Back

24 Jan 2020

Crude Oil Futures: Downside seems to have met contention

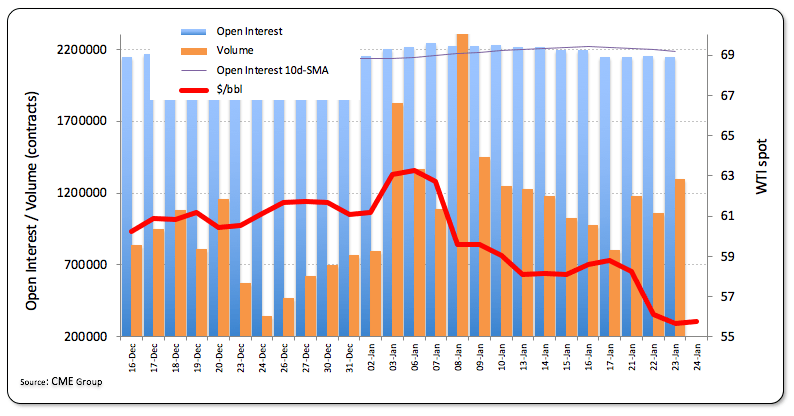

According to flash figures from CME Group, open interest shrunk by nearly 5.3K contracts on Thursday. Volume, instead, went up by almost 238K contracts, extended the erratic performance.

WTI looks supported around $55.50 so far

Prices of the WTI managed to rebound from 2-month lows in the mid-$55.00s on Thursday amidst shrinking open interest and choppy activity in volume. That said, the commodity could now attempt a relief rally to the next target at the 200-day SMA around $57.50.