Back

4 Feb 2020

S&P500 Price Analysis: Index recovers to 3300 resistance, Wall Street risk-on

- The S&P500 is up strongly this Tuesday as the risk-on mood is dominating the market.

- The level to beat for bulls is the 3300 resistance.

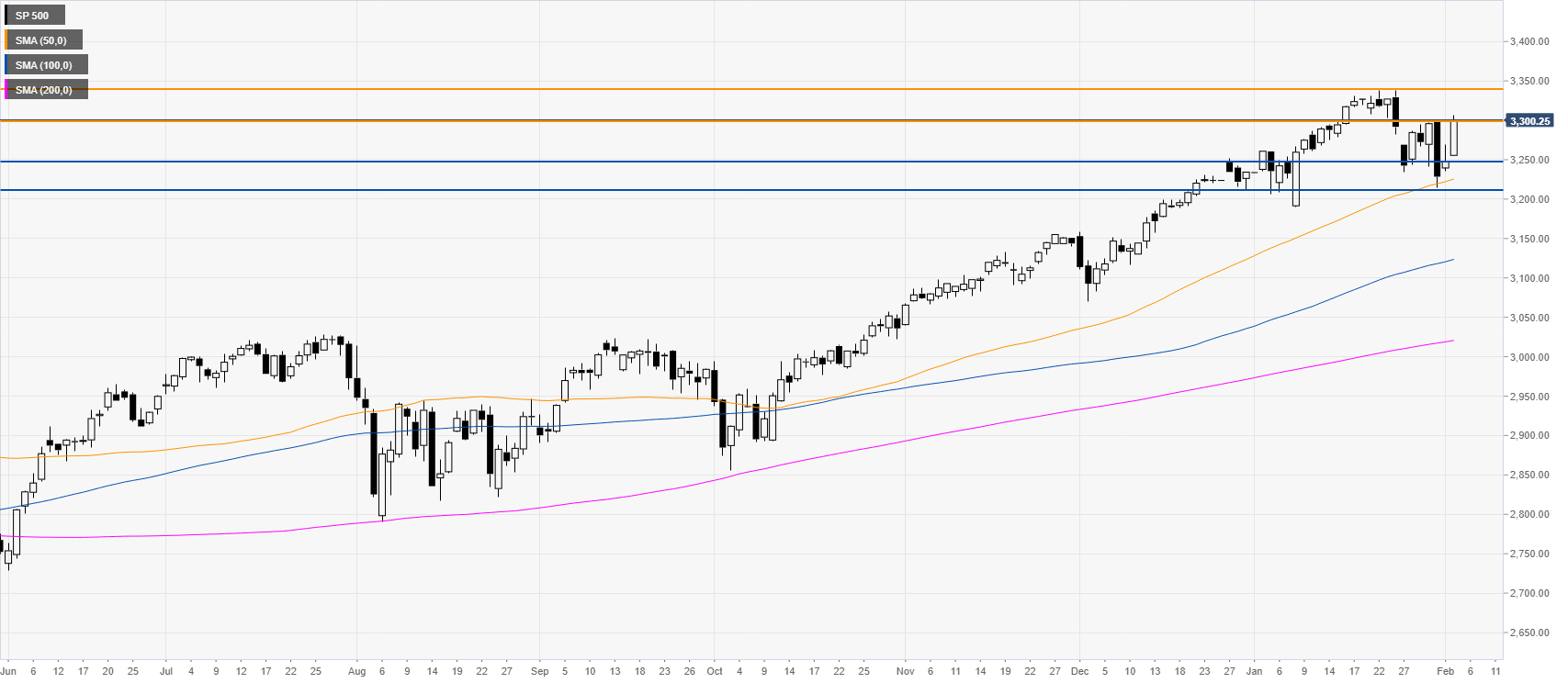

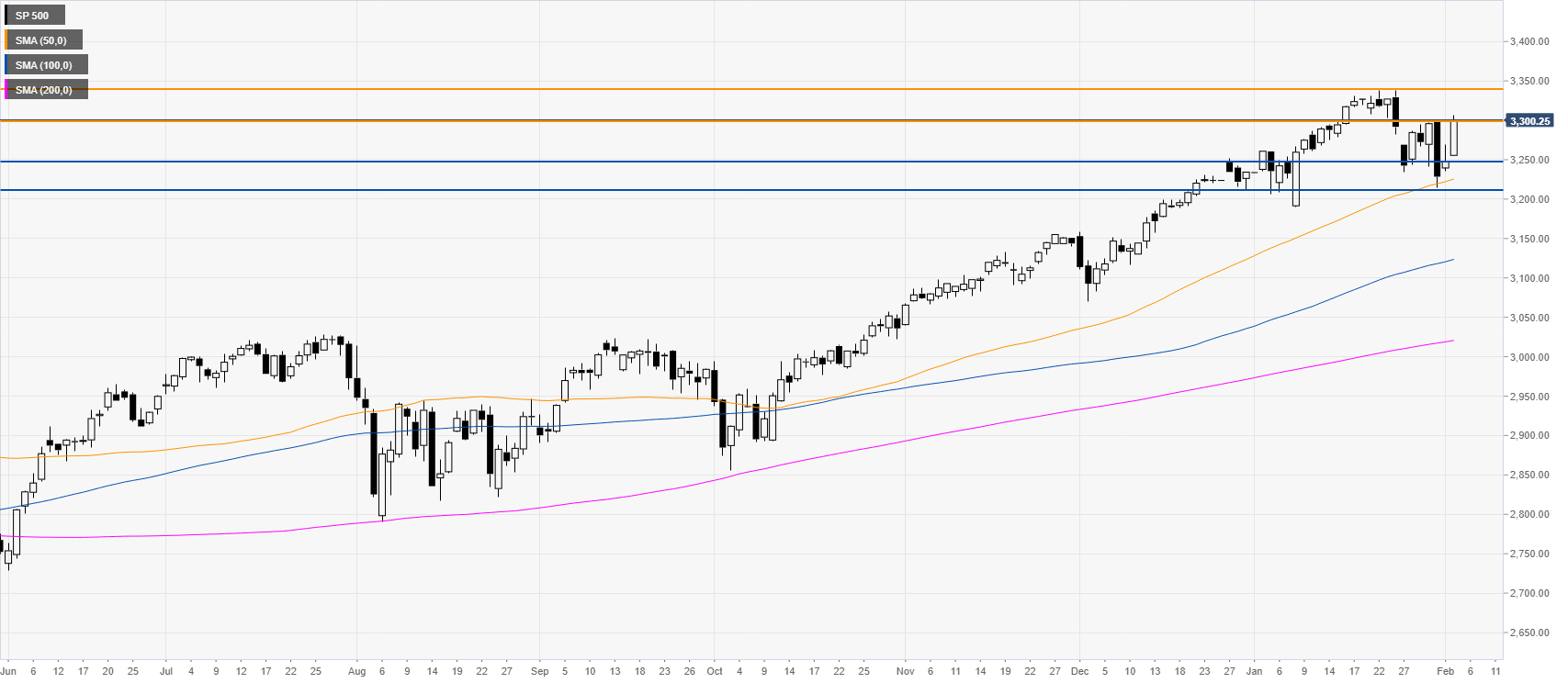

S&P500 daily chart

The S&P500 Index is trading in a bull trend above the main daily simple moving averages (SMAs). After about a week of consolidation, the market is regaining steam and challenging the 3300 resistance. Since the buyers have gathered so much momentum, a break beyond the above-mentioned resistance can yield to a retest of the all-time high near 3338.50 level. Support is seen near the 3250 and 3210 levels.

Additional key levels