Back

5 Feb 2020

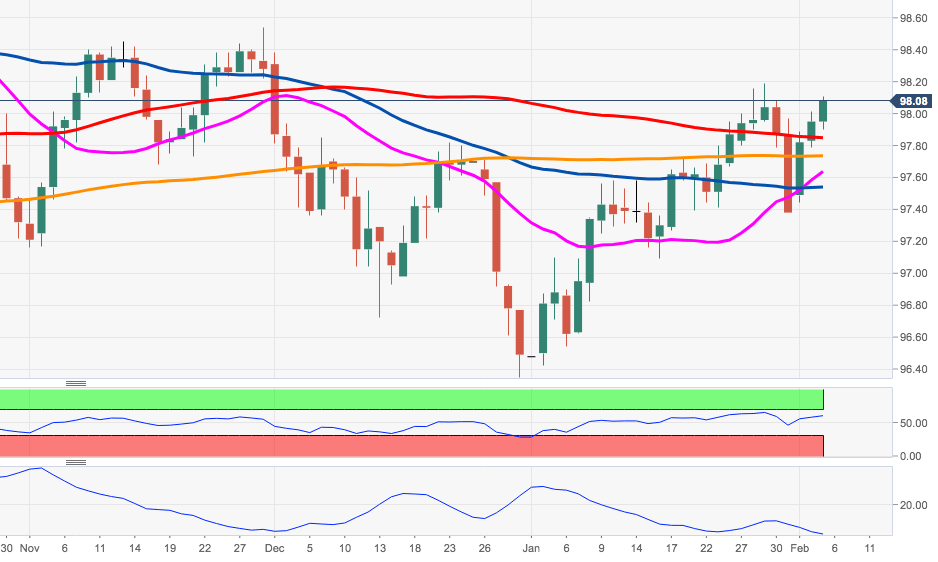

US Dollar Index Price Analysis: Remains bid above the 200-day SMA

- DXY regains the 98.00 mark and above, printing fresh weekly highs.

- Immediately to the upside emerges the 2020 peak near 98.20.

The index keeps the march north unabated so far on Wednesday, extending the rebound from recent lows and retaking the key barrier at 98.00 the figure.

Following the breakout of the 200-day SMA around 97.70, DXY is now navigating the 98.00 neighbourhood and has shifted the focus to 2020 highs near 98.20 (November 29th).

While above the 200-day SMA, the dollar’s outlook is seen as constructive.

DXY daily chart