Our best spreads and conditions

About platform

About platform

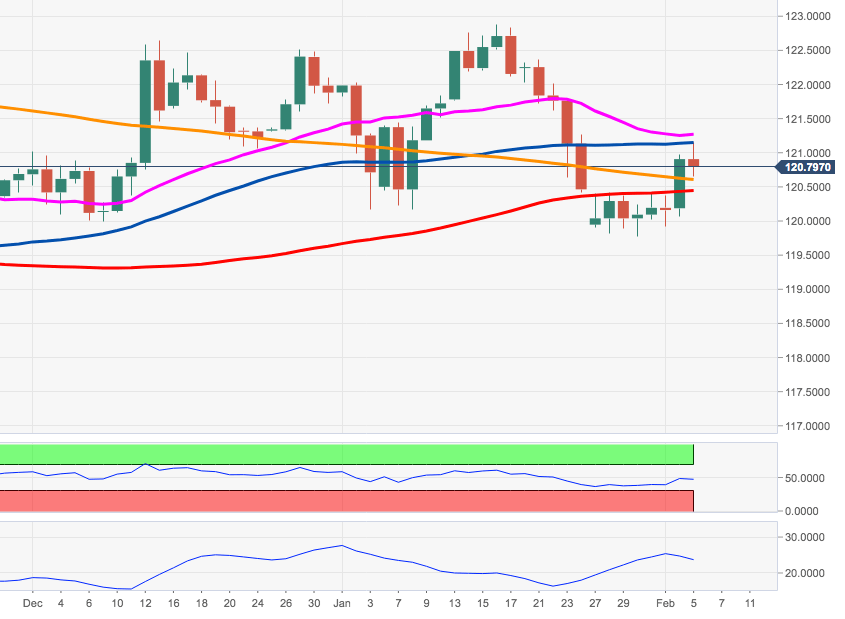

EUR/JPY has accelerated the upside after surpassing the key 200-day SMA in the 120.60 region on Tuesday, breaking above the multi-session side-lined trade at the same time.

Interim resistance emerges at the 55-day SMA just above 121.00 the figure. Further up emerges the next target of relevance near 121.30, home of the 21-day SMA.

Looking at the broader view, while above the 200-day SMA the cross should keep the near-term positive stance.