Our best spreads and conditions

About platform

About platform

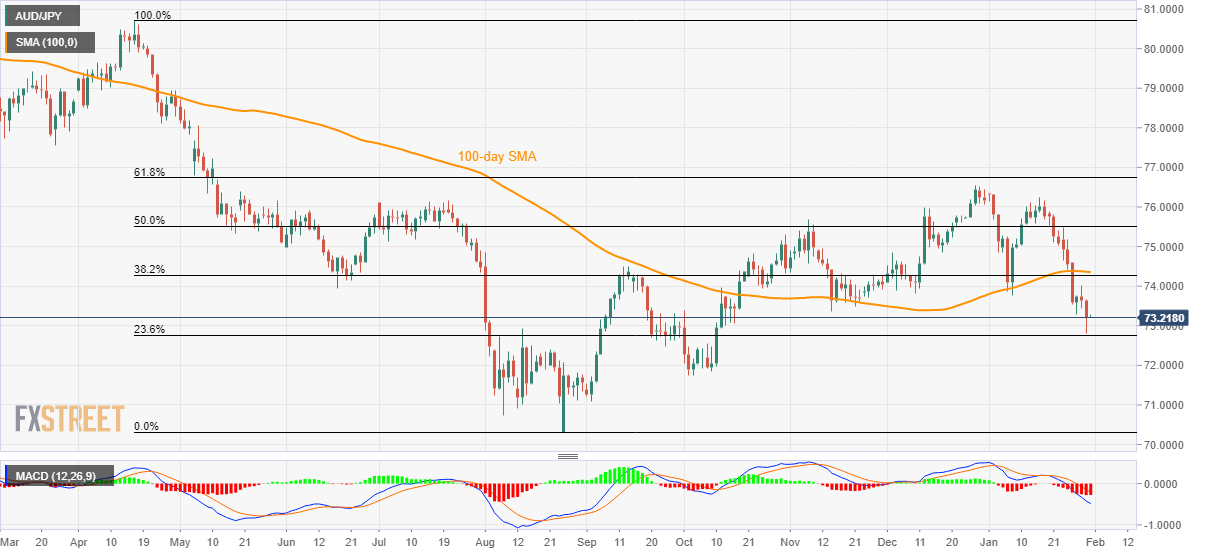

AUD/JPY nears the lowest since October 10 while flashing 73.20 during the early Asian session on Friday. The pair’s latest pullback from 23.6% Fibonacci retracement of its April-August 2019 fall is likely not to impress buyers.

The reason is bearish MACD and sustained trading below the confluence of 100-day SMA and 38.2% Fibonacci retracement.

That said, October 2019 low near 71.70 could lure sellers once AUD/JPY prices drop below 23.6% Fibonacci retracement level of 72.77.

During the pair’s further declines below 72.77, 71.20 and 70.30 could offer buffers ahead of diverting the bears to 70.00 psychological magnet.

On the upside, buyers will stay away unless prices rise successfully beyond 100-day SMA and 38.2% Fibonacci retracement, near 74.30/35.

In doing so, 75.30 and 50% Fibonacci retracement level near 75.50 will be their follow-on targets.

Trend: Bearish