Back

4 Feb 2020

EUR/USD Price Analysis: Euro beras pressuring 1.1032 support

- EUR/USD is paring most of last Friday’s jump.

- The level to beat for sellers is the 1.1032 support.

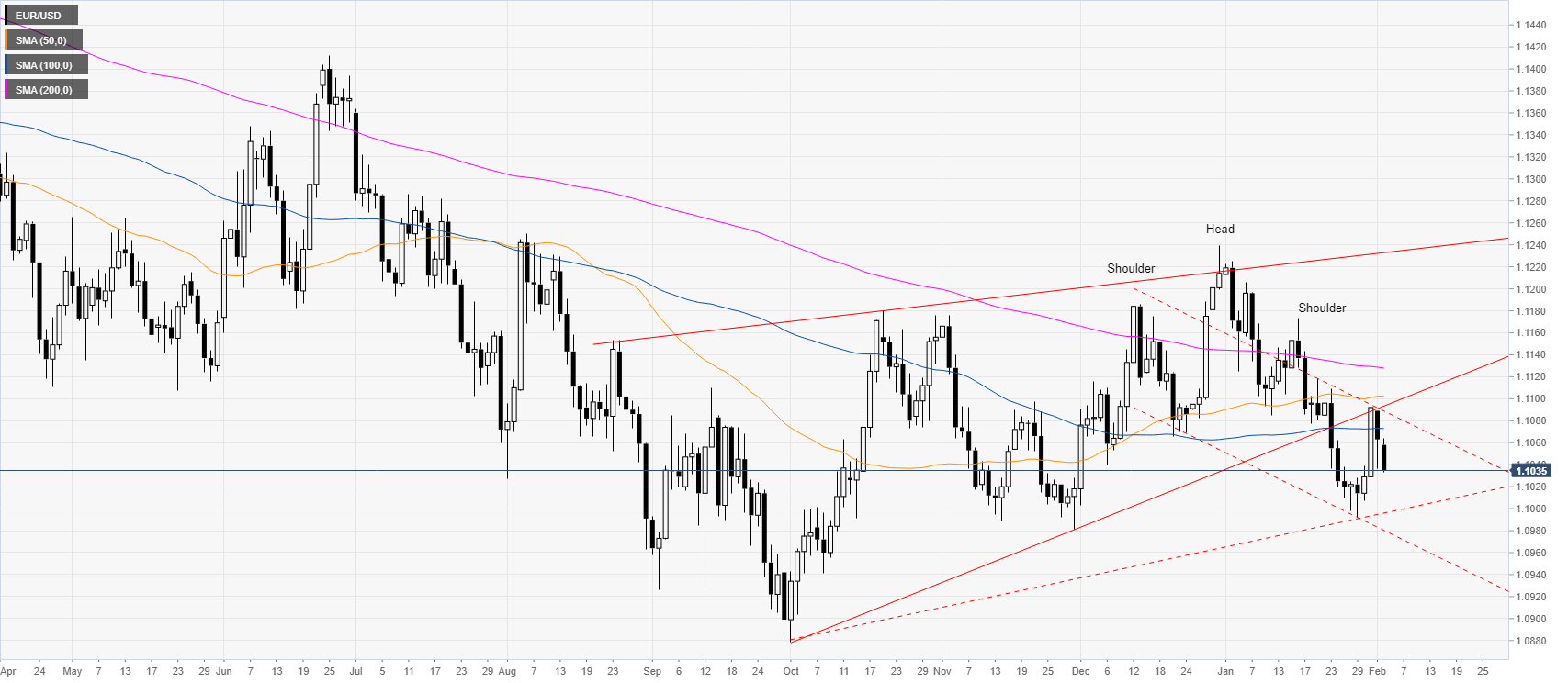

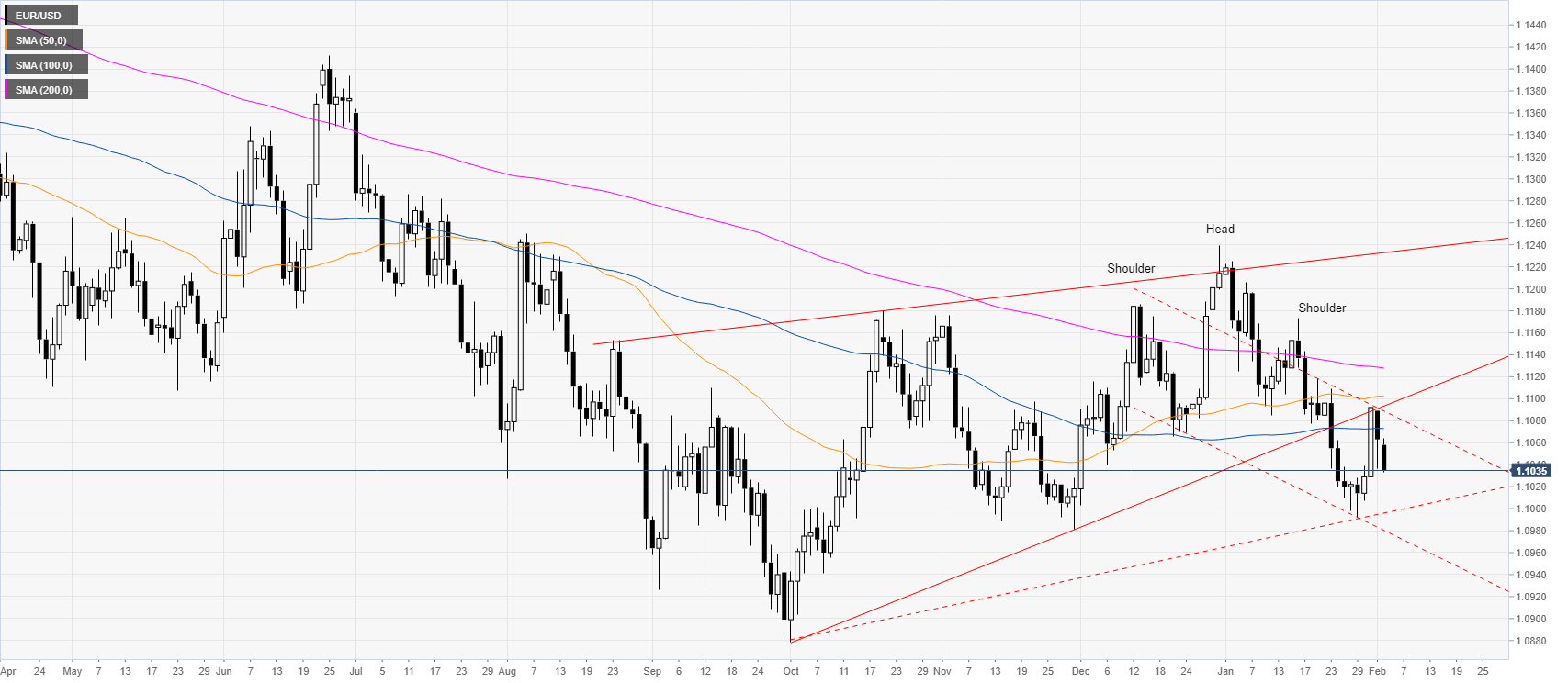

EUR/USD daily chart

EUR/USD is trading in a weak bear trend below the main simple moving averages (SMAs) as the spot rejected an ascending trendline. EUR/USD remains weak below the 200 SMA/1.1200 zone and is probably set to enter a triangle consolidation in the near future.

