Our best spreads and conditions

About platform

About platform

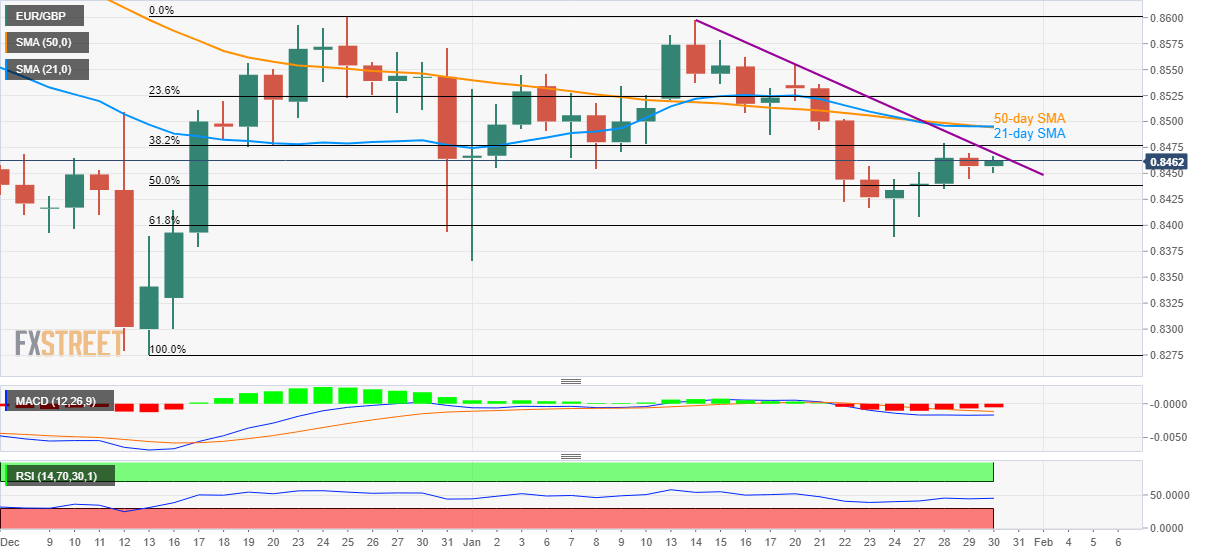

EUR/GBP registers 0.07% gains while rising to 0.8464 ahead of the European session on Thursday. In doing so the pair extends its gradual recovery from 61.8% Fibonacci retracement of its rise from December 13 to 25.

While a higher low formation is in favor of the pair’s break to the immediate resistance line, at 0.8475, its further increase will be questioned by a confluence of 21 and 50-day SMAs near 0.8495.

In a case where the bulls manage to conquer 0.8495, also cross 0.8500 round-figure, the December month’s high of 0.8602 will become their favorite.

Alternatively, a daily closing below 61.8% Fibonacci retracement level of 0.8400 could please sellers.

Trend: Pullback expected