Back

30 Jan 2020

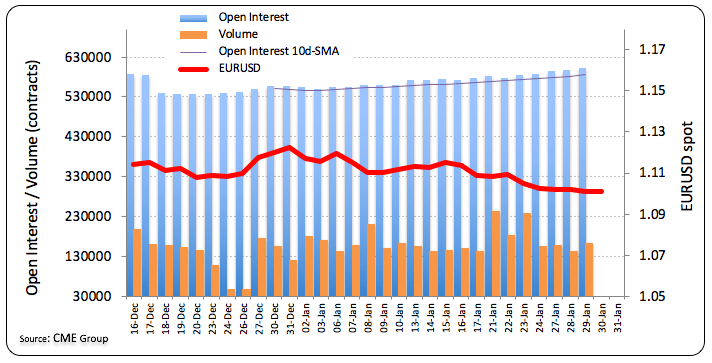

EUR Futures: Downside looks limited

In light of preliminary readings from CME Group, open interest rose by almost 3K contracts on Wednesday. In the same direction, volume rose by around 20.2K contracts.

EUR/USD stays supported around 1.0980 so far

EUR/USD’s drop and rebound from sub-1.10 levels on Wednesday was in tandem with increasing open interest and volume. Despite the bearish stance looks unchanged in the near-term, a convincing breakdown of the 1.10 support looks unlikely.