Back

27 Jan 2020

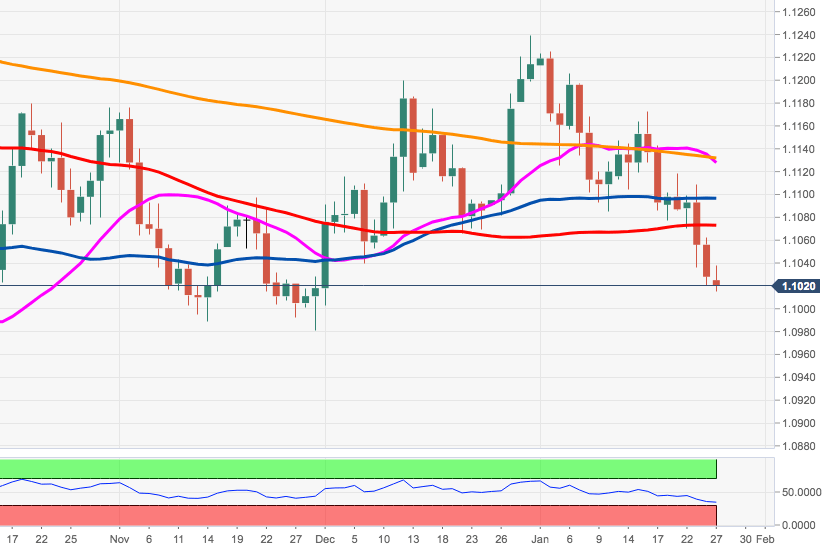

EUR/USD Price Analysis: Selling bias persists near 1.1000

- EUR/USD stays offered and printed new 2020 lows near 1.1015.

- Next on the downside emerges the 1.10 mark.

The negative mood remains well and sound around EUR/USD at the beginning of the week. The recent breach of key levels (55-day, 100-day SMAs, support line) have opened the door to a deeper retracement in the near-term.

That said, the next relevant support emerges at the psychological mark at 1.10 the figure ahead of November 2019 lows around 1.0980.

The offered bias in the spot should remain unchanged below the 55-day SMA, today at 1.1089.

EUR/USD daily chart