USD/CHF Price Analysis: Multiple upside barriers to check bulls amid overbought RSI

- USD/CHF registers four-day winning streak, nears one-week high.

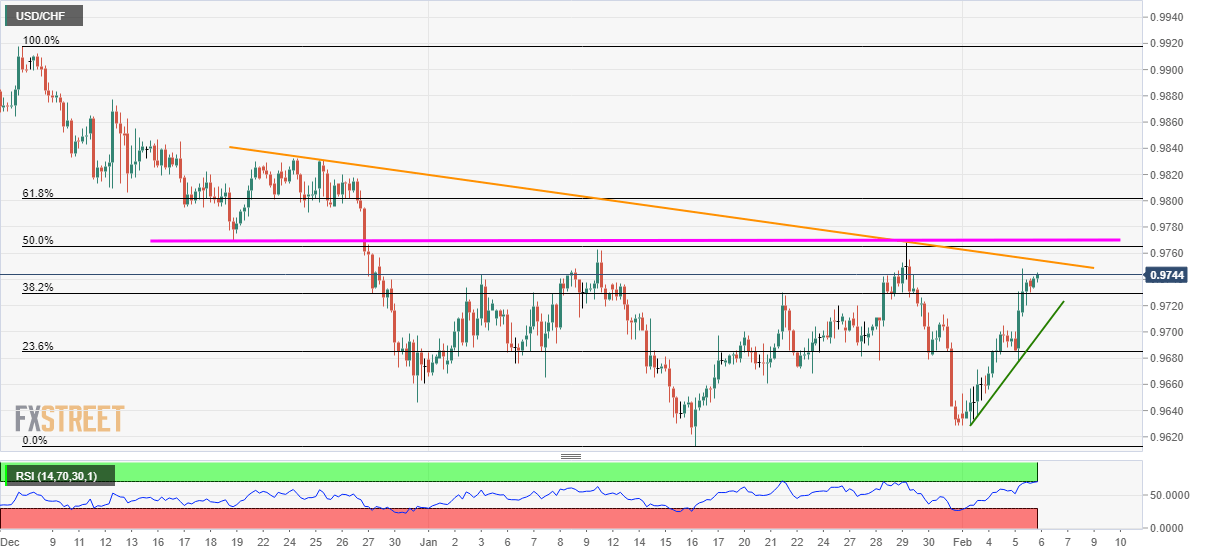

- A falling trend line since December 25, seven-week-old horizontal resistance limits the immediate upside.

- Overbought RSI conditions increase the odds of a pullback.

USD/CHF remains mildly positive while gaining 0.07% to 0.9745 amid the pre-Europe session on Thursday. Overbought RSI conditions, coupled with multiple key resistance lines, question the pair’s further upside.

As a result, sellers will look for entry below 38.2% Fibonacci retracement of the pair’s declines from December 06, 2020, to January low, at 0.9730. In doing so, an ascending trend line since Monday, at 0.9700, will be on their radars.

During the quote’s further weakness past-0.9700, 0.9630/25 will be the key support to watch.

On the upside, a downward sloping trendline from late-December at 0.9755, followed by a horizontal area including December 19 low and January 29 high, around 0.9770/65, will be the key barrier to the north.

Also questioning the buyers beyond the horizontal resistance will be 61.8% Fibonacci retracement level of 0.9800.

USD/CHF four-hour chart

Trend: Pullback expected