JPY Futures: Bearish with caution

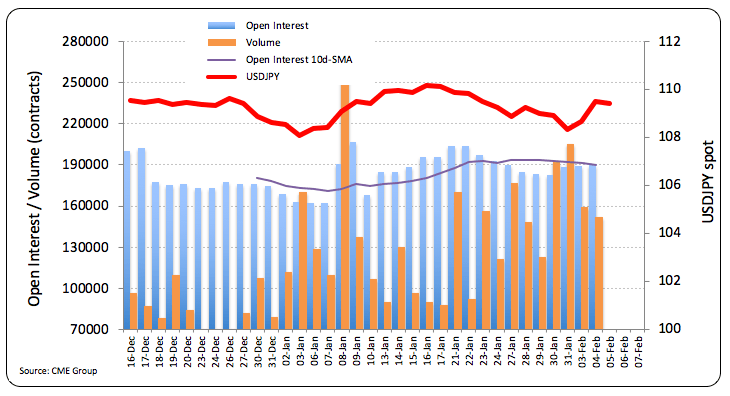

CME Group’s flash figures for JPY futures markets noted open interest rose for the third straight session on Tuesday, now by just 664 contracts. Volume, instead, shrunk for the second consecutive session, now by around 7.4K contracts.

USD/JPY does not rule out a test of 110.00

The renewed optimism in the risk complex pushed USD/JPY back above the 109.00 mark amidst rising open interest, which keeps favouring extra gains to, initially, the 110.00 neighbourhood. Shrinking volume, however, could trigger some caution among traders.