Back

4 Feb 2020

EUR/JPY Price Analysis: Euro correcting up against yen, trading near 120.60 level

- EUR/JPY is correcting to the upside after the January’s drop.

- The correction up could extend to the 120.85/95 resistance zone and the 121.25 level.

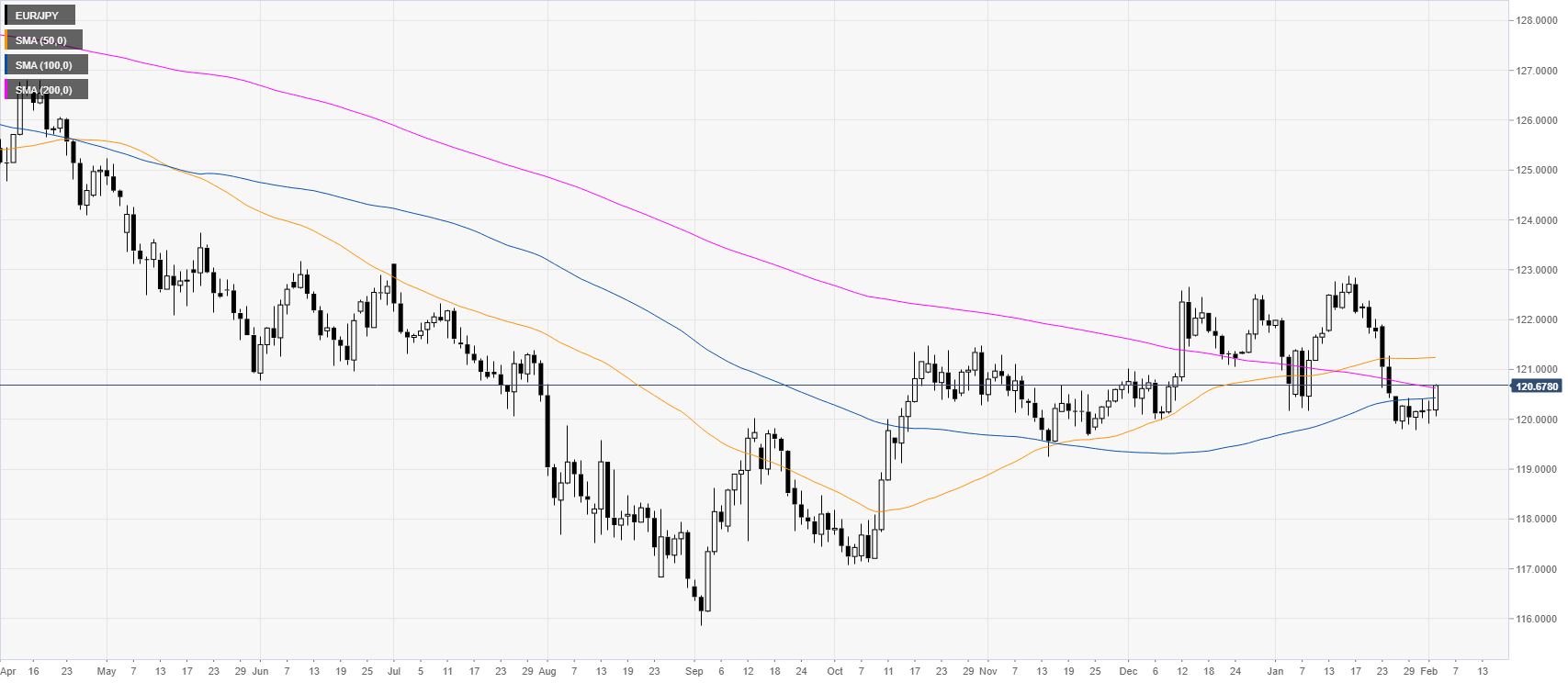

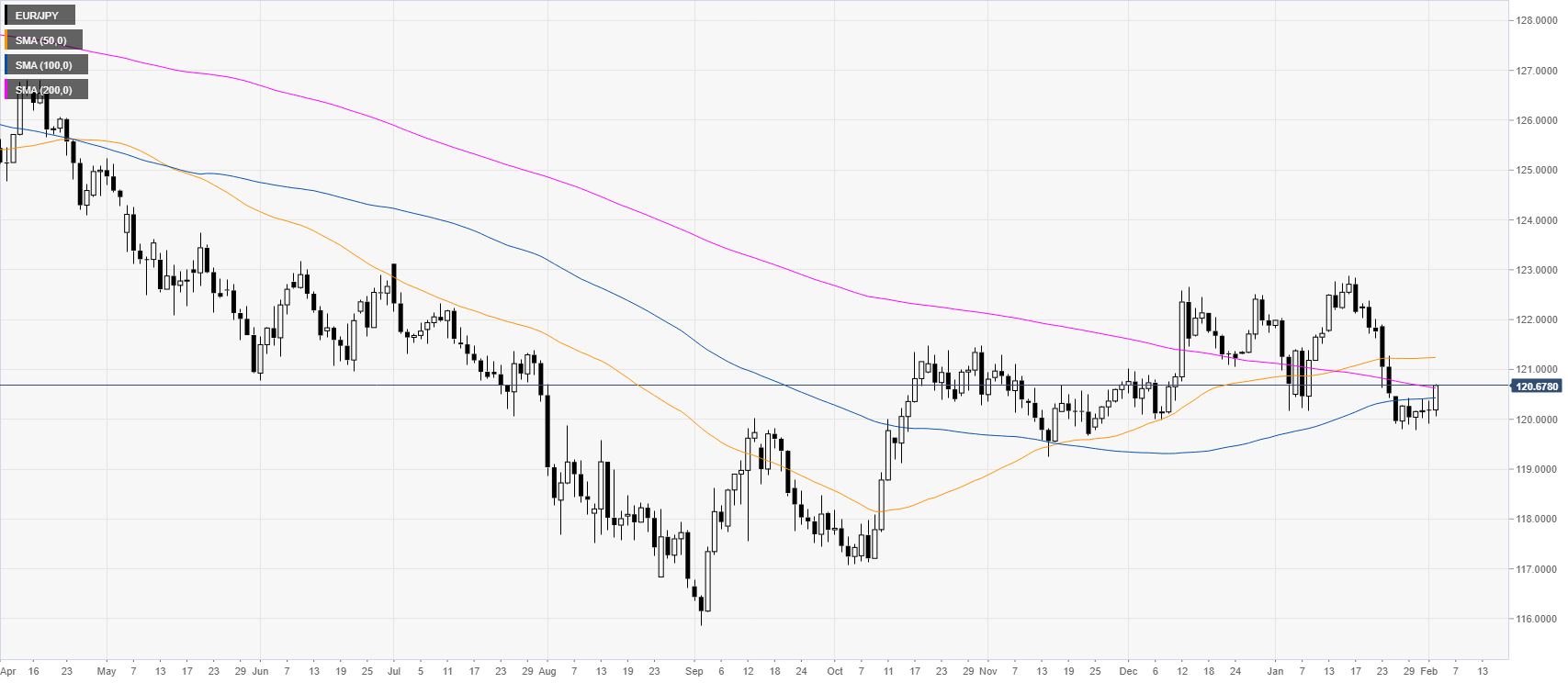

EUR/JPY daily chart

EUR/JPY is challenging the 200-day simple moving average (SMA) while consolidating the recent drop.

