Our best spreads and conditions

About platform

About platform

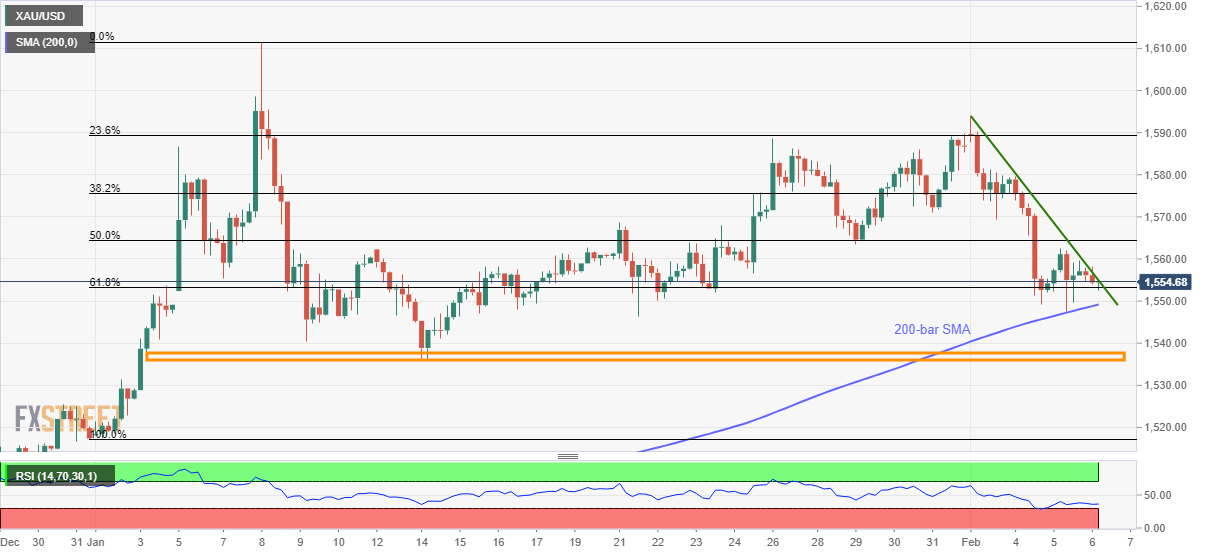

Gold prices remain mildly weak to $1,554.70 ahead of the European session on Thursday. The yellow metal recovered from a multi-day low on Wednesday but failed to extend the pullback beyond a three-day-old resistance line afterward.

Even so, the bears are waiting for entry as the quote stays above 200-bar SMA level of $1,549, a break of which could drag it towards $1,538/36 support-zone.

Should there be additional weakness past-$1,536, December 31, 2019 low near $1,517 and $1,500 will lure the sellers.

Alternatively, an upside clearance of 50% Fibonacci retracement of early-January rise, at $1,564.30 now, can escalate the previous day’s rise towards monthly top surrounding $1,594 and $1,600 round-figure.

Given the bullion’s ability to stay positive above $1,600, the yearly top close to $1,612 could be the buyers’ favorite.

Trend: Pullback expected