Our best spreads and conditions

About platform

About platform

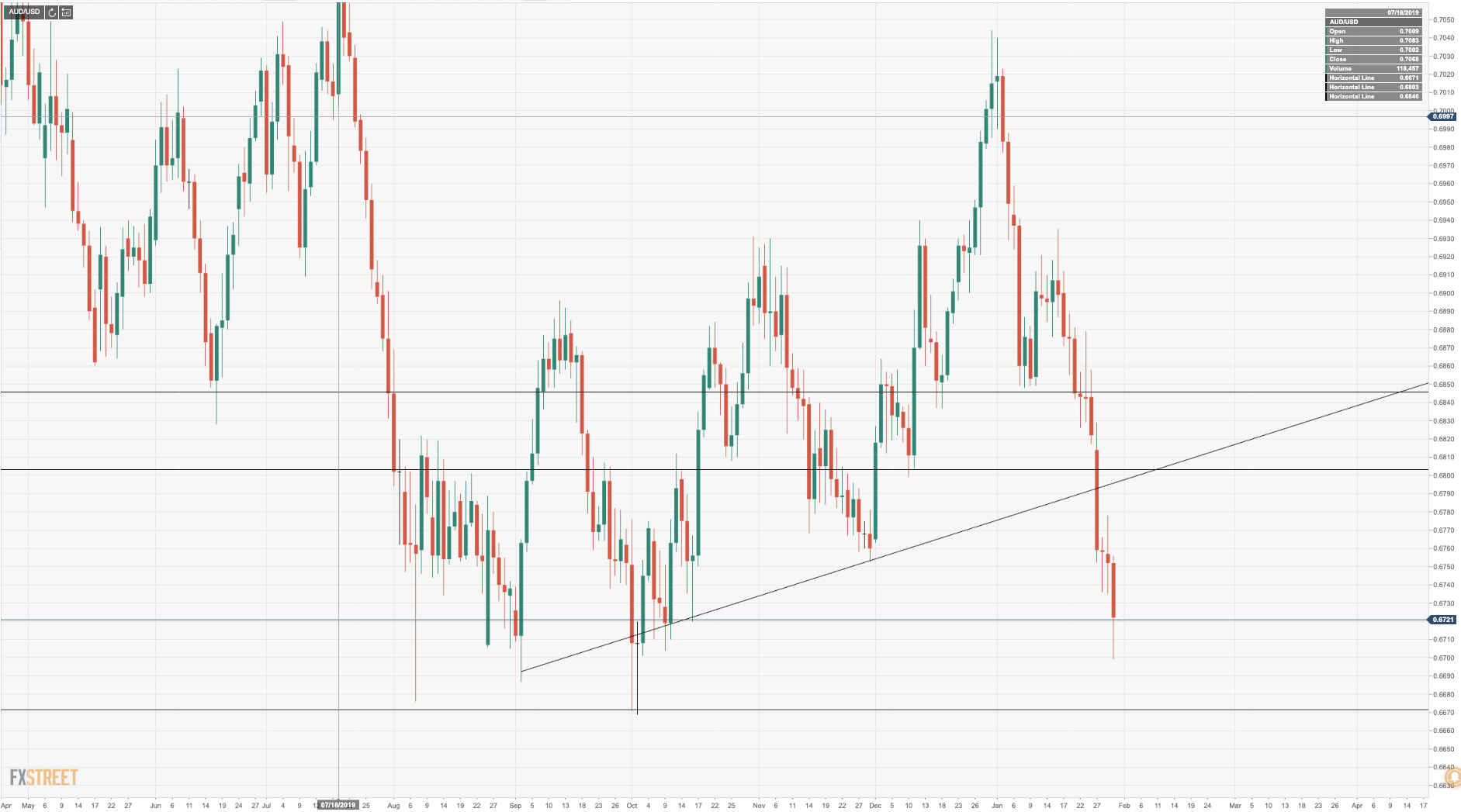

AUD/USD is forming a base in an area of buy stop liquidity following a break of 0.6550 which could transpire into a bid back to the trendline. This was something touched on in yesterday's analysis, here: AUD/USD Price Analysis: Potential bear trap at major support area, target 0.68

Ahead of the Chinse data, the market is steady around 0.6717, up from the lows of 0.6705 awaiting the data dump. Markets are expecting 50.0 on the manufacturing index and 53.5 on services with risks of a surprise were sure to be to the downside considering the impact of coronavirus.

On a positive outcome, AUD/USD can target trendline resistance and the 0.68 handle thereafter. On a disappointment, ahead of the Reserve Bank of Australia next week, then the door will be open for further punishment towards 0.6660s and Oct lows.