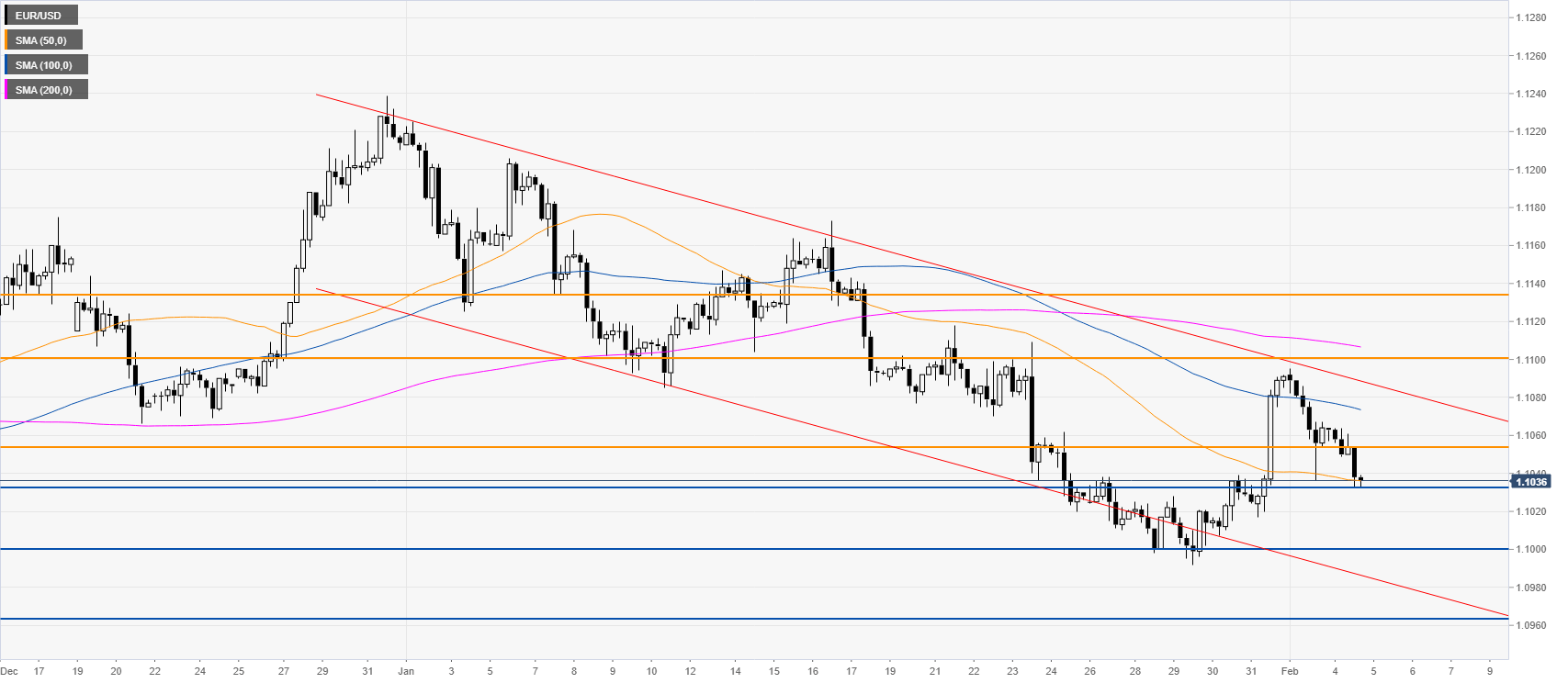

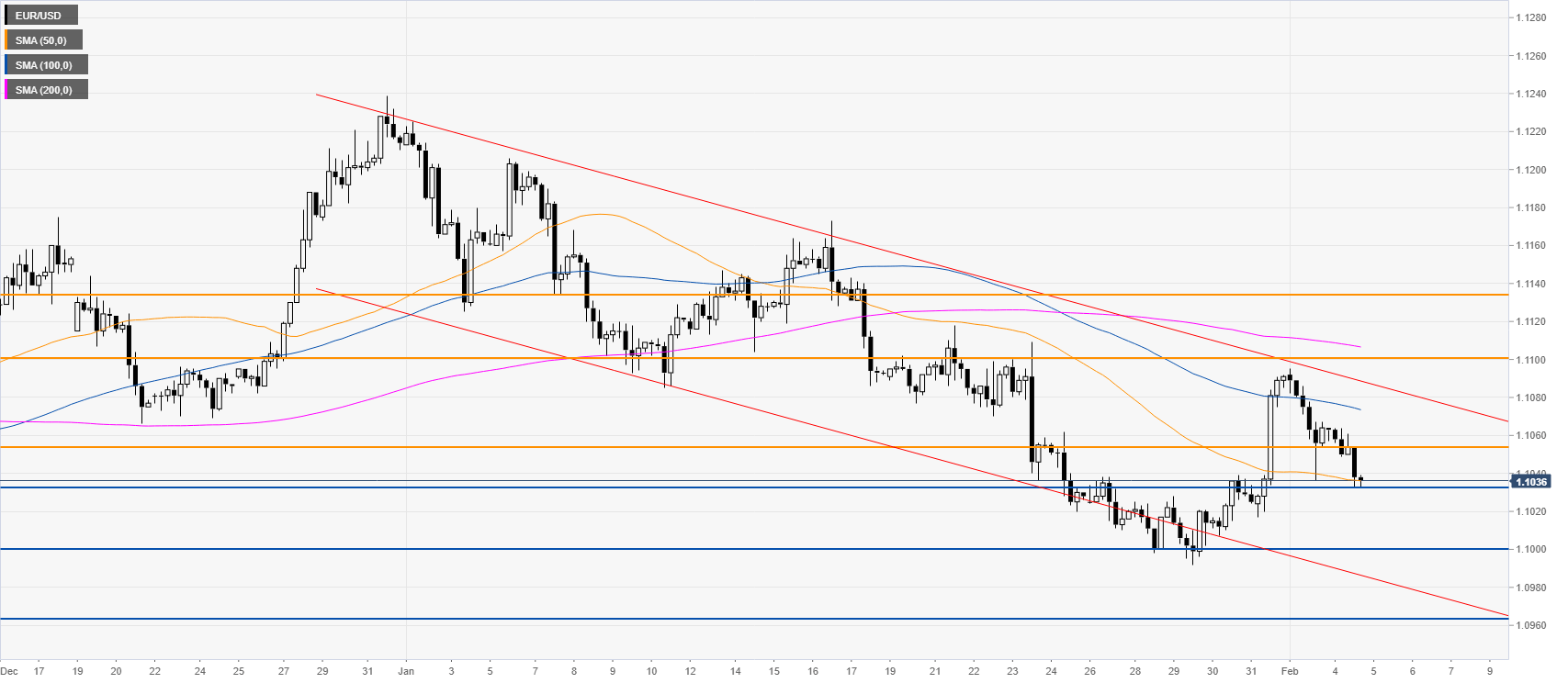

EUR/USD four-hour chart

The euro is trading in a down channel below the 100 and 200 SMAs while challenging the 50 SMA and 1.1032 support. A breach below this level is likely to lead to further weakness towards the 1.1000 and 1.0964 levels, according to the Technical Confluences Indicator. Resistances are seen near the 1.1055, 1.1100 and 1.1135 levels.

Resistance: 1.1055, 1.1100, 1.1135

Support: 1.1032, 1.1000, 1.0964

Additional key levels