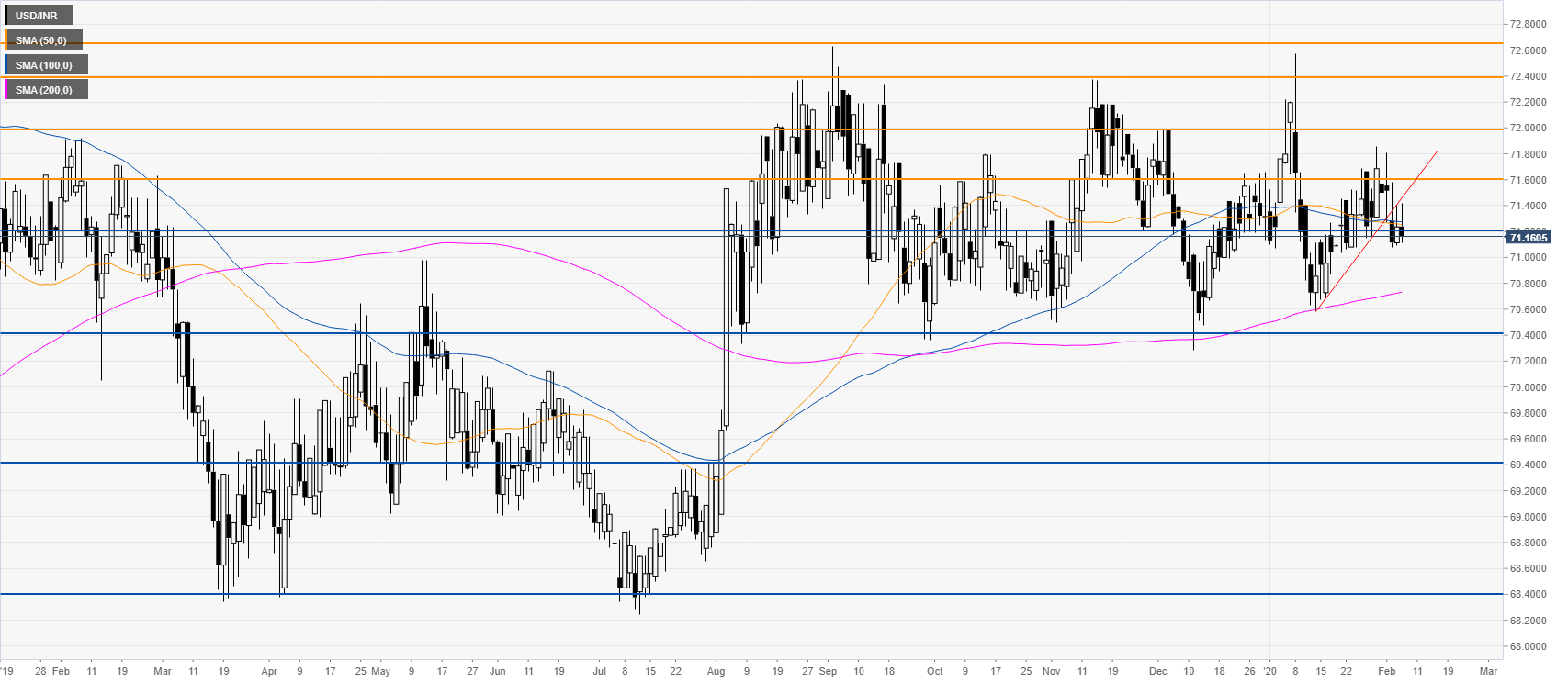

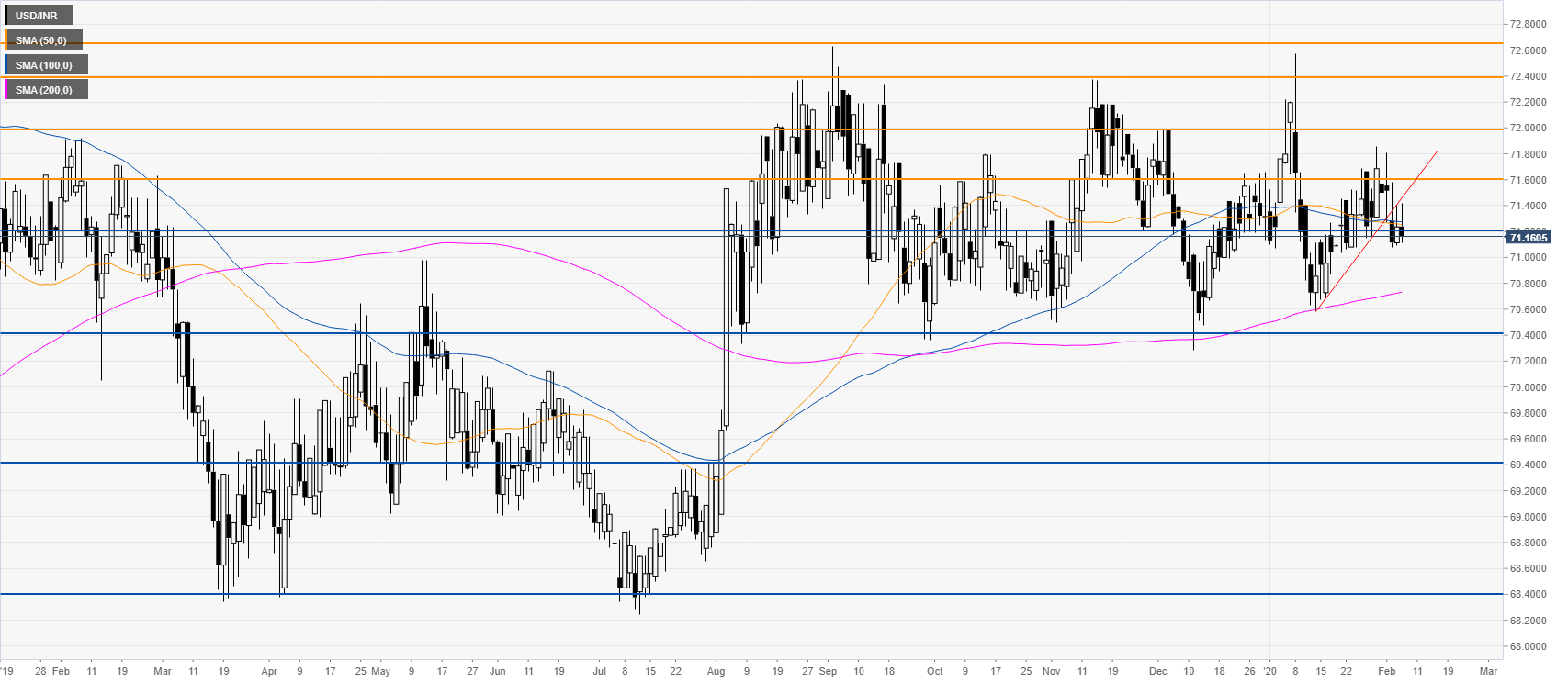

USD/INR daily chart

USD/INR broke below a bear flag pattern near the 71.20 support level, suggesting that the spot could potentially decline towards the 70.40 price level. The 71.20 support has become resistance. Looking up lies the 71.60 resistance level followed by the 72.00 figure.

Additional key levels