Back

27 Jan 2020

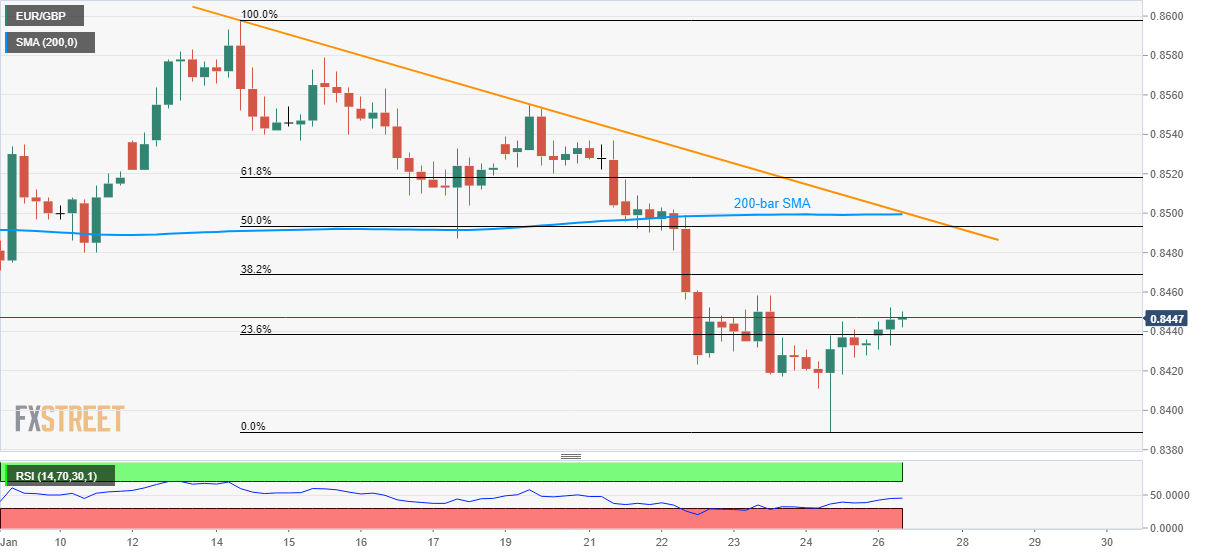

EUR/GBP Price Analysis: Bulls look for entry beyond 0.8500

- EUR/GBP trades above 23.6% Fibonacci retracement.

- 200-bar SMA, two-week-old resistance line guard near-term upside.

- Sellers keep eyes on the December month lows.

EUR/GBP extends its gradual recovery from Friday to 0.8447 while heading into the European session on Monday.

Thursday’s top near 0.8460 and 38.2% Fibonacci retracement of the pair’s declines from January 14 to January 24, at 0.8470, can please buyers during further pullback.

Even so, a confluence of 200-bar SMA and fortnight-long falling trend line, around 0.8500, will be the tough nut to crack for buyers, which if broken could recall 0.8555 back to the charts.

On the contrary, 0.8415 and 0.8390 could entertain sellers ahead of dragging the quote towards 0.8375 and December month top surrounding 0.8275.

EUR/GBP four-hour chart

Trend: Bearish