USD/CAD Price Analysis: Under pressure in Asia, forming head-and-shoulders

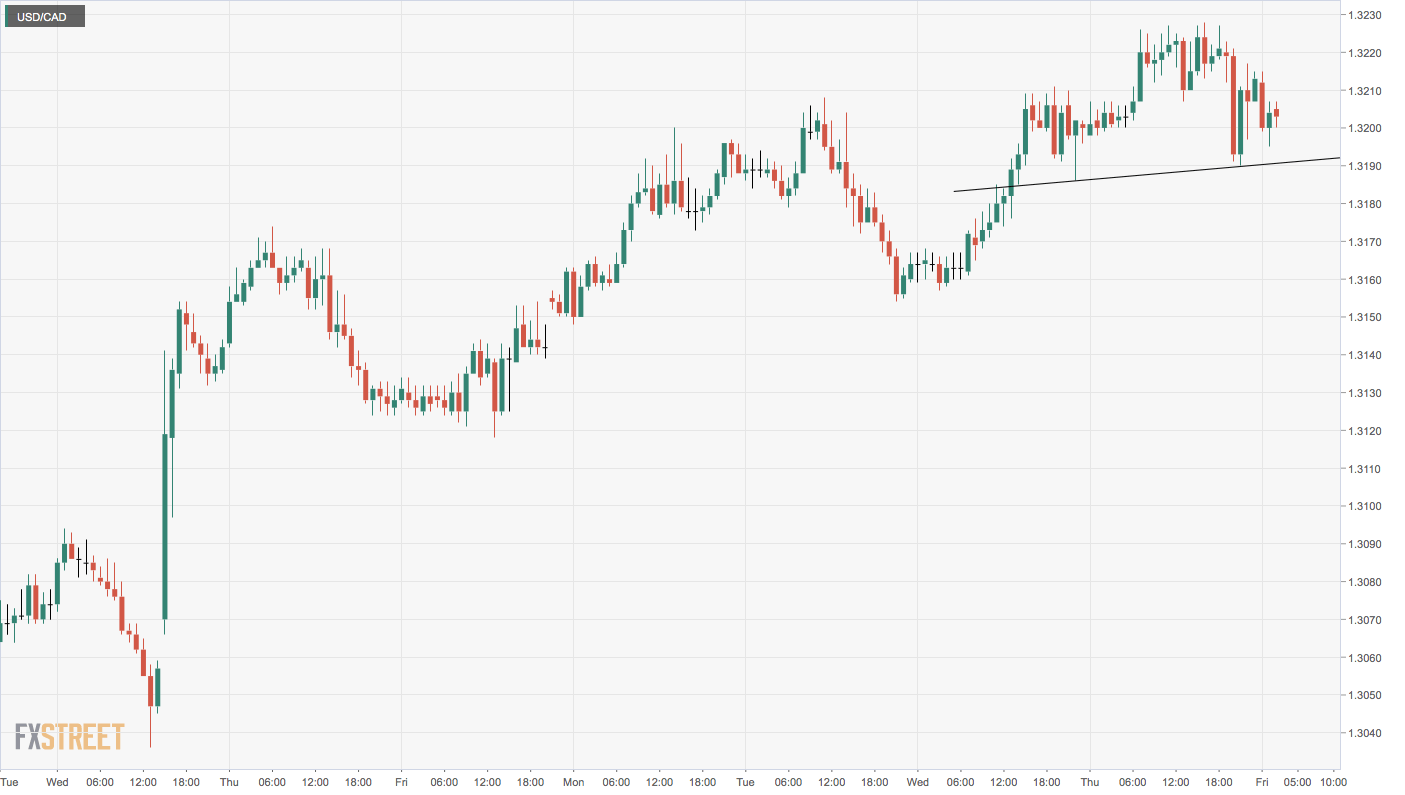

- USD/CAD is forming a head-and-shoulders on the hourly chart,

- A breakdown would open the doors to levels near 1.3150.

The Canadian dollar has found some love in Asia. The USD/CAD pair is currently trading at 1.3204, representing marginal losses on the day, having hit a low of 1.3195 earlier today.

The hourly chart shows the pair is forming a head-and-shoulders bearish reversal pattern with the neckline support at 1.3191.

A break below that level would open the doors to 1.3153 (target as per the measured move method). That looks likely as Thursday’s spinning top candle is reporting buyer exhaustion – the rally from the Dec. 31 low of 1.3069 has likely run out of steam.

However, if the neckline support at 1.3191 if holds, a bounce to Thursday’s high of 1.3227 may be seen. A close higher would expose the resistance at 1.3247 – the 78.6% Fibonacci retracement of the sell-off from 1.3328 to 1.3069.

Hourly chart

Trend: Bearish below 1.3191

Technical levels