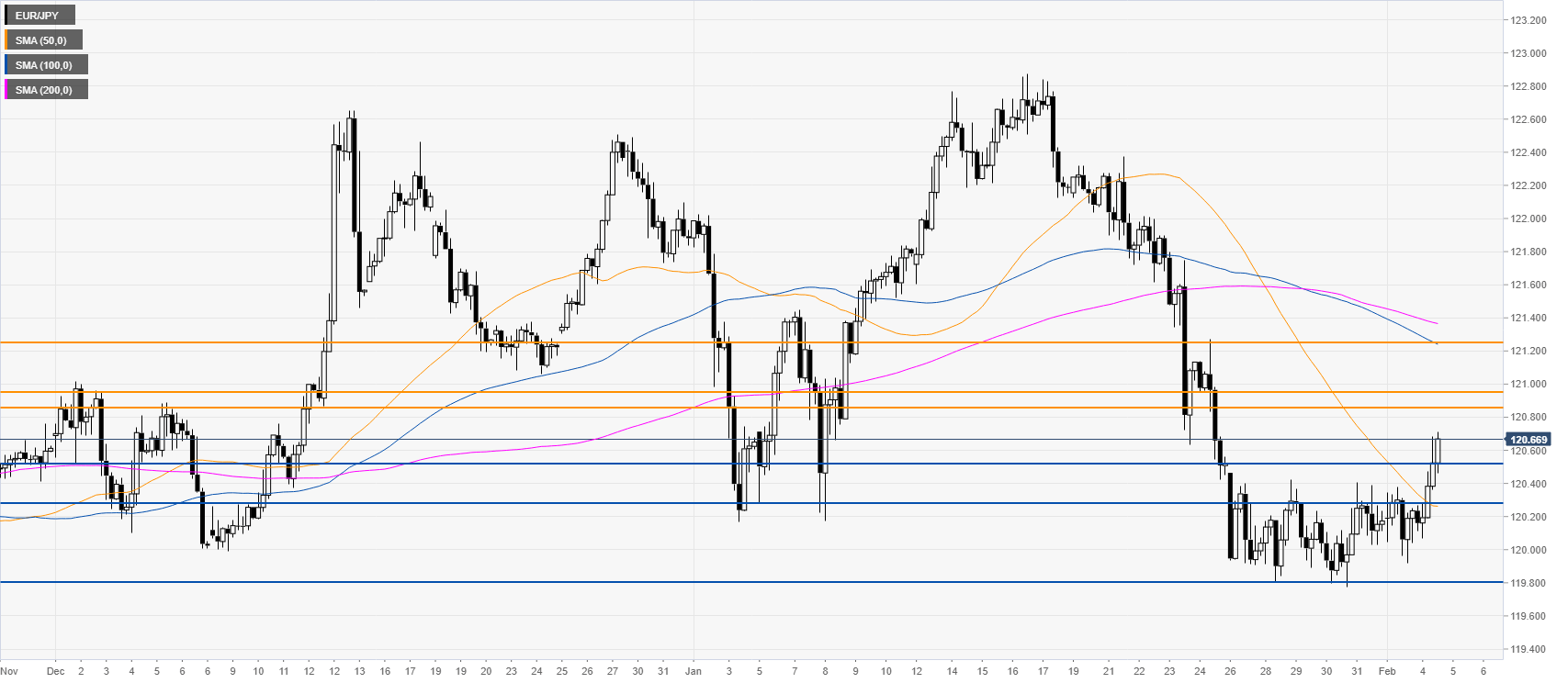

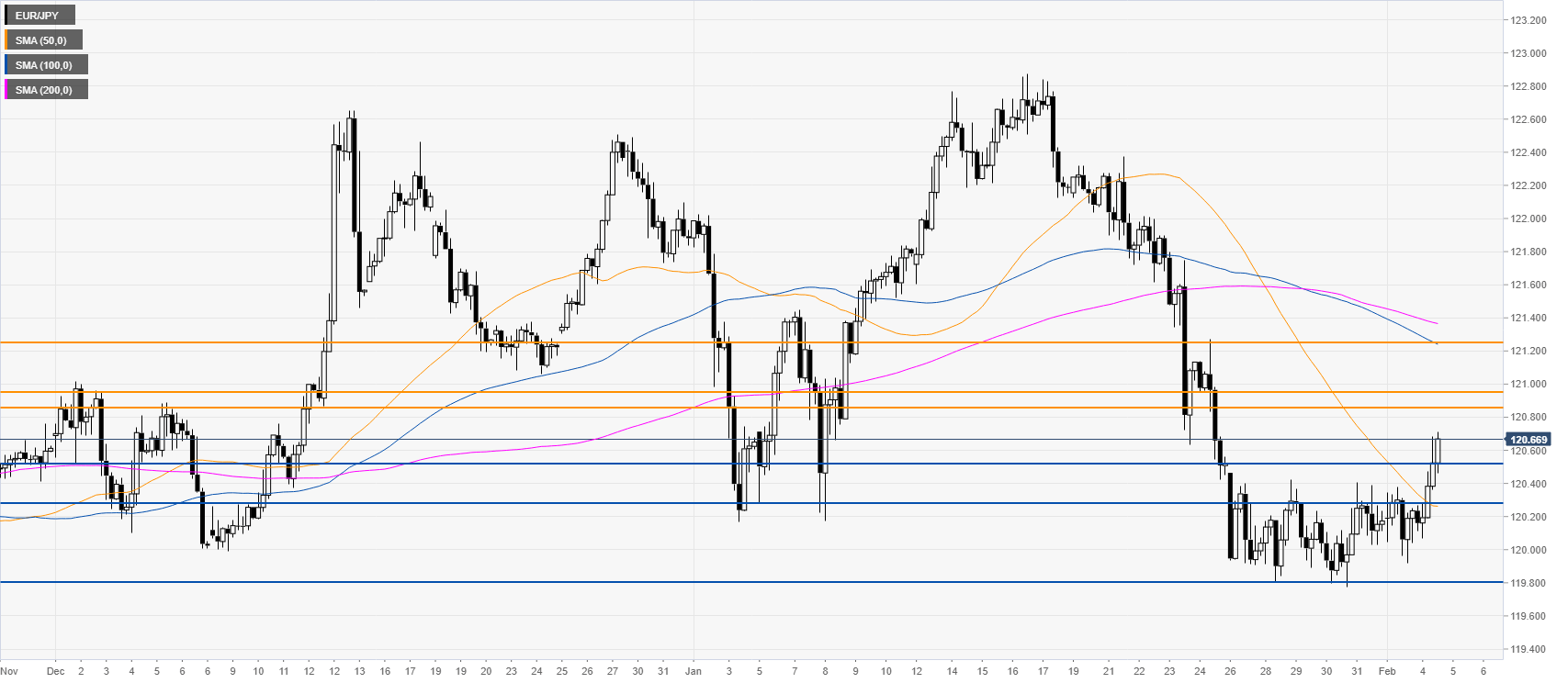

EUR/JPY four-hour chart

EUR/JPY is correcting to the upside after the drop seen in January. The correction up could extend to the 120.85/95 resistance zone and the 121.25 level. Bears will try to limit the recovery by trying to drive the price below the 120.51 support. Further down lie the 120.26 and 119.80 levels, according to the Technical Confluences Indicator.

Resistance: 120.85/95, 121.25

Support: 120.51, 120.26, 119.80

Additional key levels