GBP/JPY Price Analysis: Monthly support trend line in focus

- GBP/JPY declines to 13-day low amid broad risk-off.

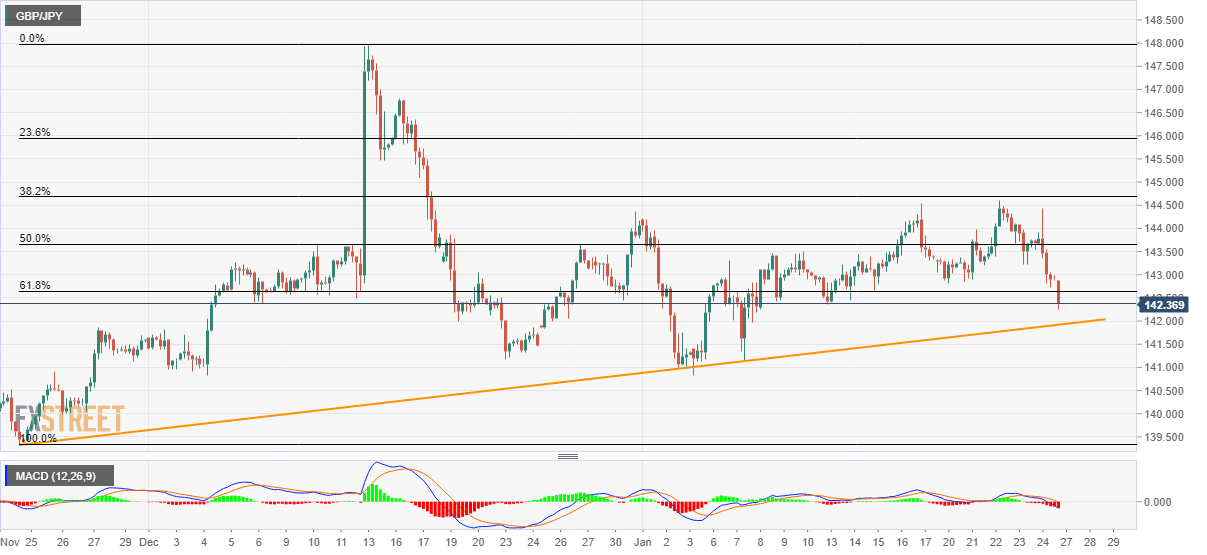

- Break of 61.8% Fibonacci retracement, bearish MACD signals further declines.

- An ascending trend line since late-November gains the bears’ attention, the bulls will refrain unless breaking 38.2% Fibonacci retracement.

GBP/JPY nosedives to 142.40 amid the initial Asian trading session on Monday. In doing so, the pair slipped beneath 61.8% Fibonacci retracement of its November 22 to December 13 upside amid the bearish MACD.

That said, sellers now look towards the monthly rising support trend line, at 141.90 now, as the nearby key rest-point.

Should GBP/JPY prices extend declines below 141.90, the current month’s low near 140.80 and 140.00 round-figure will be in the spotlight.

On the upside, 61.8% Fibonacci retracement level of 142.65 and 50% Fibonacci retracement near 143.70 can entertain short-term buyers during the pair’s pullback.

However, major buying is less likely to return unless the quote rallies successfully beyond a 38.2% Fibonacci retracement level of 144.70.

GBP/JPY four hour chart

Trend: Bearish