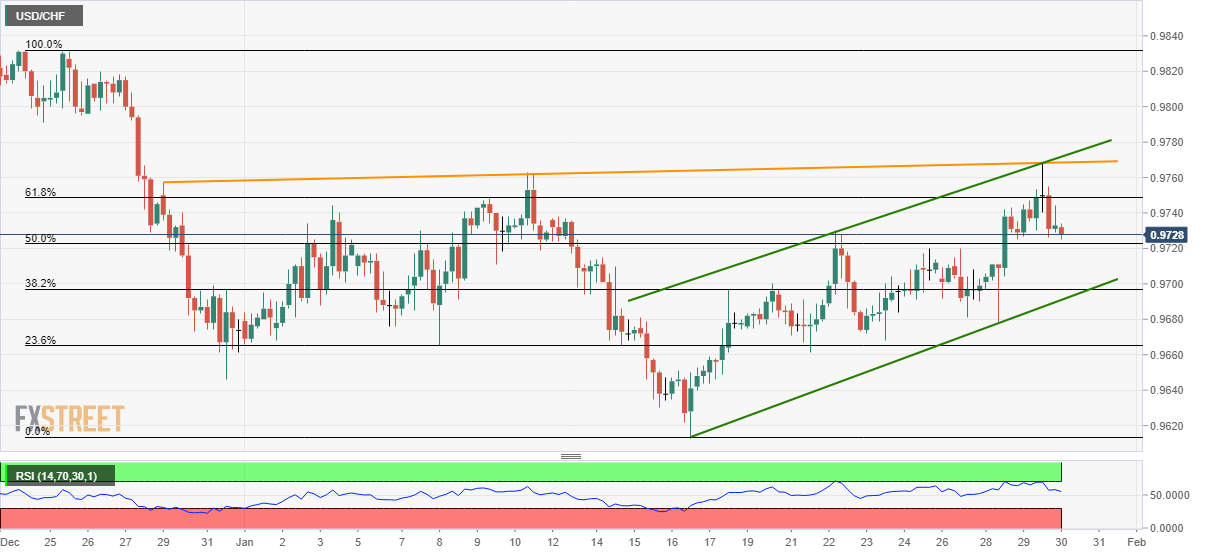

USD/CHF Price Analysis: Heavy inside two-week-old ascending channel

- USD/CHF snaps two-day winning streak, reversed from monthly resistance line.

- Buyers will remain hopeful unless the channel’s support breaks.

- 50% and 38.2% of Fibonacci retracements could offer intermediate halts during the declines.

USD/CHF declines to 0.9728, -0.11%, by the press time of early Thursday. The pair recently reversed from an ascending trend line since December 29, 2019. Even so, it stays inside the short-term bullish technical formation.

Considering the pair’s latest pullback form the key resistance, sellers can target 50% and 38.2% of Fibonacci retracements of the pair’s declines between December 24, 2019, and January 16, 2020, around 0.9720 and 0.9700 respectively.

However, the channel’s support line, at 0.9690, could restrict further declines, if not then 0.9660 and 0.9613 can offer intermediate halts during the fall to 0.9600.

On the flip side, the aforementioned resistance line and the said channel’s upper line could restrict the pair’s short-term recovery near 0.9770/75.

In a case where the bulls dominate beyond 0.9775, 0.9800 and 0.9825 will flash on their radars.

USD/CHF four-hour chart

Trend: Bullish