Back

27 Jan 2020

JPY Futures: Rebound seen limited

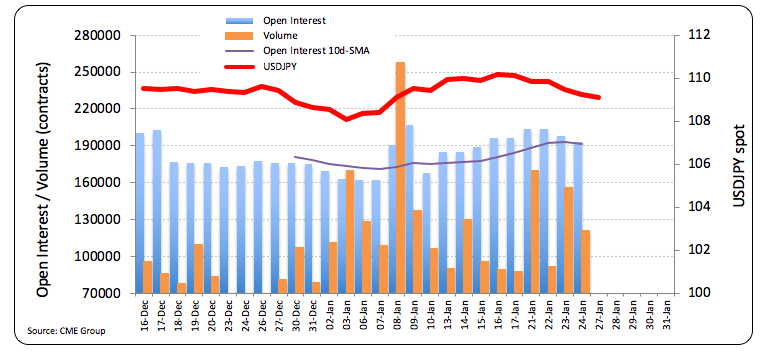

CME Group’s advanced data showed open interest and volume shrinking by around 4.6K contracts and nearly 35.3K contracts, respectively, on Friday.

USD/JPY faces strong support in the mid-108.00s

Friday’s move down in USD/JPY was in tandem with diminishing open interest and volume in the Japanese safe haven. That said, while the leg lower could extend to the 108.50 area – where sits the 200-day SMA – there is still scope for a rebound in the short-term horizon.