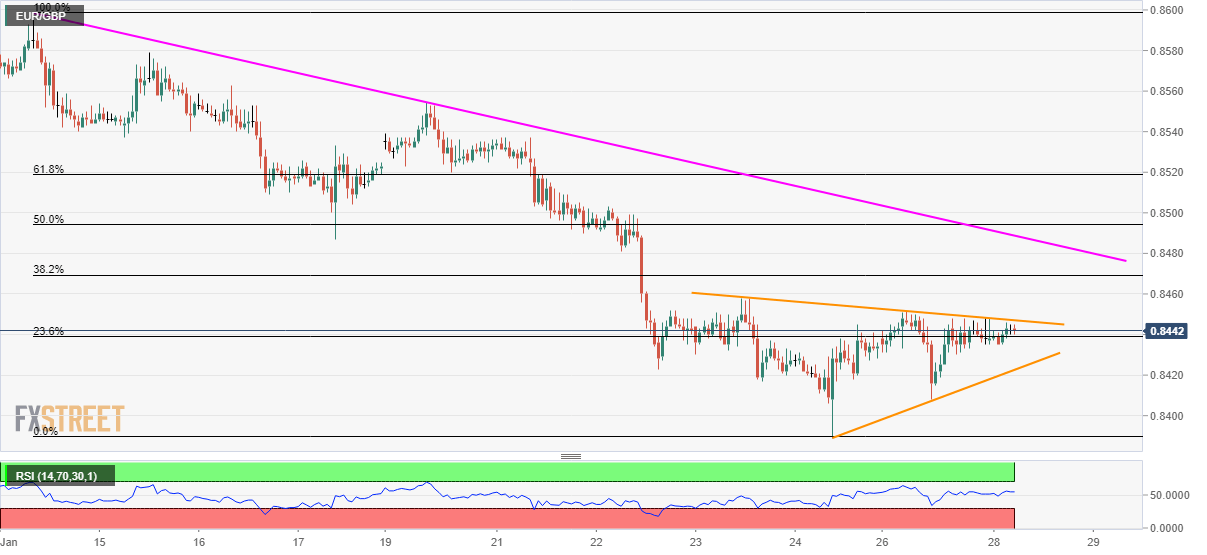

EUR/GBP Price Analysis: Choppy below three-day-old falling trednline

- EUR/GBP clings to 23.6% Fibonacci retracement of January 14-24 fall.

- A two-week-old descending trend line, 50% Fibonacci retracement limit near-term upside.

EUR/GBP trades modestly flat near 0.8442 ahead of the European session on Tuesday. The pair stays below a short-term falling trend line while clinging to 23.6% Fibonacci retracement of its declines between January 14 and 24.

Unless breaking the 0.8448 immediate resistance, the quote is less likely to avoid visiting the support line of the short-term rising triangle, at 0.8424.

Should EUR/GBP prices slip below 0.8424, 0.8408 and the monthly bottom surrounding 0.8390 will gain the market’s attention.

Alternatively, the pair’s successful break of 0.8448 resistance line can escalate its recovery moves to a fortnight-long descending trend line and 50% Fibonacci retracement near 0.8490/95.

In a case where the bulls manage to conquer 0.8495, also dominate beyond 0.8500 round-figure, odds favoring the return of the 0.8555 and 0.8600 can’t be ruled out.

EUR/GBP hourly chart

Trend: Bearish